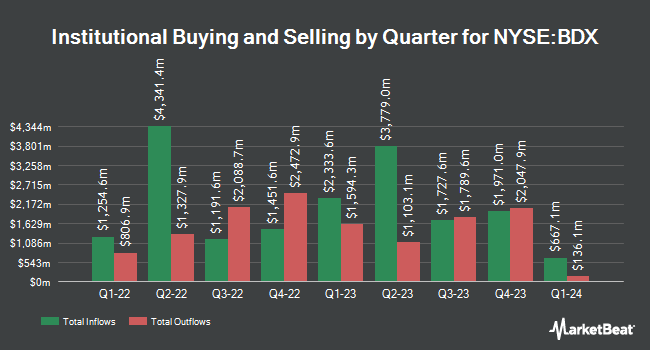

Jump Financial LLC purchased a new position in Becton, Dickinson and Company (NYSE:BDX - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 1,402 shares of the medical instruments supplier's stock, valued at approximately $321,000.

A number of other large investors have also made changes to their positions in BDX. Smallwood Wealth Investment Management LLC acquired a new position in Becton, Dickinson and Company in the 1st quarter valued at about $27,000. REAP Financial Group LLC grew its holdings in shares of Becton, Dickinson and Company by 75.3% during the fourth quarter. REAP Financial Group LLC now owns 128 shares of the medical instruments supplier's stock worth $29,000 after buying an additional 55 shares in the last quarter. Alpine Bank Wealth Management acquired a new position in shares of Becton, Dickinson and Company in the first quarter valued at approximately $29,000. Cornerstone Planning Group LLC grew its stake in Becton, Dickinson and Company by 341.4% in the 1st quarter. Cornerstone Planning Group LLC now owns 128 shares of the medical instruments supplier's stock worth $29,000 after acquiring an additional 99 shares during the period. Finally, Kelly Lawrence W & Associates Inc. CA acquired a new position in Becton, Dickinson and Company in the 1st quarter valued at $31,000. Institutional investors and hedge funds own 86.97% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on the company. Citigroup cut Becton, Dickinson and Company from a "strong-buy" rating to a "hold" rating and decreased their price objective for the stock from $217.00 to $185.00 in a report on Thursday, May 22nd. Wall Street Zen upgraded Becton, Dickinson and Company from a "hold" rating to a "buy" rating in a research report on Saturday, August 9th. Morgan Stanley lifted their price target on Becton, Dickinson and Company from $196.00 to $197.00 and gave the company an "overweight" rating in a report on Monday, August 11th. Piper Sandler reiterated a "neutral" rating and set a $200.00 price objective (up from $185.00) on shares of Becton, Dickinson and Company in a report on Friday, August 8th. Finally, Wells Fargo & Company raised their target price on shares of Becton, Dickinson and Company from $172.00 to $184.00 and gave the stock an "equal weight" rating in a research report on Friday, August 8th. Four equities research analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $211.44.

Read Our Latest Stock Report on BDX

Becton, Dickinson and Company Trading Up 0.5%

Shares of NYSE:BDX traded up $0.92 during trading on Friday, reaching $192.18. 1,244,193 shares of the stock were exchanged, compared to its average volume of 2,050,719. The firm's 50-day moving average price is $185.08 and its 200 day moving average price is $193.08. The firm has a market cap of $55.08 billion, a price-to-earnings ratio of 34.56, a price-to-earnings-growth ratio of 1.43 and a beta of 0.27. Becton, Dickinson and Company has a 12-month low of $163.33 and a 12-month high of $251.99. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.62 and a current ratio of 1.10.

Becton, Dickinson and Company (NYSE:BDX - Get Free Report) last posted its earnings results on Thursday, August 7th. The medical instruments supplier reported $3.68 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.40 by $0.28. The business had revenue of $5.51 billion during the quarter, compared to analyst estimates of $5.50 billion. Becton, Dickinson and Company had a return on equity of 16.23% and a net margin of 7.51%.The company's revenue for the quarter was up 10.4% compared to the same quarter last year. During the same quarter last year, the firm earned $3.50 earnings per share. Becton, Dickinson and Company has set its FY 2025 guidance at 14.300-14.450 EPS. On average, sell-side analysts anticipate that Becton, Dickinson and Company will post 14.43 earnings per share for the current fiscal year.

Becton, Dickinson and Company Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Monday, September 8th will be paid a $1.04 dividend. The ex-dividend date is Monday, September 8th. This represents a $4.16 annualized dividend and a dividend yield of 2.2%. Becton, Dickinson and Company's dividend payout ratio is 74.82%.

Insiders Place Their Bets

In related news, Director Claire Fraser sold 863 shares of Becton, Dickinson and Company stock in a transaction on Friday, August 8th. The shares were sold at an average price of $192.30, for a total transaction of $165,954.90. Following the sale, the director owned 23,143 shares of the company's stock, valued at $4,450,398.90. The trade was a 3.59% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, EVP Michael David Garrison sold 1,185 shares of the firm's stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $180.29, for a total value of $213,643.65. Following the sale, the executive vice president owned 4,887 shares of the company's stock, valued at $881,077.23. This represents a 19.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.36% of the stock is currently owned by company insiders.

Becton, Dickinson and Company Company Profile

(

Free Report)

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide. The company operates in three segments: BD Medical, BD Life Sciences, and BD Interventional.

Read More

Before you consider Becton, Dickinson and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Becton, Dickinson and Company wasn't on the list.

While Becton, Dickinson and Company currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report