Carvana (NYSE:CVNA - Get Free Report) had its price objective raised by investment analysts at Evercore ISI from $295.00 to $305.00 in a note issued to investors on Tuesday,Benzinga reports. The brokerage presently has an "in-line" rating on the stock. Evercore ISI's price target indicates a potential downside of 4.33% from the company's current price.

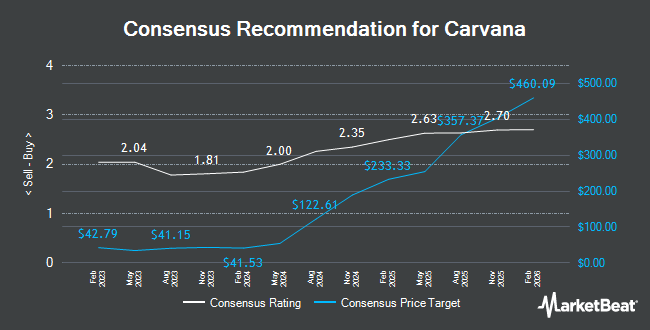

Other equities analysts also recently issued reports about the stock. Wedbush raised shares of Carvana to a "hold" rating in a research note on Thursday, May 8th. Citigroup upped their price target on Carvana from $280.00 to $325.00 and gave the company a "buy" rating in a research report on Thursday, May 8th. Morgan Stanley lifted their price objective on Carvana from $280.00 to $290.00 and gave the stock an "overweight" rating in a research report on Thursday, May 15th. Wall Street Zen downgraded Carvana from a "buy" rating to a "hold" rating in a report on Saturday, June 21st. Finally, Piper Sandler set a $340.00 price target on shares of Carvana and gave the company an "overweight" rating in a report on Thursday, May 22nd. Seven analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $284.18.

Check Out Our Latest Stock Analysis on Carvana

Carvana Trading Up 4.0%

CVNA stock traded up $12.33 during trading on Tuesday, hitting $318.81. 2,972,423 shares of the company traded hands, compared to its average volume of 4,453,818. The company has a 50-day moving average of $291.33 and a 200-day moving average of $244.45. The company has a debt-to-equity ratio of 2.97, a quick ratio of 2.70 and a current ratio of 3.81. Carvana has a 1 year low of $118.50 and a 1 year high of $351.43. The firm has a market capitalization of $68.27 billion, a PE ratio of 111.74, a P/E/G ratio of 1.23 and a beta of 3.65.

Carvana (NYSE:CVNA - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The company reported $1.51 earnings per share for the quarter, beating analysts' consensus estimates of $0.75 by $0.76. Carvana had a return on equity of 44.86% and a net margin of 2.68%. The firm had revenue of $4.23 billion during the quarter, compared to analyst estimates of $3.94 billion. During the same quarter in the prior year, the firm posted $0.23 earnings per share. The business's quarterly revenue was up 38.3% compared to the same quarter last year. Analysts predict that Carvana will post 2.85 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, major shareholder Ernest C. Garcia II sold 50,000 shares of Carvana stock in a transaction dated Friday, May 30th. The stock was sold at an average price of $325.16, for a total value of $16,258,000.00. Following the completion of the sale, the insider now directly owns 37,342,317 shares in the company, valued at approximately $12,142,227,795.72. This trade represents a 0.13% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Ernest C. Garcia III sold 10,000 shares of the company's stock in a transaction dated Wednesday, May 14th. The shares were sold at an average price of $303.97, for a total transaction of $3,039,700.00. Following the transaction, the chief executive officer now owns 845,000 shares in the company, valued at $256,854,650. This represents a 1.17% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 1,350,544 shares of company stock worth $413,498,149 in the last three months. Insiders own 17.12% of the company's stock.

Institutional Trading of Carvana

Large investors have recently made changes to their positions in the stock. Principal Securities Inc. boosted its holdings in Carvana by 50.0% in the fourth quarter. Principal Securities Inc. now owns 366 shares of the company's stock worth $74,000 after purchasing an additional 122 shares during the last quarter. Venturi Wealth Management LLC boosted its stake in shares of Carvana by 79.2% in the 4th quarter. Venturi Wealth Management LLC now owns 224 shares of the company's stock worth $46,000 after buying an additional 99 shares during the last quarter. Global Retirement Partners LLC boosted its stake in shares of Carvana by 109.9% in the 4th quarter. Global Retirement Partners LLC now owns 149 shares of the company's stock worth $30,000 after buying an additional 78 shares during the last quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund bought a new stake in shares of Carvana in the fourth quarter worth $4,982,000. Finally, IFP Advisors Inc increased its position in Carvana by 21.4% during the fourth quarter. IFP Advisors Inc now owns 550 shares of the company's stock valued at $112,000 after acquiring an additional 97 shares during the last quarter. 56.71% of the stock is currently owned by institutional investors.

Carvana Company Profile

(

Get Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

Featured Articles

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.