FORA Capital LLC purchased a new stake in shares of Fortive Corporation (NYSE:FTV - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 19,602 shares of the technology company's stock, valued at approximately $1,434,000.

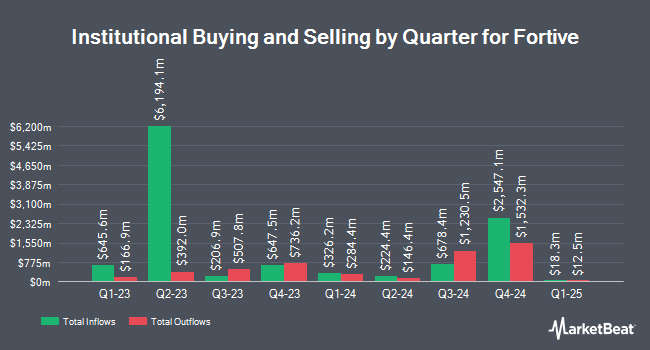

Several other institutional investors have also recently made changes to their positions in the business. Dodge & Cox grew its position in Fortive by 181.5% during the first quarter. Dodge & Cox now owns 21,900,363 shares of the technology company's stock valued at $1,602,669,000 after buying an additional 14,120,456 shares during the period. Price T Rowe Associates Inc. MD boosted its stake in shares of Fortive by 50.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 13,112,403 shares of the technology company's stock worth $959,567,000 after acquiring an additional 4,382,242 shares during the last quarter. Invesco Ltd. grew its position in shares of Fortive by 96.6% during the 1st quarter. Invesco Ltd. now owns 5,626,962 shares of the technology company's stock valued at $411,781,000 after acquiring an additional 2,764,432 shares during the period. Select Equity Group L.P. grew its position in shares of Fortive by 20.1% during the 4th quarter. Select Equity Group L.P. now owns 4,297,573 shares of the technology company's stock valued at $322,318,000 after acquiring an additional 720,250 shares during the period. Finally, Northern Trust Corp increased its stake in shares of Fortive by 2.8% in the 1st quarter. Northern Trust Corp now owns 4,067,929 shares of the technology company's stock worth $297,691,000 after purchasing an additional 109,307 shares in the last quarter. Institutional investors own 94.94% of the company's stock.

Fortive Price Performance

NYSE FTV traded down $0.19 during trading hours on Monday, reaching $47.82. The company's stock had a trading volume of 2,948,731 shares, compared to its average volume of 4,549,641. Fortive Corporation has a 1 year low of $46.34 and a 1 year high of $83.32. The company has a quick ratio of 0.82, a current ratio of 0.98 and a debt-to-equity ratio of 0.28. The company has a market capitalization of $16.18 billion, a price-to-earnings ratio of 21.54, a PEG ratio of 3.03 and a beta of 1.10. The firm's 50-day moving average price is $51.97 and its 200-day moving average price is $64.93.

Fortive (NYSE:FTV - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The technology company reported $0.58 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.60 by ($0.02). Fortive had a net margin of 13.62% and a return on equity of 11.96%. The company had revenue of $1.52 billion for the quarter, compared to the consensus estimate of $1.54 billion. During the same quarter in the previous year, the business earned $0.93 EPS. The company's quarterly revenue was down .4% on a year-over-year basis. Fortive has set its FY 2025 guidance at 2.500-2.600 EPS. On average, equities research analysts predict that Fortive Corporation will post 4.05 EPS for the current fiscal year.

Fortive announced that its Board of Directors has initiated a stock buyback program on Tuesday, May 27th that permits the company to repurchase 15,630,000 outstanding shares. This repurchase authorization permits the technology company to repurchase shares of its stock through open market purchases. Shares repurchase programs are typically a sign that the company's management believes its stock is undervalued.

Fortive Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Shareholders of record on Friday, September 12th will be issued a dividend of $0.06 per share. This represents a $0.24 annualized dividend and a dividend yield of 0.5%. The ex-dividend date of this dividend is Friday, September 12th. Fortive's dividend payout ratio is 14.41%.

Analyst Upgrades and Downgrades

FTV has been the topic of several analyst reports. Melius downgraded Fortive from a "buy" rating to a "hold" rating and set a $62.00 target price on the stock. in a research report on Tuesday, July 22nd. Mizuho decreased their price objective on Fortive from $85.00 to $65.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 16th. Raymond James Financial cut their price objective on Fortive from $90.00 to $65.00 and set an "outperform" rating for the company in a research note on Tuesday, July 1st. Robert W. Baird decreased their target price on shares of Fortive from $88.00 to $82.00 and set an "outperform" rating on the stock in a research note on Wednesday, May 7th. Finally, Wall Street Zen raised shares of Fortive to a "hold" rating in a report on Saturday, July 5th. Five analysts have rated the stock with a Buy rating and thirteen have issued a Hold rating to the stock. According to MarketBeat.com, Fortive currently has an average rating of "Hold" and a consensus price target of $65.57.

Get Our Latest Analysis on Fortive

Fortive Company Profile

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

Featured Stories

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report