CCM Investment Group LLC bought a new position in shares of ManpowerGroup Inc. (NYSE:MAN - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 11,965 shares of the business services provider's stock, valued at approximately $702,000.

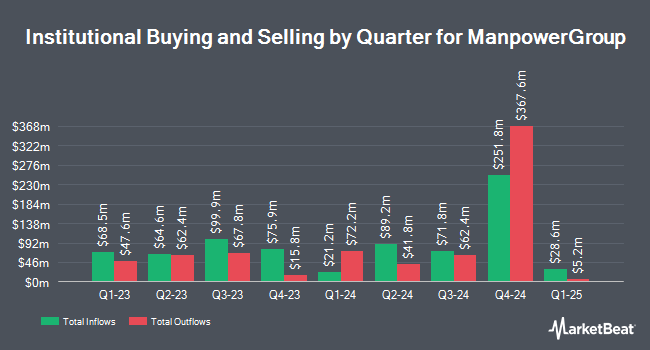

Several other institutional investors have also recently made changes to their positions in MAN. Colonial Trust Co SC purchased a new position in shares of ManpowerGroup during the fourth quarter worth $28,000. Fifth Third Bancorp raised its holdings in shares of ManpowerGroup by 48.6% during the first quarter. Fifth Third Bancorp now owns 743 shares of the business services provider's stock worth $43,000 after purchasing an additional 243 shares during the last quarter. GAMMA Investing LLC raised its holdings in shares of ManpowerGroup by 190.6% during the first quarter. GAMMA Investing LLC now owns 744 shares of the business services provider's stock worth $43,000 after purchasing an additional 488 shares during the last quarter. UMB Bank n.a. raised its holdings in shares of ManpowerGroup by 131.7% during the first quarter. UMB Bank n.a. now owns 899 shares of the business services provider's stock worth $52,000 after purchasing an additional 511 shares during the last quarter. Finally, WFA Asset Management Corp raised its holdings in shares of ManpowerGroup by 129.3% during the first quarter. WFA Asset Management Corp now owns 1,376 shares of the business services provider's stock worth $80,000 after purchasing an additional 776 shares during the last quarter. Hedge funds and other institutional investors own 98.03% of the company's stock.

ManpowerGroup Price Performance

Shares of NYSE MAN traded up $0.06 during trading on Friday, hitting $41.25. The company had a trading volume of 167,892 shares, compared to its average volume of 911,502. The stock has a fifty day simple moving average of $41.89 and a two-hundred day simple moving average of $47.90. ManpowerGroup Inc. has a fifty-two week low of $37.97 and a fifty-two week high of $75.57. The firm has a market capitalization of $1.91 billion, a price-to-earnings ratio of -108.52 and a beta of 1.08. The company has a quick ratio of 0.98, a current ratio of 0.98 and a debt-to-equity ratio of 0.24.

ManpowerGroup (NYSE:MAN - Get Free Report) last announced its earnings results on Thursday, July 17th. The business services provider reported $0.78 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.69 by $0.09. The business had revenue of $4.52 billion for the quarter, compared to analyst estimates of $4.34 billion. ManpowerGroup had a negative net margin of 0.09% and a positive return on equity of 7.98%. The company's revenue for the quarter was down .5% compared to the same quarter last year. During the same quarter last year, the business earned $1.30 earnings per share. On average, research analysts expect that ManpowerGroup Inc. will post 4.23 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on MAN. UBS Group raised their target price on shares of ManpowerGroup from $42.00 to $45.00 and gave the stock a "neutral" rating in a report on Monday, July 14th. JPMorgan Chase & Co. dropped their price target on shares of ManpowerGroup from $65.00 to $50.00 and set a "neutral" rating on the stock in a research report on Monday, April 21st. Truist Financial dropped their price target on shares of ManpowerGroup from $55.00 to $48.00 and set a "hold" rating on the stock in a research report on Monday, April 21st. BMO Capital Markets dropped their price target on shares of ManpowerGroup from $54.00 to $48.00 and set a "market perform" rating on the stock in a research report on Monday, April 21st. Finally, Wall Street Zen upgraded shares of ManpowerGroup from a "sell" rating to a "hold" rating in a research report on Friday, June 27th. Six equities research analysts have rated the stock with a hold rating, According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $48.20.

Read Our Latest Stock Report on MAN

ManpowerGroup Company Profile

(

Free Report)

ManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

Featured Articles

Before you consider ManpowerGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ManpowerGroup wasn't on the list.

While ManpowerGroup currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.