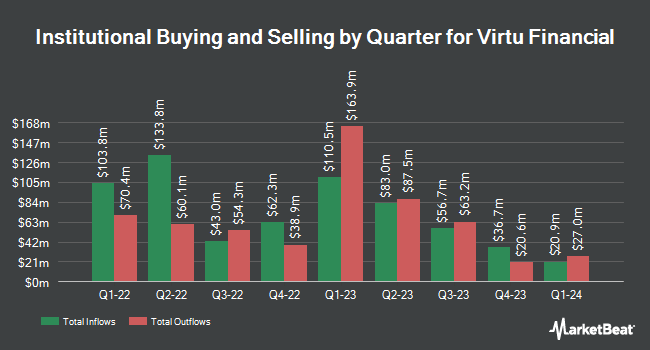

GSA Capital Partners LLP acquired a new stake in Virtu Financial, Inc. (NASDAQ:VIRT - Free Report) in the first quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 28,714 shares of the financial services provider's stock, valued at approximately $1,095,000.

Several other hedge funds have also added to or reduced their stakes in VIRT. Financial Management Professionals Inc. acquired a new stake in shares of Virtu Financial in the first quarter valued at about $32,000. Penserra Capital Management LLC acquired a new stake in Virtu Financial during the first quarter worth about $54,000. SBI Securities Co. Ltd. lifted its position in shares of Virtu Financial by 26.0% during the 1st quarter. SBI Securities Co. Ltd. now owns 1,670 shares of the financial services provider's stock worth $64,000 after buying an additional 345 shares during the last quarter. Huntington National Bank increased its position in Virtu Financial by 528.9% during the 4th quarter. Huntington National Bank now owns 3,182 shares of the financial services provider's stock worth $114,000 after purchasing an additional 2,676 shares in the last quarter. Finally, Wexford Capital LP bought a new stake in shares of Virtu Financial during the fourth quarter worth $203,000. Institutional investors and hedge funds own 45.78% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on the stock. Bank of America cut shares of Virtu Financial from a "buy" rating to a "neutral" rating and set a $43.00 price objective on the stock. in a research note on Thursday, May 15th. UBS Group boosted their price target on shares of Virtu Financial from $40.00 to $45.00 and gave the stock a "neutral" rating in a research report on Monday. Wall Street Zen cut shares of Virtu Financial from a "buy" rating to a "hold" rating in a research report on Saturday, May 24th. Evercore ISI boosted their target price on shares of Virtu Financial from $41.00 to $42.00 and gave the company an "in-line" rating in a report on Thursday, April 24th. Finally, Morgan Stanley increased their price target on Virtu Financial from $31.00 to $35.00 and gave the stock an "underweight" rating in a report on Tuesday, July 15th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $39.75.

Get Our Latest Report on VIRT

Virtu Financial Stock Performance

Shares of Virtu Financial stock traded up $0.50 on Monday, hitting $43.87. 198,910 shares of the company's stock were exchanged, compared to its average volume of 951,992. The company has a 50-day simple moving average of $42.82 and a 200-day simple moving average of $39.81. The company has a debt-to-equity ratio of 1.11, a quick ratio of 0.49 and a current ratio of 0.49. Virtu Financial, Inc. has a 1 year low of $26.88 and a 1 year high of $45.77. The stock has a market capitalization of $6.76 billion, a PE ratio of 12.69, a PEG ratio of 1.14 and a beta of 0.69.

Virtu Financial Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Monday, September 1st will be issued a $0.24 dividend. The ex-dividend date is Friday, August 29th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 2.2%. Virtu Financial's payout ratio is 21.82%.

Insider Activity at Virtu Financial

In other news, Director John Nixon sold 6,965 shares of the company's stock in a transaction that occurred on Tuesday, May 13th. The stock was sold at an average price of $42.82, for a total transaction of $298,241.30. Following the transaction, the director owned 33,923 shares of the company's stock, valued at approximately $1,452,582.86. This represents a 17.03% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Company insiders own 47.20% of the company's stock.

Virtu Financial Company Profile

(

Free Report)

Virtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

Further Reading

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.