Expro Group (NYSE:XPRO - Get Free Report) is expected to release its Q3 2025 results before the market opens on Thursday, October 23rd. Analysts expect the company to announce earnings of $0.23 per share and revenue of $426.6510 million for the quarter. Expro Group has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS.Parties can check the company's upcoming Q3 2025 earningsummary page for the latest details on the call scheduled for Thursday, October 23, 2025 at 11:00 AM ET.

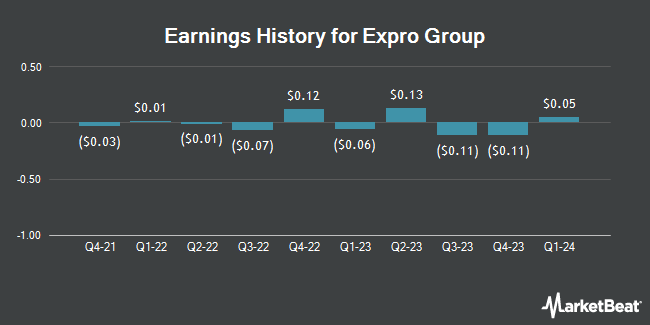

Expro Group (NYSE:XPRO - Get Free Report) last announced its earnings results on Tuesday, July 29th. The company reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.12 by $0.04. Expro Group had a return on equity of 6.43% and a net margin of 4.26%.The company had revenue of $422.74 million for the quarter, compared to the consensus estimate of $408.04 million. On average, analysts expect Expro Group to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Expro Group Trading Up 1.4%

Shares of XPRO stock opened at $12.54 on Thursday. The business's 50 day moving average is $12.00 and its two-hundred day moving average is $9.87. Expro Group has a twelve month low of $6.70 and a twelve month high of $17.38. The company has a market capitalization of $1.45 billion, a P/E ratio of 20.55 and a beta of 1.11. The company has a current ratio of 2.14, a quick ratio of 1.78 and a debt-to-equity ratio of 0.09.

Analyst Ratings Changes

XPRO has been the topic of a number of analyst reports. Weiss Ratings restated a "hold (c)" rating on shares of Expro Group in a research note on Wednesday, October 8th. Barclays boosted their target price on Expro Group from $12.00 to $15.00 and gave the stock an "overweight" rating in a research report on Friday, August 1st. Pickering Energy Partners started coverage on Expro Group in a report on Monday, July 28th. They issued an "outperform" rating for the company. Finally, Piper Sandler boosted their price target on Expro Group from $10.00 to $11.00 and gave the stock a "neutral" rating in a report on Thursday, August 14th. Three equities research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $12.50.

View Our Latest Report on Expro Group

Institutional Investors Weigh In On Expro Group

Large investors have recently modified their holdings of the stock. Balyasny Asset Management L.P. boosted its holdings in Expro Group by 113.7% in the second quarter. Balyasny Asset Management L.P. now owns 939,398 shares of the company's stock valued at $8,069,000 after purchasing an additional 499,826 shares during the last quarter. Qube Research & Technologies Ltd increased its holdings in shares of Expro Group by 35.3% in the 2nd quarter. Qube Research & Technologies Ltd now owns 1,553,748 shares of the company's stock valued at $13,347,000 after acquiring an additional 405,168 shares during the last quarter. Jane Street Group LLC increased its holdings in shares of Expro Group by 732.6% in the 1st quarter. Jane Street Group LLC now owns 421,163 shares of the company's stock valued at $4,186,000 after acquiring an additional 370,579 shares during the last quarter. Federated Hermes Inc. bought a new stake in shares of Expro Group in the 2nd quarter worth approximately $3,180,000. Finally, Goldman Sachs Group Inc. lifted its holdings in shares of Expro Group by 47.8% in the 1st quarter. Goldman Sachs Group Inc. now owns 903,612 shares of the company's stock worth $8,982,000 after purchasing an additional 292,198 shares during the last quarter. Institutional investors and hedge funds own 92.07% of the company's stock.

About Expro Group

(

Get Free Report)

Expro Group Holdings N.V. engages in the provision of energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific. The company provides well construction services, such as technology solutions in drilling, tubular running services, and cementing and tubulars; and well management services, including well flow management, subsea well access, and well intervention and integrity solutions.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Expro Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expro Group wasn't on the list.

While Expro Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.