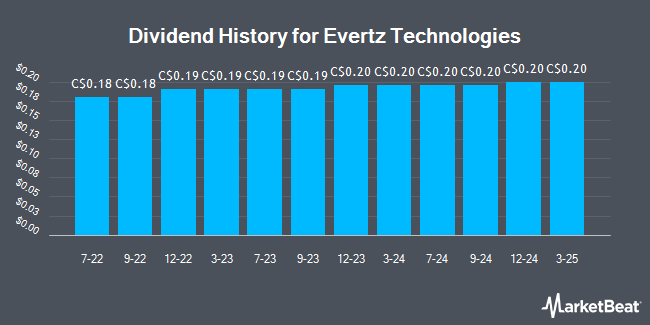

Evertz Technologies Limited (TSE:ET - Get Free Report) declared a quarterly dividend on Thursday, September 18th, TickerTech Dividends reports. Shareholders of record on Thursday, September 25th will be given a dividend of 0.20 per share on Thursday, September 25th. This represents a c) annualized dividend and a dividend yield of 6.5%. The ex-dividend date is Thursday, September 18th.

Evertz Technologies Stock Up 0.2%

Shares of ET stock traded up C$0.03 on Friday, reaching C$12.30. 21,325 shares of the stock were exchanged, compared to its average volume of 24,086. The company has a current ratio of 2.18, a quick ratio of 0.68 and a debt-to-equity ratio of 8.09. The business's 50 day moving average price is C$12.12 and its 200 day moving average price is C$11.63. The company has a market capitalization of C$927.53 million, a price-to-earnings ratio of 15.57, a PEG ratio of 0.79 and a beta of 0.61. Evertz Technologies has a twelve month low of C$9.45 and a twelve month high of C$13.52.

Evertz Technologies Company Profile

(

Get Free Report)

Evertz Technologies Ltd is a Canadian provider of telecommunications equipment and technology solutions to the television broadcast and new-media industries. Evertz equipment is used in the production, post-production and transmission of television content. Its solutions are sold to content creators, broadcasters, and service providers looking to support multi-channel digital and high definition television, and next generation Internet Protocol environments.

Read More

Before you consider Evertz Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evertz Technologies wasn't on the list.

While Evertz Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.