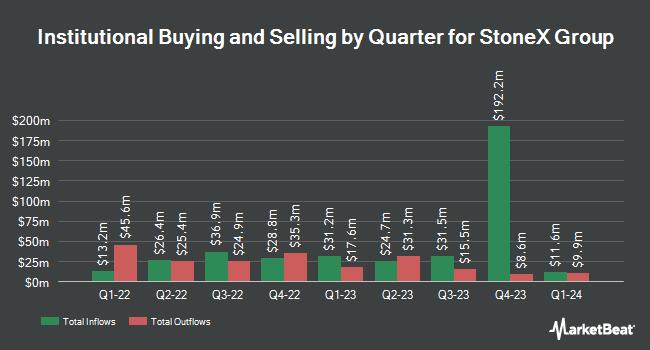

HighTower Advisors LLC acquired a new position in StoneX Group Inc. (NASDAQ:SNEX - Free Report) in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 2,797 shares of the company's stock, valued at approximately $214,000.

A number of other institutional investors have also added to or reduced their stakes in SNEX. Ridgewood Investments LLC raised its position in shares of StoneX Group by 50.0% during the 1st quarter. Ridgewood Investments LLC now owns 450 shares of the company's stock valued at $34,000 after buying an additional 150 shares in the last quarter. Focus Partners Wealth raised its position in shares of StoneX Group by 2.1% during the 4th quarter. Focus Partners Wealth now owns 8,109 shares of the company's stock valued at $794,000 after buying an additional 164 shares in the last quarter. Hohimer Wealth Management LLC raised its position in shares of StoneX Group by 4.5% during the 1st quarter. Hohimer Wealth Management LLC now owns 7,112 shares of the company's stock valued at $543,000 after buying an additional 306 shares in the last quarter. CWM LLC raised its position in shares of StoneX Group by 78.4% during the 1st quarter. CWM LLC now owns 808 shares of the company's stock valued at $62,000 after buying an additional 355 shares in the last quarter. Finally, GAMMA Investing LLC raised its position in shares of StoneX Group by 92.7% during the 1st quarter. GAMMA Investing LLC now owns 742 shares of the company's stock valued at $57,000 after buying an additional 357 shares in the last quarter. 75.93% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Zacks Research upgraded shares of StoneX Group to a "strong-buy" rating in a research report on Friday, August 8th. One research analyst has rated the stock with a Strong Buy rating and one has issued a Buy rating to the company's stock. According to MarketBeat, StoneX Group currently has an average rating of "Strong Buy".

Check Out Our Latest Report on SNEX

StoneX Group Trading Up 0.5%

Shares of SNEX stock traded up $0.48 on Tuesday, hitting $96.82. 99,018 shares of the company's stock traded hands, compared to its average volume of 423,014. The company has a debt-to-equity ratio of 1.30, a quick ratio of 1.48 and a current ratio of 2.08. StoneX Group Inc. has a one year low of $50.31 and a one year high of $106.98. The company's fifty day simple moving average is $95.39 and its 200 day simple moving average is $86.94. The stock has a market capitalization of $5.05 billion, a price-to-earnings ratio of 16.47 and a beta of 0.56.

StoneX Group (NASDAQ:SNEX - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported $1.22 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.39 by ($0.17). StoneX Group had a return on equity of 16.20% and a net margin of 0.23%.The firm had revenue of $1.02 billion during the quarter, compared to the consensus estimate of $923.10 million. Equities analysts forecast that StoneX Group Inc. will post 8.7 EPS for the current year.

Insiders Place Their Bets

In other news, Chairman John Radziwill bought 1,400 shares of the firm's stock in a transaction on Thursday, June 12th. The stock was acquired at an average cost of $85.00 per share, with a total value of $119,000.00. Following the completion of the acquisition, the chairman owned 100,240 shares of the company's stock, valued at approximately $8,520,400. This represents a 1.42% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Abigail H. Perkins sold 16,098 shares of StoneX Group stock in a transaction that occurred on Thursday, June 12th. The stock was sold at an average price of $85.04, for a total transaction of $1,368,973.92. Following the completion of the sale, the insider owned 31,076 shares of the company's stock, valued at $2,642,703.04. This represents a 34.12% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 37,805 shares of company stock valued at $3,231,633. Insiders own 11.70% of the company's stock.

About StoneX Group

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

See Also

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.