Excelerate Energy (NYSE:EE - Get Free Report) is expected to be posting its Q2 2025 quarterly earnings results before the market opens on Monday, August 11th. Analysts expect Excelerate Energy to post earnings of $0.33 per share and revenue of $259.82 million for the quarter.

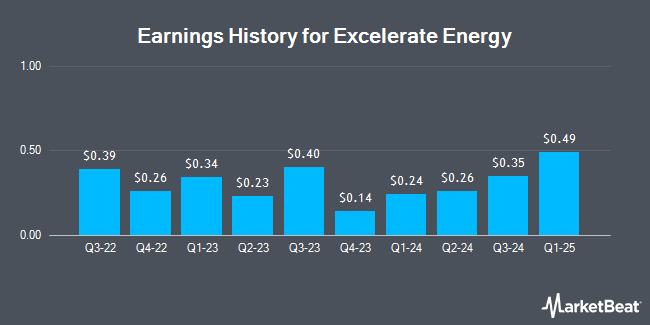

Excelerate Energy (NYSE:EE - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The company reported $0.49 EPS for the quarter, beating the consensus estimate of $0.39 by $0.10. The business had revenue of $315.09 million during the quarter, compared to analyst estimates of $207.87 million. Excelerate Energy had a net margin of 3.93% and a return on equity of 2.20%. The firm's revenue was up 14.8% on a year-over-year basis. On average, analysts expect Excelerate Energy to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Excelerate Energy Stock Down 0.6%

Shares of EE stock traded down $0.15 during mid-day trading on Friday, hitting $24.28. 173,484 shares of the stock traded hands, compared to its average volume of 400,120. The stock has a market cap of $2.77 billion, a P/E ratio of 16.50 and a beta of 1.38. The stock's fifty day moving average is $27.82 and its two-hundred day moving average is $28.20. Excelerate Energy has a 52-week low of $17.70 and a 52-week high of $32.99. The company has a debt-to-equity ratio of 0.31, a current ratio of 3.34 and a quick ratio of 3.34.

Excelerate Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Investors of record on Wednesday, August 20th will be given a $0.08 dividend. This is a positive change from Excelerate Energy's previous quarterly dividend of $0.06. This represents a $0.32 annualized dividend and a dividend yield of 1.3%. Excelerate Energy's dividend payout ratio (DPR) is presently 21.77%.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on EE. Wall Street Zen raised shares of Excelerate Energy from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. Jefferies Financial Group began coverage on shares of Excelerate Energy in a research report on Thursday, June 5th. They issued a "buy" rating and a $39.00 price objective for the company. Three investment analysts have rated the stock with a sell rating and five have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $32.29.

Check Out Our Latest Stock Report on Excelerate Energy

Hedge Funds Weigh In On Excelerate Energy

A number of institutional investors have recently bought and sold shares of the business. Goldman Sachs Group Inc. raised its position in Excelerate Energy by 27.5% during the 1st quarter. Goldman Sachs Group Inc. now owns 442,764 shares of the company's stock worth $12,698,000 after buying an additional 95,565 shares during the last quarter. Millennium Management LLC grew its stake in shares of Excelerate Energy by 26.8% during the 1st quarter. Millennium Management LLC now owns 415,206 shares of the company's stock worth $11,908,000 after purchasing an additional 87,672 shares during the period. Jane Street Group LLC grew its stake in shares of Excelerate Energy by 133.9% during the 1st quarter. Jane Street Group LLC now owns 63,505 shares of the company's stock worth $1,821,000 after purchasing an additional 36,354 shares during the period. Finally, AQR Capital Management LLC grew its stake in shares of Excelerate Energy by 91.7% during the 1st quarter. AQR Capital Management LLC now owns 18,117 shares of the company's stock worth $520,000 after purchasing an additional 8,665 shares during the period. 21.79% of the stock is owned by hedge funds and other institutional investors.

Excelerate Energy Company Profile

(

Get Free Report)

Excelerate Energy, Inc provides flexible liquefied natural gas (LNG) solutions worldwide. The company offers regasification services, including floating storage and regasification units (FSRUs), infrastructure development, and LNG and natural gas supply, procurement, and distribution services; LNG terminal services; and natural gas supply to-power projects.

Featured Articles

Before you consider Excelerate Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Excelerate Energy wasn't on the list.

While Excelerate Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.