Prudential PLC acquired a new stake in Expand Energy Corporation (NASDAQ:EXE - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 19,900 shares of the company's stock, valued at approximately $2,215,000.

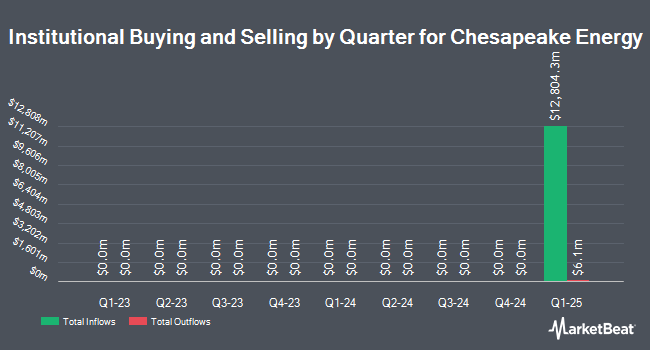

A number of other hedge funds and other institutional investors have also bought and sold shares of the company. GAMMA Investing LLC acquired a new position in Expand Energy in the first quarter valued at approximately $36,507,000. Parallel Advisors LLC purchased a new stake in Expand Energy in the 1st quarter worth approximately $286,000. Doliver Advisors LP bought a new stake in Expand Energy during the first quarter valued at $446,000. Peoples Bank KS bought a new position in Expand Energy during the first quarter valued at approximately $33,000. Finally, Fifth Third Wealth Advisors LLC bought a new stake in shares of Expand Energy in the 1st quarter valued at about $466,000. Institutional investors own 97.93% of the company's stock.

Insider Activity at Expand Energy

In related news, CEO Domenic J. Dell'osso, Jr. purchased 2,500 shares of the company's stock in a transaction dated Friday, August 15th. The stock was acquired at an average cost of $95.86 per share, for a total transaction of $239,650.00. Following the completion of the transaction, the chief executive officer directly owned 166,715 shares of the company's stock, valued at approximately $15,981,299.90. This trade represents a 1.52% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Also, COO Joshua J. Viets purchased 2,000 shares of Expand Energy stock in a transaction dated Monday, August 18th. The shares were bought at an average price of $92.16 per share, for a total transaction of $184,320.00. Following the acquisition, the chief operating officer owned 61,676 shares in the company, valued at approximately $5,684,060.16. This trade represents a 3.35% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 0.17% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have recently commented on EXE. The Goldman Sachs Group lowered their price objective on shares of Expand Energy from $127.00 to $125.00 in a research note on Thursday, July 17th. Barclays upped their price target on shares of Expand Energy from $122.00 to $139.00 and gave the company an "overweight" rating in a research report on Monday, July 7th. Scotiabank reissued an "outperform" rating on shares of Expand Energy in a report on Wednesday, August 13th. Roth Capital cut shares of Expand Energy from a "buy" rating to a "neutral" rating and reduced their target price for the company from $125.00 to $98.00 in a report on Monday. Finally, Wells Fargo & Company cut their price objective on shares of Expand Energy from $121.00 to $120.00 and set an "equal weight" rating for the company in a research report on Tuesday, July 15th. Two investment analysts have rated the stock with a Strong Buy rating, seventeen have given a Buy rating and two have given a Hold rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus target price of $127.92.

View Our Latest Analysis on Expand Energy

Expand Energy Stock Performance

NASDAQ EXE traded down $0.7250 during trading hours on Tuesday, reaching $92.3050. The stock had a trading volume of 981,951 shares, compared to its average volume of 3,765,402. Expand Energy Corporation has a 52-week low of $69.12 and a 52-week high of $123.35. The stock has a fifty day moving average of $107.34 and a 200 day moving average of $107.21. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.78 and a current ratio of 0.78. The stock has a market cap of $21.98 billion, a P/E ratio of 236.32 and a beta of 0.46.

Expand Energy (NASDAQ:EXE - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The company reported $1.10 EPS for the quarter, missing the consensus estimate of $1.14 by ($0.04). The business had revenue of $3.69 billion during the quarter, compared to analysts' expectations of $2.09 billion. Expand Energy had a net margin of 2.41% and a return on equity of 5.76%. Sell-side analysts predict that Expand Energy Corporation will post 1.33 earnings per share for the current year.

Expand Energy Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Shareholders of record on Thursday, August 14th will be issued a $0.575 dividend. The ex-dividend date is Thursday, August 14th. This represents a $2.30 dividend on an annualized basis and a yield of 2.5%. Expand Energy's dividend payout ratio is presently 589.74%.

About Expand Energy

(

Free Report)

Expand Energy Corporation is an independent natural gas producer principally in the United States. Expand Energy Corporation, formerly known as Chesapeake Energy Corporation, is based in OKLAHOMA CITY.

See Also

Before you consider Expand Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expand Energy wasn't on the list.

While Expand Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.