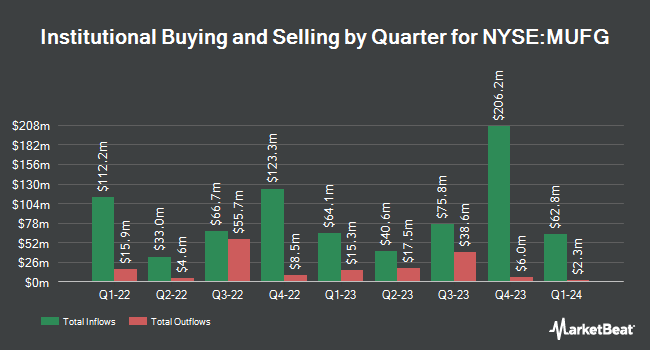

Jane Street Group LLC bought a new position in Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 131,393 shares of the company's stock, valued at approximately $1,540,000.

Other hedge funds have also added to or reduced their stakes in the company. Custom Index Systems LLC bought a new stake in Mitsubishi UFJ Financial Group in the fourth quarter worth $281,000. JPMorgan Chase & Co. boosted its holdings in Mitsubishi UFJ Financial Group by 41.7% in the third quarter. JPMorgan Chase & Co. now owns 258,298 shares of the company's stock worth $2,629,000 after acquiring an additional 75,997 shares in the last quarter. Franklin Resources Inc. boosted its holdings in Mitsubishi UFJ Financial Group by 1.9% in the third quarter. Franklin Resources Inc. now owns 49,208 shares of the company's stock worth $526,000 after acquiring an additional 938 shares in the last quarter. Bank of New York Mellon Corp boosted its holdings in Mitsubishi UFJ Financial Group by 17.7% in the fourth quarter. Bank of New York Mellon Corp now owns 1,090,733 shares of the company's stock worth $12,783,000 after acquiring an additional 164,011 shares in the last quarter. Finally, Rockefeller Capital Management L.P. boosted its holdings in Mitsubishi UFJ Financial Group by 182.6% in the fourth quarter. Rockefeller Capital Management L.P. now owns 152,526 shares of the company's stock worth $1,787,000 after acquiring an additional 98,562 shares in the last quarter. 13.59% of the stock is owned by institutional investors.

Mitsubishi UFJ Financial Group Stock Performance

Shares of NYSE:MUFG traded down $0.11 during midday trading on Friday, reaching $13.55. 9,060,002 shares of the company's stock traded hands, compared to its average volume of 4,025,845. The company has a market cap of $163.52 billion, a price-to-earnings ratio of 12.43, a P/E/G ratio of 1.16 and a beta of 0.39. The company has a debt-to-equity ratio of 2.06, a quick ratio of 0.92 and a current ratio of 0.90. Mitsubishi UFJ Financial Group, Inc. has a one year low of $8.75 and a one year high of $15.03. The stock has a 50 day moving average of $12.72 and a 200 day moving average of $12.41.

Mitsubishi UFJ Financial Group (NYSE:MUFG - Get Free Report) last announced its quarterly earnings results on Thursday, May 15th. The company reported $0.13 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.10. The firm had revenue of $22.91 billion for the quarter, compared to the consensus estimate of $6.47 billion. Mitsubishi UFJ Financial Group had a return on equity of 9.27% and a net margin of 14.19%. As a group, equities research analysts anticipate that Mitsubishi UFJ Financial Group, Inc. will post 0.99 EPS for the current fiscal year.

Analysts Set New Price Targets

Separately, Wall Street Zen raised Mitsubishi UFJ Financial Group from a "sell" rating to a "hold" rating in a report on Friday, May 16th.

Get Our Latest Research Report on MUFG

Mitsubishi UFJ Financial Group Profile

(

Free Report)

Mitsubishi UFJ Financial Group, Inc operates as the bank holding company, that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally. It operates through seven segments: Digital Service, Retail & Commercial Banking, Japanese Corporate & Investment Banking, Global Commercial Banking, Asset Management & Investor Services, Global Corporate & Investment Banking, and Global Markets.

Read More

Before you consider Mitsubishi UFJ Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitsubishi UFJ Financial Group wasn't on the list.

While Mitsubishi UFJ Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.