Ero Copper (TSE:ERO - Get Free Report) was downgraded by equities researchers at CIBC from an "outperform" rating to a "neutral" rating in a research report issued to clients and investors on Friday,BayStreet.CA reports. They presently have a C$37.00 price target on the stock, up from their prior price target of C$22.50. CIBC's price objective points to a potential upside of 24.04% from the company's current price.

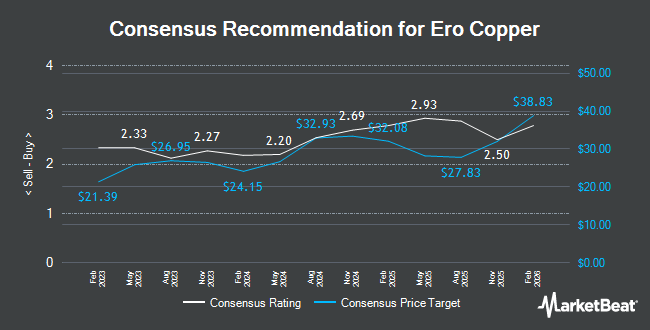

A number of other brokerages have also recently issued reports on ERO. BMO Capital Markets increased their target price on shares of Ero Copper from C$24.00 to C$27.00 and gave the company an "outperform" rating in a report on Friday, July 4th. Raymond James Financial raised shares of Ero Copper to a "moderate buy" rating in a research note on Monday, June 30th. Stifel Canada raised shares of Ero Copper to a "strong-buy" rating in a research note on Tuesday, July 8th. National Bank Financial cut shares of Ero Copper from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, July 8th. Finally, Scotiabank raised their price objective on shares of Ero Copper from C$24.00 to C$26.00 in a research note on Monday, June 16th. Two analysts have rated the stock with a Strong Buy rating, six have given a Buy rating and four have assigned a Hold rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of C$28.33.

Read Our Latest Report on Ero Copper

Ero Copper Stock Performance

Shares of ERO stock traded down C$1.83 on Friday, reaching C$29.83. The stock had a trading volume of 426,287 shares, compared to its average volume of 369,823. Ero Copper has a 1 year low of C$13.17 and a 1 year high of C$33.50. The company has a debt-to-equity ratio of 83.17, a quick ratio of 1.43 and a current ratio of 0.68. The stock has a market cap of C$3.09 billion, a P/E ratio of 21.62, a price-to-earnings-growth ratio of -0.72 and a beta of 1.52. The company has a 50 day simple moving average of C$22.57 and a 200 day simple moving average of C$20.22.

Ero Copper Company Profile

(

Get Free Report)

Ero Copper Corp is a base metals mining company. It is focused on the production and sale of copper from the Vale do Curaca Property in Brazil, with gold and silver produced and sold as by-products from the same. Ero's operations are segmented between MCSA, NX Gold, and corporate. Ore is processed using conventional crushing and flotation at the Caraiba Mill, located adjacent to the Pilar underground mine.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ero Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ero Copper wasn't on the list.

While Ero Copper currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.