Enovix (NASDAQ:ENVX - Get Free Report) had its target price increased by equities researchers at Benchmark from $15.00 to $25.00 in a note issued to investors on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Benchmark's target price points to a potential upside of 64.74% from the company's previous close.

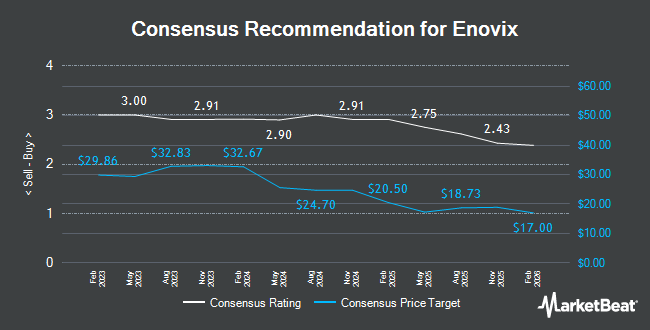

A number of other research firms have also recently weighed in on ENVX. TD Securities lowered their price target on shares of Enovix from $10.00 to $7.00 and set a "hold" rating on the stock in a report on Thursday, May 1st. B. Riley reaffirmed a "buy" rating and set a $17.00 target price (up from $12.00) on shares of Enovix in a report on Thursday, July 10th. Craig Hallum reaffirmed a "buy" rating and set a $15.00 target price (up from $12.00) on shares of Enovix in a report on Tuesday, July 8th. Cowen reissued a "hold" rating on shares of Enovix in a report on Tuesday, July 8th. Finally, TD Cowen raised shares of Enovix to a "hold" rating and boosted their price target for the stock from $7.00 to $15.00 in a report on Monday, July 7th. Six research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $18.73.

Check Out Our Latest Report on ENVX

Enovix Price Performance

ENVX stock traded up $0.49 during trading on Friday, hitting $15.18. 4,956,364 shares of the company's stock traded hands, compared to its average volume of 6,367,271. The business has a fifty day simple moving average of $10.43 and a 200 day simple moving average of $9.27. The stock has a market capitalization of $2.91 billion, a price-to-earnings ratio of -11.73 and a beta of 2.09. The company has a debt-to-equity ratio of 0.71, a quick ratio of 4.49 and a current ratio of 4.68. Enovix has a 52 week low of $5.27 and a 52 week high of $16.49.

Enovix announced that its Board of Directors has approved a share repurchase program on Wednesday, July 2nd that authorizes the company to repurchase $60.00 million in outstanding shares. This repurchase authorization authorizes the company to buy up to 3.1% of its stock through open market purchases. Stock repurchase programs are typically a sign that the company's leadership believes its shares are undervalued.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. increased its position in Enovix by 15.1% during the fourth quarter. Vanguard Group Inc. now owns 15,773,464 shares of the company's stock worth $171,458,000 after buying an additional 2,063,631 shares in the last quarter. Electron Capital Partners LLC lifted its position in shares of Enovix by 18.6% during the first quarter. Electron Capital Partners LLC now owns 6,712,763 shares of the company's stock worth $49,272,000 after purchasing an additional 1,054,029 shares during the last quarter. Geode Capital Management LLC boosted its stake in Enovix by 6.6% in the fourth quarter. Geode Capital Management LLC now owns 3,818,827 shares of the company's stock valued at $41,520,000 after acquiring an additional 235,142 shares during the period. Driehaus Capital Management LLC increased its position in Enovix by 1.8% in the 1st quarter. Driehaus Capital Management LLC now owns 2,323,612 shares of the company's stock valued at $17,055,000 after acquiring an additional 41,559 shares during the period. Finally, Fred Alger Management LLC increased its position in shares of Enovix by 21.5% during the 1st quarter. Fred Alger Management LLC now owns 2,233,446 shares of the company's stock valued at $16,393,000 after purchasing an additional 394,532 shares during the period. 50.92% of the stock is currently owned by institutional investors and hedge funds.

About Enovix

(

Get Free Report)

Enovix Corporation designs develops and manufactures silicon-anode lithium-ion batteries. It serves wearables and IoT, smartphone, laptops and tablets, industrial and medical, and electric vehicles industries. The company was founded in 2007 and is headquartered in Fremont, California.

See Also

Before you consider Enovix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovix wasn't on the list.

While Enovix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.