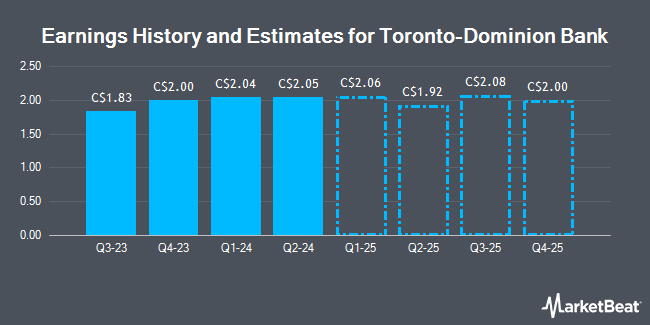

The Toronto-Dominion Bank (TSE:TD - Free Report) NYSE: TD - Analysts at Desjardins upped their Q3 2025 earnings per share (EPS) estimates for shares of Toronto-Dominion Bank in a note issued to investors on Tuesday, August 12th. Desjardins analyst D. Young now anticipates that the company will earn $2.02 per share for the quarter, up from their previous estimate of $1.92. Desjardins has a "Buy" rating and a $107.00 price target on the stock. The consensus estimate for Toronto-Dominion Bank's current full-year earnings is $7.22 per share.

A number of other analysts also recently commented on the stock. National Bankshares increased their price objective on shares of Toronto-Dominion Bank from C$98.00 to C$99.00 and gave the company a "sector perform" rating in a report on Friday, August 15th. Scotiabank upgraded shares of Toronto-Dominion Bank to a "hold" rating in a report on Wednesday, May 14th. CIBC upped their price objective on Toronto-Dominion Bank from C$96.00 to C$99.00 and gave the company an "outperform" rating in a report on Thursday, June 5th. Jefferies Financial Group increased their price objective on Toronto-Dominion Bank from C$103.00 to C$117.00 in a research report on Wednesday, August 13th. Finally, Barclays lifted their target price on Toronto-Dominion Bank from C$91.00 to C$95.00 and gave the company an "underweight" rating in a research report on Thursday, August 14th. Four equities research analysts have rated the stock with a Buy rating, five have issued a Hold rating and one has given a Sell rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of C$95.31.

Check Out Our Latest Report on TD

Toronto-Dominion Bank Stock Performance

Shares of TSE TD traded up C$0.50 during mid-day trading on Friday, reaching C$102.19. The company's stock had a trading volume of 1,047,927 shares, compared to its average volume of 7,581,526. The stock has a 50-day moving average of C$100.37 and a two-hundred day moving average of C$91.48. The stock has a market capitalization of C$179.28 billion, a P/E ratio of 20.25, a P/E/G ratio of 1.22 and a beta of 0.82. Toronto-Dominion Bank has a 1-year low of C$73.22 and a 1-year high of C$103.11.

Toronto-Dominion Bank Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Shareholders of record on Thursday, July 31st were issued a dividend of $1.05 per share. This represents a $4.20 annualized dividend and a yield of 4.1%. The ex-dividend date was Thursday, July 10th. Toronto-Dominion Bank's payout ratio is 80.84%.

Insider Buying and Selling

In related news, Senior Officer Melanie Burns sold 6,272 shares of the stock in a transaction on Friday, June 20th. The stock was sold at an average price of C$97.46, for a total value of C$611,269.12. Also, Director Ana Arsov purchased 3,000 shares of the firm's stock in a transaction on Wednesday, May 28th. The shares were acquired at an average cost of C$94.49 per share, with a total value of C$283,470.00. In the last 90 days, insiders sold 81,612 shares of company stock worth $7,748,610. Corporate insiders own 0.08% of the company's stock.

About Toronto-Dominion Bank

(

Get Free Report)

Toronto-Dominion is one of Canada's two largest banks and operates three business segments: Canadian retail banking, U.S. retail banking, and wholesale banking. The bank's U.S. operations span from Maine to Florida, with a strong presence in the Northeast. It also has a 13% ownership stake in Charles Schwab.

Read More

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.