XTX Topco Ltd bought a new stake in shares of Columbia Sportswear Company (NASDAQ:COLM - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 24,973 shares of the textile maker's stock, valued at approximately $1,890,000.

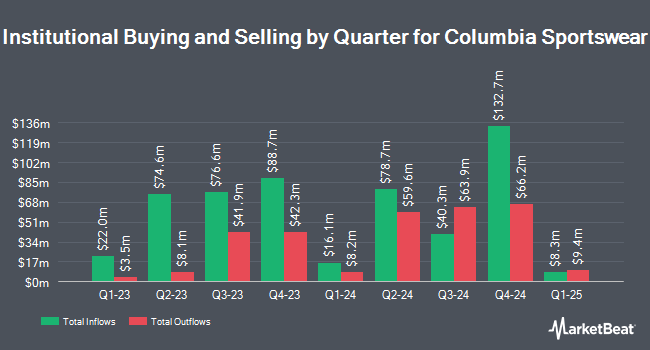

A number of other institutional investors also recently modified their holdings of COLM. LPL Financial LLC raised its holdings in shares of Columbia Sportswear by 37.8% during the 4th quarter. LPL Financial LLC now owns 3,429 shares of the textile maker's stock valued at $288,000 after purchasing an additional 941 shares in the last quarter. Norges Bank bought a new position in Columbia Sportswear in the 4th quarter worth $25,710,000. New Age Alpha Advisors LLC bought a new position in Columbia Sportswear in the 4th quarter worth $296,000. Pictet Asset Management Holding SA raised its holdings in Columbia Sportswear by 23.7% in the 4th quarter. Pictet Asset Management Holding SA now owns 4,853 shares of the textile maker's stock worth $407,000 after acquiring an additional 929 shares during the period. Finally, Arrowstreet Capital Limited Partnership raised its holdings in Columbia Sportswear by 447.7% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 294,471 shares of the textile maker's stock worth $24,715,000 after acquiring an additional 240,709 shares during the period. Institutional investors and hedge funds own 47.76% of the company's stock.

Columbia Sportswear Stock Up 2.2%

NASDAQ:COLM traded up $1.08 on Monday, reaching $50.38. The stock had a trading volume of 357,207 shares, compared to its average volume of 775,636. The company has a market capitalization of $2.78 billion, a P/E ratio of 12.86, a price-to-earnings-growth ratio of 3.33 and a beta of 1.00. Columbia Sportswear Company has a 1-year low of $48.10 and a 1-year high of $92.88. The stock has a fifty day moving average price of $61.35 and a 200-day moving average price of $70.70.

Columbia Sportswear (NASDAQ:COLM - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The textile maker reported ($0.19) EPS for the quarter, beating analysts' consensus estimates of ($0.28) by $0.09. Columbia Sportswear had a net margin of 6.59% and a return on equity of 12.97%. The firm had revenue of $605.25 million for the quarter, compared to analyst estimates of $587.97 million. During the same period in the previous year, the business earned ($0.20) earnings per share. The company's revenue for the quarter was up 6.1% compared to the same quarter last year. Sell-side analysts predict that Columbia Sportswear Company will post 4.1 earnings per share for the current fiscal year.

Columbia Sportswear Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, September 4th. Shareholders of record on Thursday, August 21st will be paid a $0.30 dividend. The ex-dividend date of this dividend is Thursday, August 21st. This represents a $1.20 dividend on an annualized basis and a dividend yield of 2.4%. Columbia Sportswear's payout ratio is currently 30.61%.

Wall Street Analyst Weigh In

Several research analysts recently commented on COLM shares. UBS Group dropped their target price on shares of Columbia Sportswear from $45.00 to $40.00 and set a "sell" rating on the stock in a report on Friday. Citigroup dropped their target price on shares of Columbia Sportswear from $64.00 to $61.00 and set a "neutral" rating on the stock in a report on Friday. Stifel Nicolaus decreased their price target on shares of Columbia Sportswear from $75.00 to $68.00 and set a "buy" rating on the stock in a research report on Friday. Barclays decreased their price target on shares of Columbia Sportswear from $62.00 to $51.00 and set an "equal weight" rating on the stock in a research report on Friday. Finally, Needham & Company LLC started coverage on shares of Columbia Sportswear in a research report on Friday, May 30th. They issued a "hold" rating on the stock. One analyst has rated the stock with a sell rating, five have given a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $60.80.

Check Out Our Latest Report on Columbia Sportswear

Insider Buying and Selling at Columbia Sportswear

In other Columbia Sportswear news, Director Stephen E. Babson sold 2,776 shares of the business's stock in a transaction dated Friday, May 9th. The shares were sold at an average price of $65.94, for a total value of $183,049.44. Following the completion of the transaction, the director directly owned 128,309 shares of the company's stock, valued at approximately $8,460,695.46. The trade was a 2.12% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Corporate insiders own 48.30% of the company's stock.

Columbia Sportswear Company Profile

(

Free Report)

Columbia Sportswear Company, together with its subsidiaries, designs, develops, markets, and distributes outdoor, active, and everyday lifestyle apparel, footwear, accessories, and equipment in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada. The company provides apparel, accessories, and equipment for hiking, trail running, snow, fishing, hunting, mountaineering, climbing, skiing and snowboarding, trail, and outdoor activities.

Further Reading

Before you consider Columbia Sportswear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbia Sportswear wasn't on the list.

While Columbia Sportswear currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.