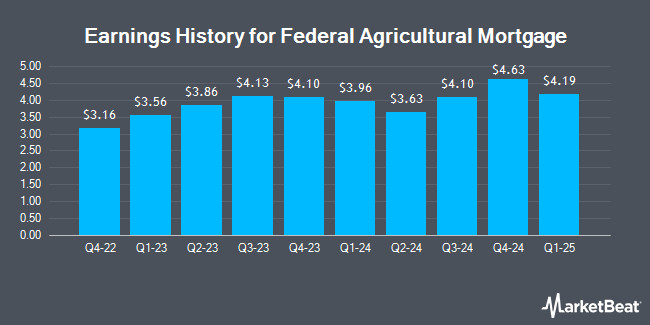

Federal Agricultural Mortgage (NYSE:AGM - Get Free Report) announced its earnings results on Thursday. The credit services provider reported $4.32 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $4.29 by $0.03, Zacks reports. The company had revenue of $100.51 million during the quarter, compared to analysts' expectations of $96.54 million. Federal Agricultural Mortgage had a net margin of 13.14% and a return on equity of 19.08%.

Federal Agricultural Mortgage Stock Performance

Shares of AGM opened at $177.93 on Friday. The company has a current ratio of 0.53, a quick ratio of 0.53 and a debt-to-equity ratio of 1.74. The stock has a market cap of $1.94 billion, a P/E ratio of 10.48, a PEG ratio of 0.90 and a beta of 1.02. The company has a 50-day moving average of $185.32 and a two-hundred day moving average of $187.68. Federal Agricultural Mortgage has a 12-month low of $159.64 and a 12-month high of $217.14.

Federal Agricultural Mortgage Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Monday, June 16th were given a dividend of $1.50 per share. The ex-dividend date was Monday, June 16th. This represents a $6.00 dividend on an annualized basis and a yield of 3.4%. Federal Agricultural Mortgage's payout ratio is presently 37.08%.

Insider Transactions at Federal Agricultural Mortgage

In other Federal Agricultural Mortgage news, Director Sara Louise Faivre-Davis sold 350 shares of Federal Agricultural Mortgage stock in a transaction that occurred on Thursday, May 15th. The shares were sold at an average price of $192.26, for a total transaction of $67,291.00. Following the transaction, the director directly owned 1,751 shares of the company's stock, valued at $336,647.26. The trade was a 16.66% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Eric T. Mckissack sold 728 shares of Federal Agricultural Mortgage stock in a transaction that occurred on Monday, June 9th. The shares were sold at an average price of $192.37, for a total transaction of $140,045.36. Following the transaction, the director directly owned 2,357 shares in the company, valued at approximately $453,416.09. This trade represents a 23.60% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.20% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the company. Intech Investment Management LLC raised its holdings in Federal Agricultural Mortgage by 54.1% in the first quarter. Intech Investment Management LLC now owns 7,678 shares of the credit services provider's stock valued at $1,440,000 after acquiring an additional 2,694 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its holdings in Federal Agricultural Mortgage by 10.6% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 21,683 shares of the credit services provider's stock valued at $4,066,000 after acquiring an additional 2,070 shares in the last quarter. AQR Capital Management LLC raised its holdings in Federal Agricultural Mortgage by 8.3% in the first quarter. AQR Capital Management LLC now owns 6,702 shares of the credit services provider's stock valued at $1,257,000 after acquiring an additional 513 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Federal Agricultural Mortgage by 5.1% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 5,469 shares of the credit services provider's stock valued at $1,025,000 after acquiring an additional 267 shares in the last quarter. Finally, Acadian Asset Management LLC acquired a new stake in Federal Agricultural Mortgage in the first quarter valued at $34,000. 68.03% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Keefe, Bruyette & Woods lifted their target price on shares of Federal Agricultural Mortgage from $215.00 to $217.00 and gave the stock a "market perform" rating in a research report on Friday.

Check Out Our Latest Research Report on Federal Agricultural Mortgage

About Federal Agricultural Mortgage

(

Get Free Report)

Federal Agricultural Mortgage Corporation provides a secondary market for various loans made to borrowers in the United States. It operates through four segments: Corporate AgFinance, Farm & Ranch, Rural Utilities, and Renewable Energy. The company's Agricultural Finance line of business engages in purchasing and retaining eligible loans and securities; guaranteeing the payment of principal and interest on securities that represent interests in or obligations secured by pools of eligible loans; servicing eligible loans; and issuing LTSPCs for eligible loans.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Federal Agricultural Mortgage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Agricultural Mortgage wasn't on the list.

While Federal Agricultural Mortgage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.