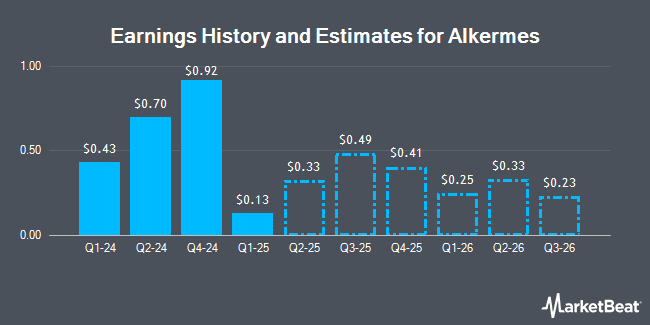

Alkermes plc (NASDAQ:ALKS - Free Report) - HC Wainwright raised their Q1 2026 earnings per share estimates for Alkermes in a research note issued on Wednesday, July 30th. HC Wainwright analyst D. Tsao now expects that the company will post earnings per share of $0.25 for the quarter, up from their prior estimate of $0.18. HC Wainwright has a "Neutral" rating and a $46.00 price target on the stock. The consensus estimate for Alkermes' current full-year earnings is $1.31 per share. HC Wainwright also issued estimates for Alkermes' Q3 2026 earnings at $0.30 EPS.

Alkermes (NASDAQ:ALKS - Get Free Report) last issued its earnings results on Tuesday, July 29th. The company reported $0.52 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.42 by $0.10. The firm had revenue of $390.66 million for the quarter, compared to analysts' expectations of $343.20 million. Alkermes had a net margin of 23.15% and a return on equity of 24.86%. Alkermes's revenue was down 2.1% on a year-over-year basis. During the same quarter last year, the company posted $1.16 earnings per share.

A number of other equities research analysts have also recently weighed in on the company. UBS Group raised Alkermes from a "neutral" rating to a "buy" rating and lifted their price target for the company from $33.00 to $42.00 in a report on Tuesday, June 17th. Royal Bank Of Canada raised their price objective on shares of Alkermes from $40.00 to $42.00 and gave the company a "sector perform" rating in a research note on Wednesday, July 30th. Cantor Fitzgerald upgraded shares of Alkermes to a "strong-buy" rating in a research note on Tuesday, May 13th. Wall Street Zen lowered shares of Alkermes from a "strong-buy" rating to a "buy" rating in a research note on Monday, May 5th. Finally, Needham & Company LLC reiterated a "buy" rating and set a $45.00 price objective on shares of Alkermes in a research note on Tuesday, July 29th. Three analysts have rated the stock with a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $41.08.

Get Our Latest Stock Analysis on Alkermes

Alkermes Stock Performance

Shares of ALKS traded down $0.08 during mid-day trading on Friday, reaching $26.56. 927,248 shares of the company's stock traded hands, compared to its average volume of 1,793,083. The business's 50-day moving average price is $29.16 and its 200-day moving average price is $30.76. The stock has a market capitalization of $4.38 billion, a P/E ratio of 12.76, a price-to-earnings-growth ratio of 1.52 and a beta of 0.47. Alkermes has a 12 month low of $25.56 and a 12 month high of $36.45.

Hedge Funds Weigh In On Alkermes

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its stake in shares of Alkermes by 0.3% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 100,032 shares of the company's stock valued at $2,877,000 after purchasing an additional 311 shares during the last quarter. Diversified Trust Co lifted its stake in shares of Alkermes by 0.8% in the 2nd quarter. Diversified Trust Co now owns 44,232 shares of the company's stock valued at $1,265,000 after purchasing an additional 372 shares during the last quarter. Quantbot Technologies LP lifted its stake in shares of Alkermes by 54.5% in the 1st quarter. Quantbot Technologies LP now owns 1,091 shares of the company's stock valued at $36,000 after purchasing an additional 385 shares during the last quarter. Louisiana State Employees Retirement System lifted its stake in shares of Alkermes by 0.5% in the 2nd quarter. Louisiana State Employees Retirement System now owns 77,000 shares of the company's stock valued at $2,203,000 after purchasing an additional 400 shares during the last quarter. Finally, Hohimer Wealth Management LLC lifted its stake in shares of Alkermes by 3.8% in the 1st quarter. Hohimer Wealth Management LLC now owns 12,362 shares of the company's stock valued at $408,000 after purchasing an additional 450 shares during the last quarter. 95.21% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Alkermes

In other Alkermes news, SVP Christian Todd Nichols sold 3,334 shares of Alkermes stock in a transaction that occurred on Tuesday, June 10th. The shares were sold at an average price of $31.09, for a total transaction of $103,654.06. Following the transaction, the senior vice president directly owned 86,208 shares in the company, valued at approximately $2,680,206.72. The trade was a 3.72% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 4.40% of the company's stock.

Alkermes Company Profile

(

Get Free Report)

Alkermes plc, a biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally. It has a portfolio of proprietary commercial products for the treatment of alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder and a pipeline of clinical and preclinical product candidates in development for neurological disorders.

Further Reading

Before you consider Alkermes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkermes wasn't on the list.

While Alkermes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.