Altfest L J & Co. Inc. bought a new position in Full Truck Alliance Co. Ltd. Sponsored ADR (NYSE:YMM - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm bought 28,905 shares of the company's stock, valued at approximately $369,000.

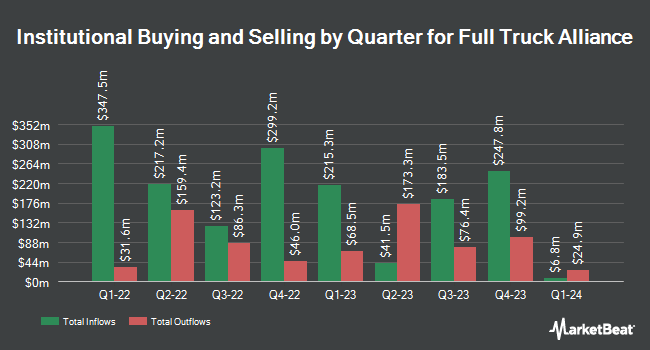

Several other institutional investors and hedge funds have also recently made changes to their positions in the company. Aspex Management HK Ltd bought a new position in Full Truck Alliance in the fourth quarter worth about $164,557,000. Nuveen Asset Management LLC bought a new position in shares of Full Truck Alliance in the 4th quarter worth approximately $60,356,000. Krane Funds Advisors LLC lifted its stake in shares of Full Truck Alliance by 23.2% in the 1st quarter. Krane Funds Advisors LLC now owns 26,207,165 shares of the company's stock valued at $334,665,000 after purchasing an additional 4,931,028 shares during the period. OVERSEA CHINESE BANKING Corp Ltd boosted its position in shares of Full Truck Alliance by 632.0% during the first quarter. OVERSEA CHINESE BANKING Corp Ltd now owns 5,159,857 shares of the company's stock valued at $65,891,000 after purchasing an additional 4,454,913 shares in the last quarter. Finally, KEYWISE CAPITAL MANAGEMENT HK Ltd grew its stake in Full Truck Alliance by 25,877.9% in the fourth quarter. KEYWISE CAPITAL MANAGEMENT HK Ltd now owns 4,234,400 shares of the company's stock worth $45,816,000 after purchasing an additional 4,218,100 shares during the period. Institutional investors own 39.02% of the company's stock.

Full Truck Alliance Stock Up 1.3%

Shares of YMM stock traded up $0.15 during mid-day trading on Tuesday, reaching $11.41. 3,583,356 shares of the company's stock traded hands, compared to its average volume of 8,703,791. Full Truck Alliance Co. Ltd. Sponsored ADR has a 12 month low of $6.85 and a 12 month high of $13.85. The company has a market cap of $11.93 billion, a P/E ratio of 22.81 and a beta of 0.20. The company's 50-day moving average price is $11.97 and its 200-day moving average price is $11.92.

Wall Street Analysts Forecast Growth

A number of analysts have recently commented on YMM shares. JPMorgan Chase & Co. cut shares of Full Truck Alliance from an "overweight" rating to a "neutral" rating and dropped their target price for the company from $18.00 to $10.00 in a report on Monday, April 14th. Citigroup dropped their target price on shares of Full Truck Alliance from $16.50 to $16.00 and set a "buy" rating on the stock in a report on Thursday, May 22nd. Two research analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $15.00.

Read Our Latest Stock Analysis on YMM

Full Truck Alliance Profile

(

Free Report)

Full Truck Alliance Co Ltd., together with its subsidiaries, operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People's Republic of China. The company offers freight matching services, such as freight listing and brokerage services; and online transaction services, as well as various value-added services, such as credit solutions, insurance brokerage, software solutions, electronic toll collection, and energy services.

See Also

Before you consider Full Truck Alliance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Full Truck Alliance wasn't on the list.

While Full Truck Alliance currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.