ESAB (NYSE:ESAB - Get Free Report) had its price target dropped by Oppenheimer from $144.00 to $142.00 in a research report issued on Thursday,Benzinga reports. The firm presently has an "outperform" rating on the stock. Oppenheimer's price objective would indicate a potential upside of 29.79% from the stock's current price.

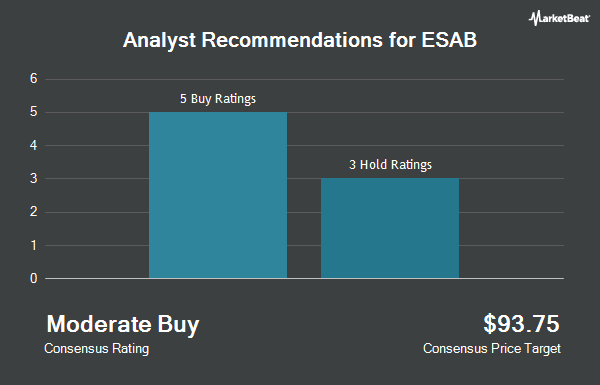

Other research analysts have also issued research reports about the company. Stifel Nicolaus upgraded ESAB from a "hold" rating to a "buy" rating and set a $141.00 price objective for the company in a research report on Thursday. Evercore ISI boosted their price objective on ESAB from $120.00 to $125.00 and gave the company an "in-line" rating in a research report on Monday, May 19th. Finally, Robert W. Baird set a $143.00 price objective on ESAB in a research report on Friday, May 2nd. Two investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $137.88.

Get Our Latest Stock Report on ESAB

ESAB Stock Down 1.6%

Shares of NYSE:ESAB traded down $1.73 during mid-day trading on Thursday, hitting $109.41. 136,776 shares of the company traded hands, compared to its average volume of 312,385. The firm has a market cap of $6.63 billion, a P/E ratio of 26.14, a PEG ratio of 2.65 and a beta of 1.27. The company has a debt-to-equity ratio of 0.50, a quick ratio of 1.26 and a current ratio of 1.95. ESAB has a 52-week low of $93.15 and a 52-week high of $135.97. The firm's 50 day simple moving average is $124.94 and its 200 day simple moving average is $122.42.

ESAB (NYSE:ESAB - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported $1.36 EPS for the quarter, beating the consensus estimate of $1.34 by $0.02. The business had revenue of $715.59 million for the quarter, compared to the consensus estimate of $670.80 million. ESAB had a return on equity of 16.32% and a net margin of 9.36%. The company's revenue was up 1.3% on a year-over-year basis. During the same period last year, the business posted $1.32 EPS. On average, equities analysts anticipate that ESAB will post 5.16 EPS for the current year.

Insiders Place Their Bets

In other news, insider Olivier Biebuyck sold 1,440 shares of the company's stock in a transaction on Thursday, July 31st. The stock was sold at an average price of $133.49, for a total value of $192,225.60. Following the completion of the sale, the insider owned 14,989 shares in the company, valued at $2,000,881.61. This represents a 8.76% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Also, Director Rhonda L. Jordan sold 1,500 shares of the company's stock in a transaction on Wednesday, June 11th. The shares were sold at an average price of $126.42, for a total value of $189,630.00. The disclosure for this sale can be found here. Insiders own 7.30% of the company's stock.

Institutional Trading of ESAB

Several institutional investors have recently modified their holdings of ESAB. Caitong International Asset Management Co. Ltd acquired a new stake in shares of ESAB during the first quarter worth $33,000. First Horizon Advisors Inc. raised its position in shares of ESAB by 204.8% during the first quarter. First Horizon Advisors Inc. now owns 320 shares of the company's stock worth $37,000 after purchasing an additional 215 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. raised its position in shares of ESAB by 706.7% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 363 shares of the company's stock worth $42,000 after purchasing an additional 318 shares during the period. Kapitalo Investimentos Ltda acquired a new stake in shares of ESAB during the fourth quarter worth $47,000. Finally, Farther Finance Advisors LLC raised its position in shares of ESAB by 1,128.9% during the first quarter. Farther Finance Advisors LLC now owns 467 shares of the company's stock worth $56,000 after purchasing an additional 429 shares during the period. Institutional investors and hedge funds own 91.13% of the company's stock.

About ESAB

(

Get Free Report)

ESAB Corporation engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment. Its comprehensive range of welding consumables includes electrodes, cored and solid wires, and fluxes using a range of specialty and other materials; and cutting consumables comprising electrodes, nozzles, shields, and tips.

See Also

Before you consider ESAB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESAB wasn't on the list.

While ESAB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.