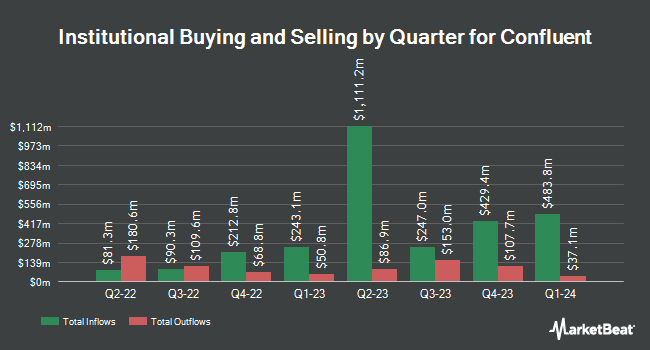

1832 Asset Management L.P. acquired a new stake in shares of Confluent, Inc. (NASDAQ:CFLT - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 2,071,100 shares of the company's stock, valued at approximately $48,547,000. 1832 Asset Management L.P. owned 0.61% of Confluent as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors also recently added to or reduced their stakes in the business. Price T Rowe Associates Inc. MD lifted its stake in Confluent by 13.5% during the first quarter. Price T Rowe Associates Inc. MD now owns 5,510,743 shares of the company's stock worth $129,173,000 after purchasing an additional 654,827 shares during the last quarter. MIG Capital LLC lifted its stake in Confluent by 11.1% during the first quarter. MIG Capital LLC now owns 1,073,354 shares of the company's stock worth $25,159,000 after purchasing an additional 107,450 shares during the last quarter. Northern Trust Corp lifted its stake in Confluent by 2.1% during the first quarter. Northern Trust Corp now owns 1,412,390 shares of the company's stock worth $33,106,000 after purchasing an additional 29,362 shares during the last quarter. Northwest & Ethical Investments L.P. bought a new stake in Confluent during the first quarter worth about $919,000. Finally, Liontrust Investment Partners LLP bought a new stake in Confluent during the first quarter worth about $1,294,000. Institutional investors own 78.09% of the company's stock.

Confluent Stock Up 6.1%

Shares of CFLT stock traded up $1.09 during midday trading on Wednesday, reaching $18.85. 11,941,155 shares of the stock were exchanged, compared to its average volume of 6,639,855. Confluent, Inc. has a 1 year low of $15.64 and a 1 year high of $37.90. The company's 50 day moving average is $22.19 and its two-hundred day moving average is $23.99. The company has a current ratio of 3.98, a quick ratio of 3.98 and a debt-to-equity ratio of 1.03. The firm has a market cap of $6.50 billion, a PE ratio of -20.05 and a beta of 0.96.

Confluent (NASDAQ:CFLT - Get Free Report) last posted its earnings results on Wednesday, July 30th. The company reported $0.09 earnings per share for the quarter, topping analysts' consensus estimates of $0.08 by $0.01. Confluent had a negative return on equity of 27.34% and a negative net margin of 29.27%.The firm had revenue of $282.29 million for the quarter, compared to the consensus estimate of $278.32 million. During the same quarter in the prior year, the business earned $0.06 EPS. The business's revenue for the quarter was up 20.1% on a year-over-year basis. Confluent has set its Q3 2025 guidance at 0.090-0.100 EPS. FY 2025 guidance at 0.360-0.360 EPS. On average, equities research analysts predict that Confluent, Inc. will post -0.83 EPS for the current year.

Analyst Ratings Changes

A number of equities research analysts have recently weighed in on the company. Oppenheimer lowered their target price on Confluent from $32.00 to $26.00 and set an "outperform" rating for the company in a research note on Thursday, July 31st. DA Davidson lowered their target price on Confluent from $32.00 to $24.00 and set a "buy" rating for the company in a research note on Thursday, July 31st. JMP Securities lowered their target price on Confluent from $40.00 to $36.00 and set a "market outperform" rating for the company in a research note on Thursday, May 1st. Robert W. Baird lowered their target price on Confluent from $37.00 to $24.00 and set a "neutral" rating for the company in a research note on Thursday, May 1st. Finally, Truist Financial lowered their target price on Confluent from $35.00 to $30.00 and set a "buy" rating for the company in a research note on Thursday, May 1st. Two investment analysts have rated the stock with a Strong Buy rating, nineteen have given a Buy rating, ten have assigned a Hold rating and one has given a Sell rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $27.36.

Get Our Latest Research Report on CFLT

Insider Activity

In related news, Director Michelangelo Volpi sold 25,000 shares of the company's stock in a transaction that occurred on Thursday, June 5th. The stock was sold at an average price of $25.00, for a total value of $625,000.00. Following the sale, the director owned 267,079 shares in the company, valued at $6,676,975. This represents a 8.56% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CEO Edward Jay Kreps sold 232,500 shares of the company's stock in a transaction that occurred on Thursday, August 14th. The stock was sold at an average price of $17.18, for a total value of $3,994,350.00. Following the completion of the sale, the chief executive officer owned 452,488 shares in the company, valued at $7,773,743.84. The trade was a 33.94% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 627,117 shares of company stock worth $13,017,274. Company insiders own 13.82% of the company's stock.

About Confluent

(

Free Report)

Confluent, Inc operates a data streaming platform in the United States and internationally. The company provides platforms that allow customers to connect their applications, systems, and data layers, such as Confluent Cloud, a managed cloud-native software-as-a-service; and Confluent Platform, an enterprise-grade self-managed software.

Further Reading

Before you consider Confluent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Confluent wasn't on the list.

While Confluent currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.