Allianz SE purchased a new position in shares of VEON Ltd. (NASDAQ:VEON - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund purchased 20,360 shares of the Wireless communications provider's stock, valued at approximately $888,000.

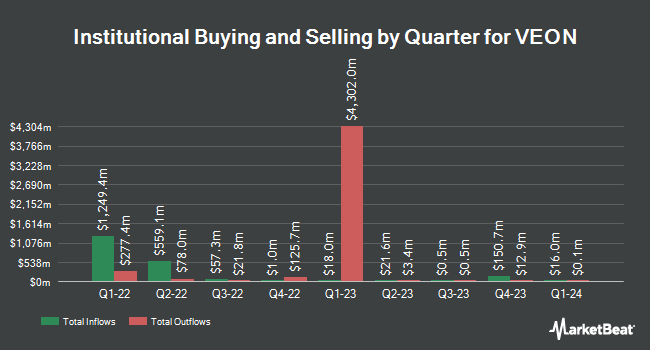

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Diameter Capital Partners LP acquired a new stake in shares of VEON during the 4th quarter valued at approximately $25,161,000. GAMMA Investing LLC boosted its position in shares of VEON by 5,190.9% in the 1st quarter. GAMMA Investing LLC now owns 157,563 shares of the Wireless communications provider's stock worth $6,871,000 after buying an additional 154,585 shares in the last quarter. Russell Investments Group Ltd. grew its stake in VEON by 2.2% in the 4th quarter. Russell Investments Group Ltd. now owns 117,808 shares of the Wireless communications provider's stock valued at $4,724,000 after acquiring an additional 2,512 shares during the last quarter. Cyrus Capital Partners L.P. purchased a new position in VEON during the 4th quarter valued at about $2,994,000. Finally, J. Goldman & Co LP acquired a new position in VEON during the fourth quarter worth about $2,084,000. Hedge funds and other institutional investors own 21.30% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on the stock. Litchfield Hills Research upgraded shares of VEON to a "strong-buy" rating in a research report on Thursday, June 26th. Benchmark reissued a "buy" rating and issued a $60.00 price target on shares of VEON in a report on Monday, June 16th. Finally, Wall Street Zen raised VEON from a "buy" rating to a "strong-buy" rating in a research note on Sunday, June 29th.

View Our Latest Stock Analysis on VEON

VEON Trading Up 7.9%

Shares of VEON traded up $3.83 during mid-day trading on Wednesday, hitting $52.35. The company had a trading volume of 236,025 shares, compared to its average volume of 244,326. VEON Ltd. has a 1-year low of $25.92 and a 1-year high of $59.68. The company has a quick ratio of 0.80, a current ratio of 0.81 and a debt-to-equity ratio of 2.17. The business's 50-day simple moving average is $47.94 and its 200-day simple moving average is $46.09. The stock has a market cap of $3.87 billion, a PE ratio of 8.26 and a beta of 1.50.

VEON (NASDAQ:VEON - Get Free Report) last released its quarterly earnings data on Thursday, May 15th. The Wireless communications provider reported $1.36 EPS for the quarter, topping analysts' consensus estimates of $0.83 by $0.53. VEON had a return on equity of 36.24% and a net margin of 11.18%. The company had revenue of $1.03 billion for the quarter, compared to the consensus estimate of $996.00 million.

VEON Profile

(

Free Report)

VEON Ltd., a digital operator, provides connectivity and internet services in Pakistan, Ukraine, Kazakhstan, Bangladesh, Uzbekistan, and Kyrgyzstan. It offers mobile telecommunications services, including value added and call completion, national and international roaming, wireless Internet access, mobile financial, and mobile bundle services; data connectivity, cross border transit, voice, Internet, and data services; fixed-line telecommunications using intercity fiber optic networks; and Internet-TV using Fiber to the building technology.

Featured Stories

Before you consider VEON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VEON wasn't on the list.

While VEON currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.