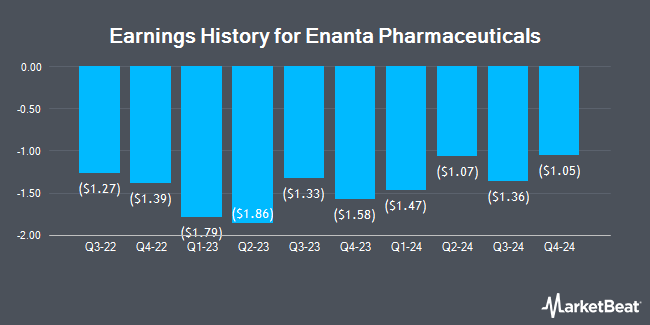

Enanta Pharmaceuticals (NASDAQ:ENTA - Get Free Report) issued its quarterly earnings data on Monday. The biotechnology company reported ($0.85) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($1.25) by $0.40, Zacks reports. Enanta Pharmaceuticals had a negative return on equity of 89.02% and a negative net margin of 141.98%. The firm had revenue of $18.31 million during the quarter, compared to the consensus estimate of $16.21 million.

Enanta Pharmaceuticals Price Performance

NASDAQ ENTA traded up $0.26 on Friday, hitting $8.00. 133,410 shares of the company's stock were exchanged, compared to its average volume of 176,188. Enanta Pharmaceuticals has a fifty-two week low of $4.09 and a fifty-two week high of $13.43. The firm's 50-day moving average price is $7.40 and its two-hundred day moving average price is $6.48. The firm has a market cap of $171.02 million, a price-to-earnings ratio of -1.85 and a beta of 0.88.

Analyst Ratings Changes

Several analysts recently weighed in on the stock. HC Wainwright assumed coverage on shares of Enanta Pharmaceuticals in a report on Monday, July 28th. They issued a "buy" rating and a $20.00 target price for the company. JMP Securities lifted their price objective on shares of Enanta Pharmaceuticals from $24.00 to $25.00 and gave the stock a "market outperform" rating in a research report on Tuesday. Finally, Wall Street Zen raised shares of Enanta Pharmaceuticals from a "sell" rating to a "hold" rating in a research report on Sunday, June 22nd.

Check Out Our Latest Report on Enanta Pharmaceuticals

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Millennium Management LLC grew its position in shares of Enanta Pharmaceuticals by 50.2% in the first quarter. Millennium Management LLC now owns 1,346,932 shares of the biotechnology company's stock valued at $7,435,000 after purchasing an additional 449,945 shares during the last quarter. Marshall Wace LLP grew its stake in shares of Enanta Pharmaceuticals by 0.8% during the 2nd quarter. Marshall Wace LLP now owns 857,412 shares of the biotechnology company's stock valued at $6,482,000 after buying an additional 6,522 shares during the period. AQR Capital Management LLC lifted its holdings in shares of Enanta Pharmaceuticals by 674.7% during the 1st quarter. AQR Capital Management LLC now owns 357,109 shares of the biotechnology company's stock valued at $1,971,000 after acquiring an additional 311,010 shares in the last quarter. Goldman Sachs Group Inc. lifted its holdings in shares of Enanta Pharmaceuticals by 5.3% during the 1st quarter. Goldman Sachs Group Inc. now owns 130,410 shares of the biotechnology company's stock valued at $720,000 after acquiring an additional 6,549 shares in the last quarter. Finally, Invesco Ltd. lifted its holdings in shares of Enanta Pharmaceuticals by 4.3% during the 2nd quarter. Invesco Ltd. now owns 62,884 shares of the biotechnology company's stock valued at $475,000 after acquiring an additional 2,607 shares in the last quarter. 94.99% of the stock is currently owned by institutional investors and hedge funds.

Enanta Pharmaceuticals Company Profile

(

Get Free Report)

Enanta Pharmaceuticals, Inc, a biotechnology company, discovers and develops small molecule drugs for the treatment of viral infections and liver diseases. Its product pipeline comprises EDP-514, which is in phase 1b clinical development for the treatment of chronic infection with hepatitis B virus or HBV; EDP-938 and EDP-323, which is in phase II clinical development for the treatment of respiratory syncytial virus; EDP-235, which is in phase II clinical development for the treatment of human coronaviruses; and Glecaprevir, which is in the market for the treatment of chronic infection with hepatitis C virus or HCV.

Further Reading

Before you consider Enanta Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enanta Pharmaceuticals wasn't on the list.

While Enanta Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.