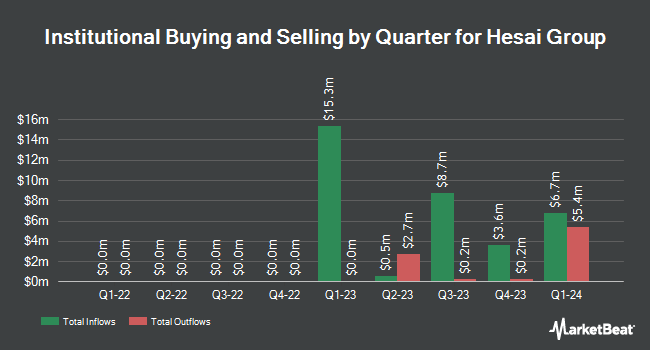

J. Safra Sarasin Holding AG acquired a new position in shares of Hesai Group Sponsored ADR (NASDAQ:HSAI - Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund acquired 130,056 shares of the company's stock, valued at approximately $1,925,000. J. Safra Sarasin Holding AG owned 0.10% of Hesai Group as of its most recent SEC filing.

Other large investors also recently made changes to their positions in the company. JPMorgan Chase & Co. purchased a new stake in shares of Hesai Group during the fourth quarter valued at approximately $1,494,000. Geode Capital Management LLC lifted its holdings in Hesai Group by 366.0% in the 4th quarter. Geode Capital Management LLC now owns 47,700 shares of the company's stock worth $659,000 after buying an additional 37,464 shares in the last quarter. Trexquant Investment LP purchased a new position in Hesai Group in the 4th quarter valued at about $1,667,000. Landscape Capital Management L.L.C. purchased a new position in Hesai Group in the 4th quarter valued at about $168,000. Finally, Renaissance Technologies LLC acquired a new stake in shares of Hesai Group during the fourth quarter valued at about $138,000. Institutional investors and hedge funds own 48.53% of the company's stock.

Hesai Group Stock Performance

Shares of NASDAQ HSAI traded up $0.43 during trading on Friday, reaching $22.72. The stock had a trading volume of 1,279,346 shares, compared to its average volume of 4,288,738. The company has a debt-to-equity ratio of 0.09, a quick ratio of 3.62 and a current ratio of 4.06. The stock has a market cap of $2.98 billion, a PE ratio of -757.27 and a beta of 1.12. Hesai Group Sponsored ADR has a one year low of $3.52 and a one year high of $24.65. The firm's 50 day moving average price is $20.65 and its two-hundred day moving average price is $18.19.

Hesai Group (NASDAQ:HSAI - Get Free Report) last issued its earnings results on Monday, May 26th. The company reported ($0.02) earnings per share for the quarter, topping analysts' consensus estimates of ($0.13) by $0.11. Hesai Group had a negative net margin of 0.72% and a positive return on equity of 1.00%. The company had revenue of $72.39 million for the quarter, compared to analysts' expectations of $532.16 million. On average, research analysts forecast that Hesai Group Sponsored ADR will post -0.14 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on HSAI shares. Morgan Stanley upgraded Hesai Group from an "equal weight" rating to an "overweight" rating and boosted their price target for the stock from $23.00 to $26.00 in a research note on Monday, July 28th. Jefferies Financial Group initiated coverage on Hesai Group in a research note on Monday, June 9th. They set a "buy" rating and a $29.30 target price for the company. Four investment analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $27.18.

View Our Latest Stock Report on HSAI

About Hesai Group

(

Free Report)

Hesai Group, through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR). Its LiDAR products are used in passenger and commercial vehicles with advanced driver assistance systems; autonomous passenger and freight mobility services; and other applications, such as delivery robots, street sweeping robots, and logistics robots in restricted areas.

Further Reading

Before you consider Hesai Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hesai Group wasn't on the list.

While Hesai Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.