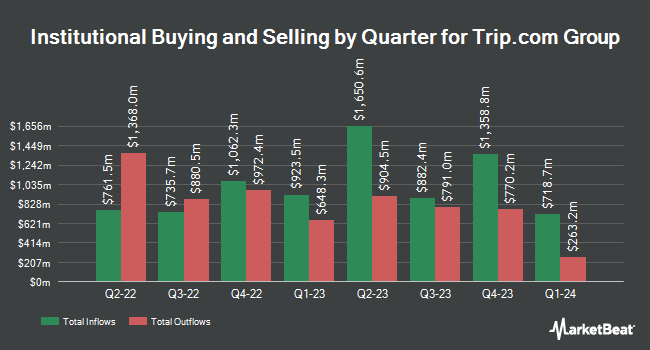

Pinnacle Investment Management Ltd acquired a new position in shares of Trip.com Group Limited Sponsored ADR (NASDAQ:TCOM - Free Report) in the first quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 20,000 shares of the company's stock, valued at approximately $1,272,000. Trip.com Group comprises about 13.7% of Pinnacle Investment Management Ltd's holdings, making the stock its 2nd largest position.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Mirae Asset Global Investments Co. Ltd. increased its position in shares of Trip.com Group by 1,609.6% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 12,920,955 shares of the company's stock worth $821,514,000 after acquiring an additional 12,165,176 shares in the last quarter. Davis Selected Advisers increased its holdings in Trip.com Group by 29.8% in the 1st quarter. Davis Selected Advisers now owns 4,862,997 shares of the company's stock valued at $309,189,000 after purchasing an additional 1,115,836 shares in the last quarter. Russell Investments Group Ltd. increased its holdings in Trip.com Group by 48.7% in the 1st quarter. Russell Investments Group Ltd. now owns 2,386,398 shares of the company's stock valued at $151,727,000 after purchasing an additional 781,916 shares in the last quarter. Kontiki Capital Management HK Ltd. increased its holdings in Trip.com Group by 3.4% in the 1st quarter. Kontiki Capital Management HK Ltd. now owns 1,929,847 shares of the company's stock valued at $122,700,000 after purchasing an additional 63,407 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD grew its stake in shares of Trip.com Group by 11.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,592,631 shares of the company's stock valued at $101,261,000 after buying an additional 161,295 shares in the last quarter. 35.41% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several analysts have issued reports on TCOM shares. Benchmark reaffirmed a "buy" rating and issued a $80.00 price objective on shares of Trip.com Group in a research report on Tuesday, May 20th. Zacks Research raised shares of Trip.com Group from a "hold" rating to a "strong-buy" rating in a report on Thursday, September 4th. Barclays raised their target price on Trip.com Group from $84.00 to $85.00 and gave the company an "overweight" rating in a research note on Friday, August 29th. Mizuho raised their target price on Trip.com Group from $78.00 to $81.00 and gave the company an "outperform" rating in a research note on Thursday, August 28th. Finally, TD Securities raised their target price on Trip.com Group from $67.00 to $73.00 and gave the company a "buy" rating in a research note on Tuesday, May 20th. Two investment analysts have rated the stock with a Strong Buy rating and eleven have assigned a Buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $76.98.

View Our Latest Stock Analysis on TCOM

Trip.com Group Trading Down 0.1%

Shares of NASDAQ TCOM traded down $0.11 during mid-day trading on Wednesday, hitting $76.47. 2,851,905 shares of the company traded hands, compared to its average volume of 3,485,194. The company has a quick ratio of 1.33, a current ratio of 1.33 and a debt-to-equity ratio of 0.07. Trip.com Group Limited Sponsored ADR has a 1 year low of $46.20 and a 1 year high of $77.87. The stock has a market capitalization of $49.95 billion, a price-to-earnings ratio of 20.92, a PEG ratio of 3.06 and a beta of 0.03. The business has a 50 day moving average of $65.67 and a two-hundred day moving average of $62.33.

Trip.com Group Company Profile

(

Free Report)

Trip.com Group Limited, through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally. The company acts as an agent for hotel-related transactions and selling air tickets, as well as provides train, long-distance bus, and ferry tickets; travel insurance products, such as flight delay, air accident, and baggage loss coverage; and air-ticket delivery, online check-in and seat selection, express security screening, real-time flight status tracker, and airport VIP lounge services.

Featured Articles

Before you consider Trip.com Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trip.com Group wasn't on the list.

While Trip.com Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.