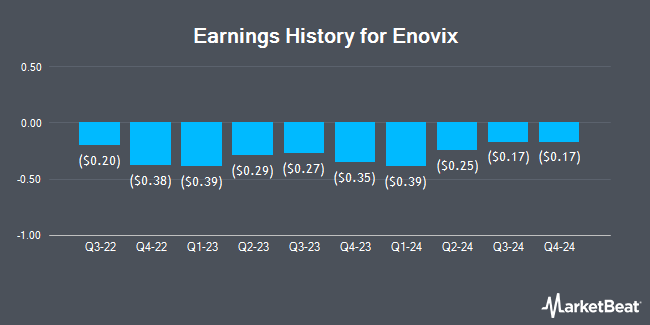

Enovix (NASDAQ:ENVX - Get Free Report) issued its quarterly earnings data on Thursday. The company reported ($0.13) EPS for the quarter, topping the consensus estimate of ($0.15) by $0.02, Briefing.com reports. Enovix had a negative net margin of 481.35% and a negative return on equity of 73.88%. The firm had revenue of $7.50 million for the quarter, compared to analyst estimates of $5.48 million. During the same period in the prior year, the business posted ($0.14) EPS. The business's revenue for the quarter was up 98.2% compared to the same quarter last year. Enovix updated its Q3 2025 guidance to -0.180--0.140 EPS.

Enovix Trading Up 1.8%

ENVX stock traded up $0.20 on Wednesday, hitting $11.47. 2,638,139 shares of the company were exchanged, compared to its average volume of 6,527,874. Enovix has a twelve month low of $5.27 and a twelve month high of $16.49. The company has a debt-to-equity ratio of 0.82, a current ratio of 4.37 and a quick ratio of 4.11. The business's fifty day moving average is $11.12 and its two-hundred day moving average is $9.37. The stock has a market capitalization of $2.26 billion, a price-to-earnings ratio of -13.70 and a beta of 2.11.

Wall Street Analyst Weigh In

ENVX has been the topic of several recent analyst reports. JPMorgan Chase & Co. restated a "neutral" rating and issued a $12.00 price objective (up from $9.00) on shares of Enovix in a report on Thursday, July 24th. Wall Street Zen lowered shares of Enovix from a "hold" rating to a "sell" rating in a report on Saturday. Benchmark increased their target price on shares of Enovix from $15.00 to $25.00 and gave the stock a "buy" rating in a report on Friday, July 25th. B. Riley reiterated a "buy" rating and set a $17.00 target price (up from $12.00) on shares of Enovix in a report on Thursday, July 10th. Finally, Canaccord Genuity Group increased their target price on shares of Enovix from $20.00 to $22.00 and gave the stock a "buy" rating in a report on Monday. One research analyst has rated the stock with a sell rating, five have given a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $18.90.

Check Out Our Latest Report on ENVX

Enovix declared that its Board of Directors has approved a stock repurchase program on Wednesday, July 2nd that authorizes the company to buyback $60.00 million in shares. This buyback authorization authorizes the company to buy up to 3.1% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's board believes its stock is undervalued.

Institutional Investors Weigh In On Enovix

Large investors have recently made changes to their positions in the business. Caxton Associates LLP acquired a new position in Enovix in the 1st quarter worth $190,000. NewEdge Advisors LLC lifted its position in Enovix by 10.4% in the 1st quarter. NewEdge Advisors LLC now owns 26,257 shares of the company's stock valued at $193,000 after purchasing an additional 2,481 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in Enovix by 5.1% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 98,318 shares of the company's stock valued at $722,000 after buying an additional 4,780 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its stake in shares of Enovix by 18.4% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 358,023 shares of the company's stock worth $2,628,000 after purchasing an additional 55,676 shares during the last quarter. Finally, Goldman Sachs Group Inc. boosted its holdings in shares of Enovix by 65.4% in the first quarter. Goldman Sachs Group Inc. now owns 1,137,777 shares of the company's stock worth $8,351,000 after buying an additional 449,934 shares during the period. Institutional investors and hedge funds own 50.92% of the company's stock.

About Enovix

(

Get Free Report)

Enovix Corporation designs develops and manufactures silicon-anode lithium-ion batteries. It serves wearables and IoT, smartphone, laptops and tablets, industrial and medical, and electric vehicles industries. The company was founded in 2007 and is headquartered in Fremont, California.

Further Reading

Before you consider Enovix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovix wasn't on the list.

While Enovix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.