SCS Capital Management LLC acquired a new position in Atlas Energy Solutions Inc. (NYSE:AESI - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 26,164 shares of the company's stock, valued at approximately $467,000.

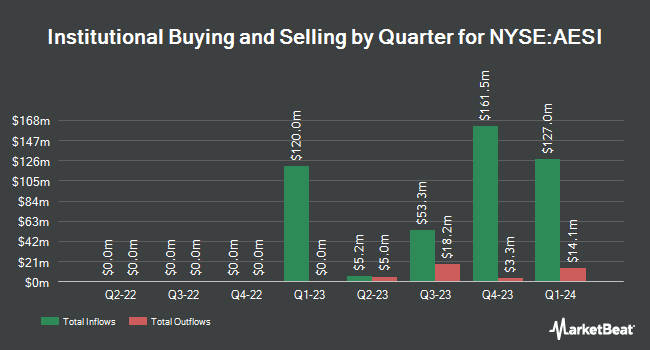

A number of other institutional investors have also recently bought and sold shares of AESI. Tower Research Capital LLC TRC boosted its stake in Atlas Energy Solutions by 307.9% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,387 shares of the company's stock worth $31,000 after buying an additional 1,047 shares in the last quarter. Fifth Third Bancorp boosted its stake in Atlas Energy Solutions by 1,240.1% during the first quarter. Fifth Third Bancorp now owns 1,970 shares of the company's stock worth $35,000 after buying an additional 1,823 shares in the last quarter. Larson Financial Group LLC boosted its stake in Atlas Energy Solutions by 201.8% during the first quarter. Larson Financial Group LLC now owns 1,968 shares of the company's stock worth $35,000 after buying an additional 1,316 shares in the last quarter. Kestra Investment Management LLC bought a new position in shares of Atlas Energy Solutions during the first quarter valued at $55,000. Finally, Canton Hathaway LLC bought a new position in shares of Atlas Energy Solutions during the first quarter valued at $73,000. Institutional investors and hedge funds own 34.59% of the company's stock.

Atlas Energy Solutions Price Performance

AESI traded up $0.03 during midday trading on Wednesday, hitting $11.24. The company had a trading volume of 285,924 shares, compared to its average volume of 1,703,084. The company has a debt-to-equity ratio of 0.39, a quick ratio of 1.30 and a current ratio of 1.56. The company has a market capitalization of $1.39 billion, a PE ratio of 80.26 and a beta of 1.19. Atlas Energy Solutions Inc. has a twelve month low of $10.40 and a twelve month high of $26.86. The firm's 50-day simple moving average is $12.23 and its 200-day simple moving average is $13.80.

Atlas Energy Solutions Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, August 21st. Shareholders of record on Thursday, August 14th were given a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 8.9%. The ex-dividend date was Thursday, August 14th. Atlas Energy Solutions's dividend payout ratio (DPR) is presently 714.29%.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on AESI. Stifel Nicolaus cut their price objective on Atlas Energy Solutions from $14.50 to $14.00 and set a "buy" rating for the company in a report on Monday, August 11th. Piper Sandler cut their price objective on Atlas Energy Solutions from $16.00 to $14.00 and set a "neutral" rating for the company in a report on Thursday, August 14th. Four investment analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $18.83.

View Our Latest Research Report on Atlas Energy Solutions

Atlas Energy Solutions Profile

(

Free Report)

Atlas Energy Solutions Inc engages in the production, processing, and sale of mesh and sand that are used as a proppant during the well completion process in the Permian Basin of Texas and New Mexico. The company provides transportation and logistics, storage solutions, and contract labor services. It sells its products and services to oil and natural gas exploration and production companies, and oilfield services companies.

Featured Articles

Before you consider Atlas Energy Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlas Energy Solutions wasn't on the list.

While Atlas Energy Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.