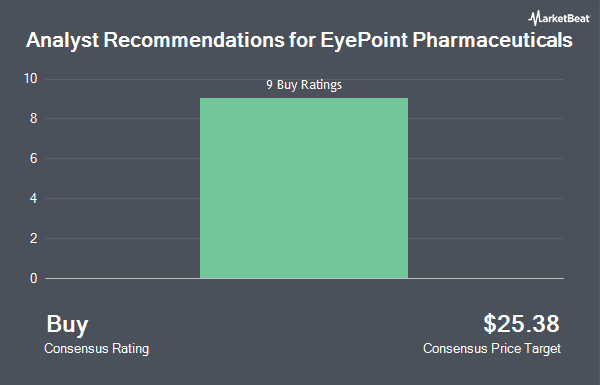

Royal Bank Of Canada began coverage on shares of Eyepoint Pharmaceuticals (NASDAQ:EYPT - Free Report) in a research note published on Tuesday morning, Marketbeat.com reports. The brokerage issued an outperform rating and a $28.00 price objective on the stock.

Several other brokerages have also recently issued reports on EYPT. Mizuho dropped their target price on Eyepoint Pharmaceuticals from $30.00 to $26.00 and set an "outperform" rating on the stock in a research report on Friday, May 16th. HC Wainwright reiterated a "buy" rating and issued a $22.00 price objective on shares of Eyepoint Pharmaceuticals in a research note on Thursday, May 29th. Chardan Capital cut their target price on shares of Eyepoint Pharmaceuticals from $33.00 to $27.00 and set a "buy" rating for the company in a research report on Thursday, May 8th. Finally, Wall Street Zen raised shares of Eyepoint Pharmaceuticals to a "sell" rating in a report on Friday, March 14th. One analyst has rated the stock with a sell rating and ten have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $25.67.

Read Our Latest Research Report on EYPT

Eyepoint Pharmaceuticals Price Performance

NASDAQ:EYPT traded down $0.50 during mid-day trading on Tuesday, hitting $8.42. 601,634 shares of the company's stock were exchanged, compared to its average volume of 817,679. The company has a market cap of $579.38 million, a PE ratio of -3.49 and a beta of 1.61. Eyepoint Pharmaceuticals has a one year low of $3.91 and a one year high of $13.99. The business has a fifty day moving average price of $6.89 and a 200 day moving average price of $6.93.

Eyepoint Pharmaceuticals (NASDAQ:EYPT - Get Free Report) last announced its quarterly earnings results on Wednesday, May 7th. The company reported ($0.65) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.65). Eyepoint Pharmaceuticals had a negative net margin of 261.91% and a negative return on equity of 54.27%. The company had revenue of $24.50 million for the quarter, compared to analysts' expectations of $8.84 million. On average, equities analysts forecast that Eyepoint Pharmaceuticals will post -2.13 EPS for the current fiscal year.

Institutional Trading of Eyepoint Pharmaceuticals

Several large investors have recently added to or reduced their stakes in the company. Rhumbline Advisers boosted its stake in shares of Eyepoint Pharmaceuticals by 16.1% in the fourth quarter. Rhumbline Advisers now owns 89,560 shares of the company's stock worth $667,000 after buying an additional 12,443 shares during the last quarter. Bank of New York Mellon Corp lifted its holdings in Eyepoint Pharmaceuticals by 22.2% in the fourth quarter. Bank of New York Mellon Corp now owns 204,260 shares of the company's stock valued at $1,522,000 after acquiring an additional 37,054 shares during the period. Levin Capital Strategies L.P. boosted its position in Eyepoint Pharmaceuticals by 440.0% in the 4th quarter. Levin Capital Strategies L.P. now owns 54,000 shares of the company's stock worth $402,000 after purchasing an additional 44,000 shares in the last quarter. Charles Schwab Investment Management Inc. grew its stake in shares of Eyepoint Pharmaceuticals by 33.9% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 191,165 shares of the company's stock worth $1,424,000 after purchasing an additional 48,402 shares during the period. Finally, Raymond James Financial Inc. acquired a new stake in shares of Eyepoint Pharmaceuticals during the 4th quarter worth approximately $76,000. Hedge funds and other institutional investors own 99.41% of the company's stock.

Eyepoint Pharmaceuticals Company Profile

(

Get Free Report)

EyePoint Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases. The company's pipeline leverages its proprietary bioerodible Durasert E technology for sustained intraocular drug delivery.

See Also

Before you consider Eyepoint Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eyepoint Pharmaceuticals wasn't on the list.

While Eyepoint Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.