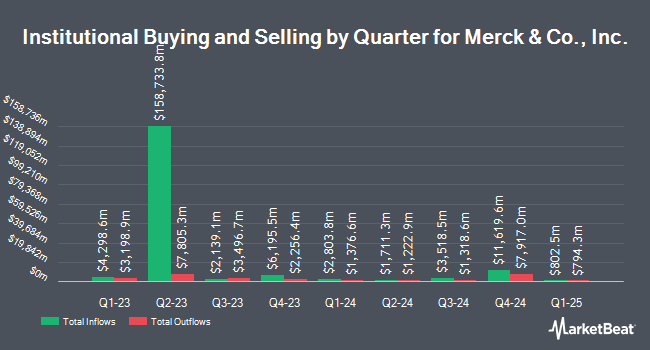

Donoghue Forlines LLC bought a new position in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 15,586 shares of the company's stock, valued at approximately $1,399,000.

A number of other large investors have also recently added to or reduced their stakes in MRK. Barnes Dennig Private Wealth Management LLC acquired a new position in Merck & Co., Inc. in the 1st quarter worth approximately $27,000. Spurstone Advisory Services LLC acquired a new position in Merck & Co., Inc. in the 4th quarter worth approximately $37,000. MorganRosel Wealth Management LLC acquired a new position in Merck & Co., Inc. in the 1st quarter worth approximately $36,000. Marshall & Sterling Wealth Advisors Inc. acquired a new position in Merck & Co., Inc. in the 4th quarter worth approximately $44,000. Finally, Minot DeBlois Advisors LLC acquired a new position in Merck & Co., Inc. in the 4th quarter worth approximately $45,000. 76.07% of the stock is currently owned by institutional investors.

Merck & Co., Inc. Stock Up 0.3%

Shares of MRK stock traded up $0.26 on Tuesday, hitting $80.29. The company's stock had a trading volume of 7,849,343 shares, compared to its average volume of 15,616,303. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.42 and a quick ratio of 1.17. Merck & Co., Inc. has a fifty-two week low of $73.31 and a fifty-two week high of $120.30. The firm's fifty day moving average price is $80.82 and its 200-day moving average price is $83.75. The stock has a market capitalization of $200.55 billion, a price-to-earnings ratio of 12.37, a P/E/G ratio of 0.85 and a beta of 0.38.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last released its quarterly earnings data on Tuesday, July 29th. The company reported $2.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.03 by $0.10. Merck & Co., Inc. had a net margin of 25.79% and a return on equity of 41.05%. The business had revenue of $15.81 billion during the quarter, compared to analyst estimates of $15.92 billion. Research analysts anticipate that Merck & Co., Inc. will post 9.01 EPS for the current year.

Merck & Co., Inc. Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, October 7th. Investors of record on Monday, September 15th will be paid a $0.81 dividend. This represents a $3.24 annualized dividend and a dividend yield of 4.0%. The ex-dividend date of this dividend is Monday, September 15th. Merck & Co., Inc.'s payout ratio is presently 49.92%.

Analyst Ratings Changes

MRK has been the subject of a number of recent analyst reports. Wells Fargo & Company decreased their price objective on shares of Merck & Co., Inc. from $97.00 to $90.00 and set an "equal weight" rating for the company in a research note on Wednesday, July 30th. Wall Street Zen lowered shares of Merck & Co., Inc. from a "strong-buy" rating to a "buy" rating in a research note on Friday, April 25th. Citigroup reaffirmed a "neutral" rating and issued a $84.00 price objective (down previously from $115.00) on shares of Merck & Co., Inc. in a research note on Wednesday, May 14th. Guggenheim reaffirmed a "buy" rating and issued a $115.00 price objective on shares of Merck & Co., Inc. in a research note on Thursday, April 17th. Finally, Morgan Stanley decreased their price objective on shares of Merck & Co., Inc. from $99.00 to $98.00 and set an "equal weight" rating for the company in a research note on Thursday, July 10th. One equities research analyst has rated the stock with a sell rating, twelve have given a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $107.44.

View Our Latest Report on MRK

Merck & Co., Inc. Company Profile

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Featured Stories

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.