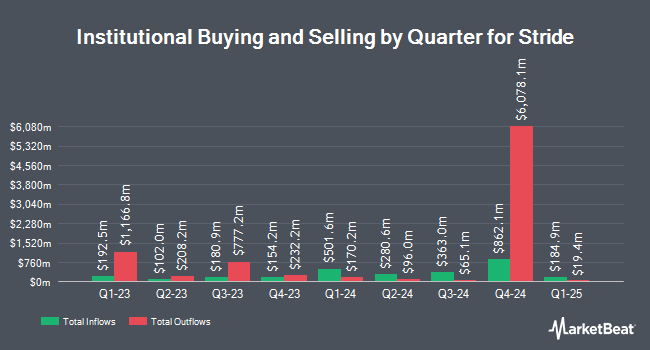

HB Wealth Management LLC purchased a new stake in shares of Stride, Inc. (NYSE:LRN - Free Report) during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor purchased 2,435 shares of the company's stock, valued at approximately $308,000.

A number of other institutional investors have also recently made changes to their positions in LRN. Bosun Asset Management LLC raised its position in Stride by 1.4% in the fourth quarter. Bosun Asset Management LLC now owns 8,292 shares of the company's stock worth $862,000 after acquiring an additional 111 shares during the period. First Horizon Advisors Inc. raised its position in Stride by 140.5% in the first quarter. First Horizon Advisors Inc. now owns 267 shares of the company's stock worth $34,000 after acquiring an additional 156 shares during the period. Larson Financial Group LLC raised its position in Stride by 333.3% in the first quarter. Larson Financial Group LLC now owns 208 shares of the company's stock worth $26,000 after acquiring an additional 160 shares during the period. CIBC Private Wealth Group LLC raised its position in Stride by 85.6% in the fourth quarter. CIBC Private Wealth Group LLC now owns 386 shares of the company's stock worth $42,000 after acquiring an additional 178 shares during the period. Finally, NDVR Inc. raised its position in Stride by 5.1% in the fourth quarter. NDVR Inc. now owns 3,762 shares of the company's stock worth $391,000 after acquiring an additional 182 shares during the period. Hedge funds and other institutional investors own 98.24% of the company's stock.

Analyst Upgrades and Downgrades

LRN has been the topic of several recent research reports. Wall Street Zen upgraded shares of Stride from a "hold" rating to a "buy" rating in a research report on Saturday, June 21st. Canaccord Genuity Group raised their price objective on shares of Stride from $145.00 to $155.00 and gave the company a "buy" rating in a research report on Monday, April 28th. William Blair restated an "outperform" rating on shares of Stride in a research report on Wednesday, April 30th. Barrington Research restated an "outperform" rating and set a $170.00 price objective on shares of Stride in a research report on Thursday, July 24th. Finally, BMO Capital Markets restated an "outperform" rating on shares of Stride in a research report on Thursday, May 1st. Two investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat, Stride currently has an average rating of "Moderate Buy" and a consensus price target of $126.83.

Check Out Our Latest Stock Report on Stride

Stride Price Performance

LRN traded up $1.09 during trading on Monday, hitting $130.35. 565,269 shares of the company traded hands, compared to its average volume of 767,404. The company has a market cap of $5.67 billion, a PE ratio of 20.33, a P/E/G ratio of 0.83 and a beta of 0.10. The stock's 50-day simple moving average is $139.80 and its two-hundred day simple moving average is $137.10. Stride, Inc. has a 1 year low of $63.25 and a 1 year high of $162.30. The company has a current ratio of 5.61, a quick ratio of 5.53 and a debt-to-equity ratio of 0.33.

Stride Company Profile

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Further Reading

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.