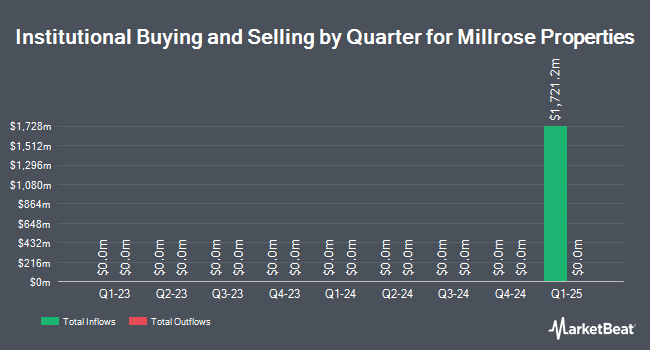

Shufro Rose & Co. LLC acquired a new position in Millrose Properties, Inc. (NYSE:MRP - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 28,641 shares of the company's stock, valued at approximately $759,000.

A number of other institutional investors have also recently made changes to their positions in MRP. Greenhaven Associates Inc. acquired a new stake in shares of Millrose Properties in the 1st quarter worth $209,111,000. GAMMA Investing LLC purchased a new stake in Millrose Properties during the 1st quarter valued at about $1,784,000. Asset Management Advisors LLC purchased a new stake in Millrose Properties during the 1st quarter valued at about $721,000. Rhumbline Advisers purchased a new stake in Millrose Properties during the 1st quarter valued at about $7,441,000. Finally, Merit Financial Group LLC purchased a new stake in Millrose Properties during the 1st quarter valued at about $552,000.

Analyst Upgrades and Downgrades

MRP has been the topic of several research analyst reports. Citigroup initiated coverage on Millrose Properties in a research note on Monday, April 14th. They set a "buy" rating and a $30.00 price target on the stock. The Goldman Sachs Group boosted their price objective on Millrose Properties from $28.00 to $31.50 and gave the company a "buy" rating in a report on Thursday, May 15th.

Check Out Our Latest Analysis on Millrose Properties

Insiders Place Their Bets

In other news, Director Matthew B. Gorson bought 7,500 shares of Millrose Properties stock in a transaction on Monday, May 19th. The shares were bought at an average cost of $28.24 per share, with a total value of $211,800.00. Following the completion of the purchase, the director directly owned 15,660 shares of the company's stock, valued at approximately $442,238.40. This trade represents a 91.91% increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CTO Adil Pasha bought 2,500 shares of the firm's stock in a transaction on Wednesday, May 21st. The stock was purchased at an average price of $28.34 per share, for a total transaction of $70,850.00. Following the completion of the acquisition, the chief technology officer directly owned 2,500 shares in the company, valued at $70,850. The trade was a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders purchased 18,750 shares of company stock valued at $530,800 in the last three months.

Millrose Properties Stock Performance

NYSE MRP traded up $0.42 during trading hours on Monday, reaching $30.36. The company's stock had a trading volume of 178,676 shares, compared to its average volume of 2,113,037. Millrose Properties, Inc. has a 1-year low of $19.00 and a 1-year high of $31.56. The company has a current ratio of 0.06, a quick ratio of 0.06 and a debt-to-equity ratio of 0.17. The firm has a 50-day moving average price of $28.87.

Millrose Properties (NYSE:MRP - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The company reported $0.68 EPS for the quarter. The firm had revenue of $149.00 million for the quarter.

Millrose Properties Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Thursday, July 3rd were paid a $0.69 dividend. This represents a $2.76 dividend on an annualized basis and a dividend yield of 9.1%.

Millrose Properties Company Profile

(

Free Report)

Millrose Properties, Inc is a real estate investment and management company that focuses on acquiring, developing, and managing high-quality commercial properties. They are headquartered in Purchase, New York.

Read More

Before you consider Millrose Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Millrose Properties wasn't on the list.

While Millrose Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.