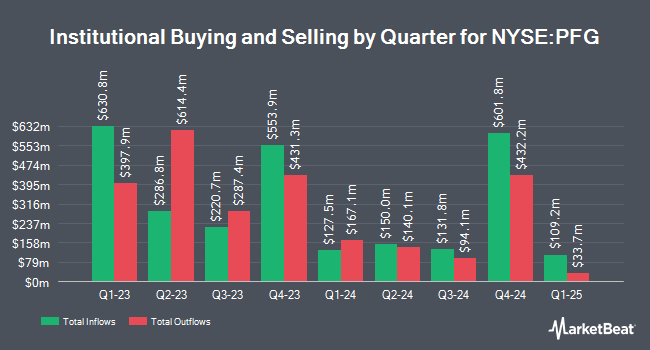

Magnetar Financial LLC purchased a new position in shares of Principal Financial Group, Inc. (NYSE:PFG - Free Report) during the first quarter, according to its most recent disclosure with the SEC. The institutional investor purchased 22,878 shares of the company's stock, valued at approximately $1,930,000.

Other institutional investors have also added to or reduced their stakes in the company. von Borstel & Associates Inc. acquired a new position in Principal Financial Group during the 1st quarter worth approximately $32,000. Zions Bancorporation National Association UT acquired a new position in Principal Financial Group during the 1st quarter worth approximately $34,000. Ameriflex Group Inc. acquired a new position in Principal Financial Group during the 4th quarter worth approximately $37,000. GKV Capital Management Co. Inc. bought a new stake in Principal Financial Group during the 1st quarter worth approximately $45,000. Finally, MorganRosel Wealth Management LLC bought a new stake in Principal Financial Group during the 1st quarter worth approximately $46,000. 75.08% of the stock is owned by institutional investors and hedge funds.

Principal Financial Group Stock Performance

Principal Financial Group stock traded up $0.24 during midday trading on Wednesday, reaching $80.18. The stock had a trading volume of 1,431,150 shares, compared to its average volume of 1,394,376. Principal Financial Group, Inc. has a 12 month low of $68.39 and a 12 month high of $91.97. The firm's 50-day moving average price is $79.23 and its 200 day moving average price is $79.27. The firm has a market capitalization of $17.86 billion, a PE ratio of 12.00, a P/E/G ratio of 0.76 and a beta of 1.03. The company has a quick ratio of 0.30, a current ratio of 0.29 and a debt-to-equity ratio of 0.36.

Principal Financial Group (NYSE:PFG - Get Free Report) last announced its quarterly earnings data on Monday, July 28th. The company reported $2.16 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.97 by $0.19. Principal Financial Group had a return on equity of 14.68% and a net margin of 9.74%.During the same period in the previous year, the company posted $1.63 EPS. As a group, research analysts predict that Principal Financial Group, Inc. will post 8.5 earnings per share for the current fiscal year.

Principal Financial Group Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Thursday, September 4th will be paid a $0.78 dividend. The ex-dividend date is Thursday, September 4th. This represents a $3.12 dividend on an annualized basis and a yield of 3.9%. This is an increase from Principal Financial Group's previous quarterly dividend of $0.76. Principal Financial Group's dividend payout ratio (DPR) is presently 62.78%.

Analyst Upgrades and Downgrades

A number of analysts have commented on the company. Wells Fargo & Company decreased their price objective on Principal Financial Group from $73.00 to $72.00 and set an "underweight" rating for the company in a report on Wednesday, July 30th. Morgan Stanley boosted their price objective on Principal Financial Group from $75.00 to $77.00 and gave the stock an "underweight" rating in a report on Monday, August 18th. Piper Sandler boosted their price objective on Principal Financial Group from $88.00 to $89.00 and gave the stock an "overweight" rating in a report on Thursday, July 3rd. Keefe, Bruyette & Woods decreased their price objective on Principal Financial Group from $90.00 to $88.00 and set a "market perform" rating for the company in a report on Monday, August 4th. Finally, Barclays boosted their price objective on Principal Financial Group from $76.00 to $80.00 and gave the stock an "underweight" rating in a report on Monday, July 7th. Two equities research analysts have rated the stock with a Buy rating, five have issued a Hold rating and three have given a Sell rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Reduce" and an average target price of $86.90.

View Our Latest Research Report on Principal Financial Group

Principal Financial Group Profile

(

Free Report)

Principal Financial Group, Inc provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide. The company operates through Retirement and Income Solutions, Principal Asset Management, and Benefits and Protection segments. The Retirement and Income Solutions segment provides retirement, and related financial products and services.

Further Reading

Before you consider Principal Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Principal Financial Group wasn't on the list.

While Principal Financial Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.