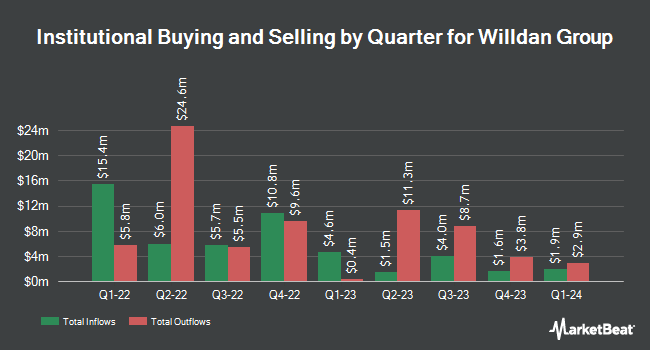

Kingstone Capital Partners Texas LLC bought a new position in shares of Willdan Group, Inc. (NASDAQ:WLDN - Free Report) in the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 108,900 shares of the construction company's stock, valued at approximately $6,807,000. Kingstone Capital Partners Texas LLC owned about 0.75% of Willdan Group as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds and other institutional investors have also recently modified their holdings of the stock. Militia Capital Partners LP bought a new position in shares of Willdan Group during the first quarter worth $652,000. Strs Ohio bought a new position in shares of Willdan Group during the first quarter worth $334,000. Jane Street Group LLC boosted its position in shares of Willdan Group by 205.9% during the first quarter. Jane Street Group LLC now owns 25,302 shares of the construction company's stock worth $1,030,000 after acquiring an additional 17,031 shares during the last quarter. McIlrath & Eck LLC bought a new position in shares of Willdan Group during the first quarter worth $75,000. Finally, MBB Public Markets I LLC bought a new position in shares of Willdan Group during the first quarter worth $203,000. Institutional investors own 72.29% of the company's stock.

Willdan Group Stock Down 2.3%

WLDN stock opened at $103.33 on Friday. The firm has a 50 day moving average of $98.20 and a 200 day moving average of $65.78. The stock has a market capitalization of $1.52 billion, a PE ratio of 43.23 and a beta of 1.31. The company has a quick ratio of 1.43, a current ratio of 1.43 and a debt-to-equity ratio of 0.22. Willdan Group, Inc. has a 52 week low of $30.43 and a 52 week high of $121.00.

Wall Street Analysts Forecast Growth

WLDN has been the topic of a number of recent research reports. Wedbush upped their price target on shares of Willdan Group from $85.00 to $120.00 and gave the company an "outperform" rating in a research note on Friday, August 8th. Roth Capital reaffirmed a "buy" rating and set a $103.00 price target (up previously from $62.00) on shares of Willdan Group in a research note on Tuesday, August 5th. Finally, Zacks Research raised shares of Willdan Group from a "hold" rating to a "strong-buy" rating in a research note on Thursday, August 21st. One research analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the company's stock. Based on data from MarketBeat, Willdan Group presently has a consensus rating of "Buy" and a consensus target price of $111.50.

Read Our Latest Stock Report on Willdan Group

Insider Activity at Willdan Group

In other news, Director Thomas Donald Brisbin sold 130,082 shares of Willdan Group stock in a transaction that occurred on Monday, August 18th. The shares were sold at an average price of $109.69, for a total transaction of $14,268,694.58. Following the completion of the transaction, the director directly owned 320,696 shares of the company's stock, valued at $35,177,144.24. The trade was a 28.86% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Creighton K. Early sold 7,764 shares of Willdan Group stock in a transaction that occurred on Wednesday, August 13th. The shares were sold at an average price of $116.54, for a total transaction of $904,816.56. Following the transaction, the chief financial officer directly owned 72,071 shares of the company's stock, valued at approximately $8,399,154.34. This trade represents a 9.73% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 399,141 shares of company stock worth $43,089,466 in the last ninety days. 8.60% of the stock is owned by company insiders.

Willdan Group Profile

(

Free Report)

Willdan Group, Inc, together with its subsidiaries, provides professional, technical, and consulting services primarily in the United States. It operates in two segments, Energy, and Engineering and Consulting. The Energy segment offers comprehensive audit and surveys, program design and implementation, master planning, demand reduction, grid optimization, benchmarking analyses, design engineering, construction management, performance contracting, installation, alternative financing, measurement and verification services, and software and data analytics, as well as energy consulting and engineering, turnkey facility and infrastructure projects, and customer support services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Willdan Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Willdan Group wasn't on the list.

While Willdan Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.