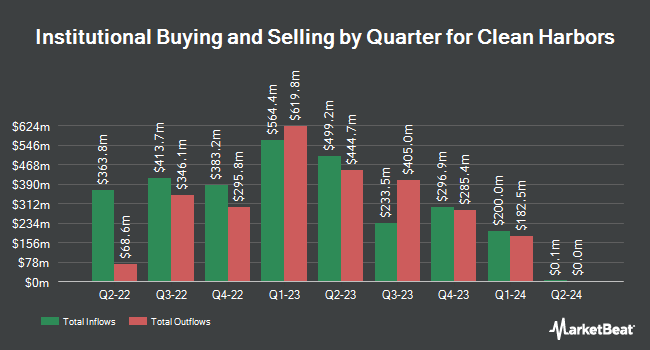

Vaughan Nelson Investment Management L.P. purchased a new position in Clean Harbors, Inc. (NYSE:CLH - Free Report) in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 255,580 shares of the business services provider's stock, valued at approximately $59,085,000. Vaughan Nelson Investment Management L.P. owned about 0.48% of Clean Harbors as of its most recent SEC filing.

A number of other institutional investors also recently bought and sold shares of the stock. Ameritas Advisory Services LLC bought a new stake in Clean Harbors in the second quarter worth $48,000. LBP AM SA increased its stake in Clean Harbors by 24.4% in the second quarter. LBP AM SA now owns 240,850 shares of the business services provider's stock worth $55,680,000 after purchasing an additional 47,211 shares during the period. Avior Wealth Management LLC purchased a new stake in Clean Harbors in the second quarter worth $348,000. Public Employees Retirement System of Ohio increased its stake in Clean Harbors by 0.3% in the second quarter. Public Employees Retirement System of Ohio now owns 15,726 shares of the business services provider's stock worth $3,636,000 after purchasing an additional 48 shares during the period. Finally, Ballentine Partners LLC purchased a new stake in Clean Harbors in the second quarter worth $204,000. 90.43% of the stock is currently owned by institutional investors.

Insider Activity

In other news, Director Andrea Robertson sold 836 shares of the business's stock in a transaction dated Thursday, July 31st. The stock was sold at an average price of $233.64, for a total transaction of $195,323.04. Following the sale, the director owned 9,888 shares in the company, valued at approximately $2,310,232.32. The trade was a 7.80% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Michael Louis Battles purchased 2,000 shares of the company's stock in a transaction dated Friday, August 1st. The shares were acquired at an average price of $233.50 per share, for a total transaction of $467,000.00. Following the purchase, the chief executive officer directly owned 82,911 shares of the company's stock, valued at approximately $19,359,718.50. The trade was a 2.47% increase in their position. The disclosure for this purchase can be found here. 5.60% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

CLH has been the topic of a number of recent analyst reports. Oppenheimer increased their target price on Clean Harbors from $254.00 to $256.00 and gave the stock an "outperform" rating in a research note on Thursday, July 31st. Raymond James Financial increased their target price on Clean Harbors from $278.00 to $280.00 and gave the stock a "strong-buy" rating in a research note on Thursday, July 31st. UBS Group raised their price target on Clean Harbors from $220.00 to $240.00 and gave the company a "neutral" rating in a research note on Thursday, July 31st. BMO Capital Markets set a $268.00 price target on Clean Harbors and gave the company an "outperform" rating in a research note on Thursday, July 31st. Finally, Barclays initiated coverage on Clean Harbors in a research note on Friday, September 19th. They set an "equal weight" rating and a $253.00 price target on the stock. One analyst has rated the stock with a Strong Buy rating, eight have issued a Buy rating and three have assigned a Hold rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $262.45.

Check Out Our Latest Report on Clean Harbors

Clean Harbors Price Performance

CLH opened at $228.51 on Friday. The business's 50-day moving average is $238.63 and its two-hundred day moving average is $225.64. Clean Harbors, Inc. has a 1 year low of $178.29 and a 1 year high of $267.11. The company has a debt-to-equity ratio of 1.02, a current ratio of 2.45 and a quick ratio of 2.07. The firm has a market capitalization of $12.26 billion, a PE ratio of 32.09 and a beta of 1.18.

Clean Harbors (NYSE:CLH - Get Free Report) last posted its earnings results on Wednesday, July 30th. The business services provider reported $2.36 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.33 by $0.03. Clean Harbors had a return on equity of 14.82% and a net margin of 6.48%.The company had revenue of $1.55 billion for the quarter, compared to analyst estimates of $1.59 billion. During the same quarter in the previous year, the firm earned $2.46 earnings per share. The firm's quarterly revenue was down .2% compared to the same quarter last year. Research analysts anticipate that Clean Harbors, Inc. will post 7.89 earnings per share for the current fiscal year.

About Clean Harbors

(

Free Report)

Clean Harbors, Inc provides environmental and industrial services in the United States and internationally. The company operates through two segments, Environmental Services and Safety-Kleen Sustainability Solutions. The Environmental Services segment collects, transports, treats, and disposes hazardous and non-hazardous waste, such as resource recovery, physical treatment, fuel blending, incineration, landfill disposal, wastewater treatment, lab chemicals disposal, and explosives management services; and offers CleanPack services, including collection, identification, categorization, specialized packaging, transportation, and disposal of laboratory chemicals and household hazardous waste.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Clean Harbors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clean Harbors wasn't on the list.

While Clean Harbors currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.