Mattson Financial Services LLC purchased a new position in M/I Homes, Inc. (NYSE:MHO - Free Report) during the second quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 2,843 shares of the construction company's stock, valued at approximately $319,000.

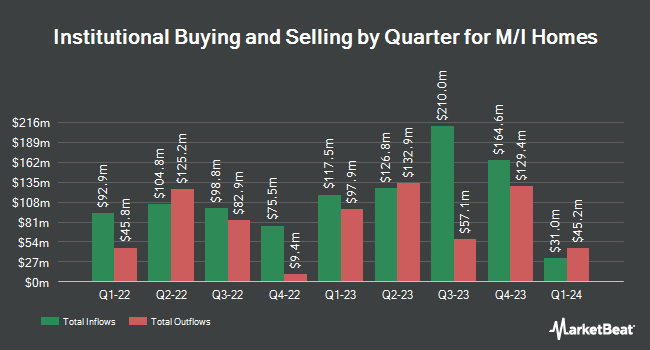

A number of other institutional investors and hedge funds have also modified their holdings of MHO. Fifth Third Bancorp grew its holdings in shares of M/I Homes by 38.3% in the 1st quarter. Fifth Third Bancorp now owns 379 shares of the construction company's stock worth $43,000 after acquiring an additional 105 shares during the period. Covestor Ltd grew its holdings in shares of M/I Homes by 134.8% in the 1st quarter. Covestor Ltd now owns 655 shares of the construction company's stock worth $75,000 after acquiring an additional 376 shares during the period. GAMMA Investing LLC grew its holdings in shares of M/I Homes by 57.6% in the 1st quarter. GAMMA Investing LLC now owns 919 shares of the construction company's stock worth $105,000 after acquiring an additional 336 shares during the period. Strs Ohio acquired a new stake in shares of M/I Homes in the 1st quarter worth approximately $114,000. Finally, National Bank of Canada FI grew its holdings in shares of M/I Homes by 36.1% in the 1st quarter. National Bank of Canada FI now owns 1,164 shares of the construction company's stock worth $133,000 after acquiring an additional 309 shares during the period. Institutional investors and hedge funds own 95.14% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on the company. Weiss Ratings restated a "hold (c+)" rating on shares of M/I Homes in a report on Wednesday, October 8th. Zacks Research upgraded M/I Homes from a "strong sell" rating to a "hold" rating in a report on Friday, September 26th. Finally, Zelman & Associates upgraded M/I Homes from a "neutral" rating to an "outperform" rating in a report on Tuesday, August 12th. Two equities research analysts have rated the stock with a Strong Buy rating, two have assigned a Buy rating and two have given a Hold rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $162.50.

View Our Latest Analysis on M/I Homes

M/I Homes Price Performance

Shares of NYSE:MHO opened at $137.51 on Friday. The business's fifty day moving average price is $144.52 and its two-hundred day moving average price is $123.23. The stock has a market cap of $3.68 billion, a PE ratio of 7.55 and a beta of 1.70. The company has a debt-to-equity ratio of 0.32, a quick ratio of 1.78 and a current ratio of 7.21. M/I Homes, Inc. has a one year low of $100.22 and a one year high of $176.18.

M/I Homes (NYSE:MHO - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The construction company reported $4.42 earnings per share for the quarter, missing analysts' consensus estimates of $4.43 by ($0.01). M/I Homes had a return on equity of 17.23% and a net margin of 11.40%.The business had revenue of $1.16 billion for the quarter, compared to analysts' expectations of $1.12 billion. M/I Homes's revenue was up 4.8% on a year-over-year basis. On average, analysts forecast that M/I Homes, Inc. will post 18.44 EPS for the current fiscal year.

About M/I Homes

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Further Reading

Want to see what other hedge funds are holding MHO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for M/I Homes, Inc. (NYSE:MHO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.