Synovus Financial Corp purchased a new stake in Genmab A/S Sponsored ADR (NASDAQ:GMAB - Free Report) during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 32,341 shares of the company's stock, valued at approximately $633,000.

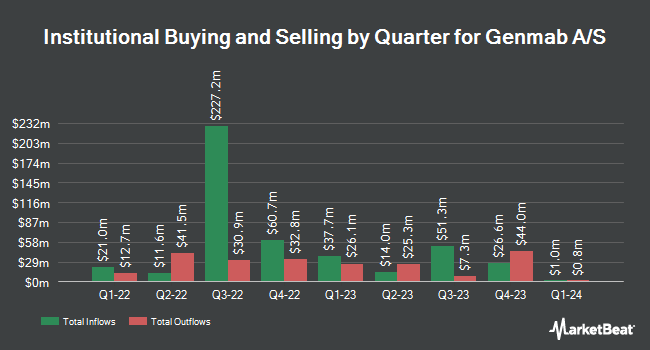

Other large investors have also added to or reduced their stakes in the company. Headlands Technologies LLC raised its stake in Genmab A/S by 1,525.0% in the 1st quarter. Headlands Technologies LLC now owns 1,560 shares of the company's stock valued at $31,000 after acquiring an additional 1,464 shares during the period. Caitong International Asset Management Co. Ltd grew its holdings in Genmab A/S by 124.3% in the 1st quarter. Caitong International Asset Management Co. Ltd now owns 1,931 shares of the company's stock valued at $38,000 after buying an additional 1,070 shares in the last quarter. Barclays PLC grew its holdings in Genmab A/S by 1,072.8% in the 4th quarter. Barclays PLC now owns 2,498 shares of the company's stock valued at $52,000 after buying an additional 2,285 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. acquired a new position in Genmab A/S in the 4th quarter valued at $60,000. Finally, Brooklyn Investment Group grew its holdings in Genmab A/S by 729.3% in the 1st quarter. Brooklyn Investment Group now owns 4,246 shares of the company's stock valued at $83,000 after buying an additional 3,734 shares in the last quarter. Institutional investors own 7.07% of the company's stock.

Analyst Ratings Changes

A number of research analysts have commented on GMAB shares. HC Wainwright upped their price objective on Genmab A/S from $35.00 to $36.00 and gave the company a "buy" rating in a report on Friday, August 15th. Wall Street Zen raised Genmab A/S from a "hold" rating to a "buy" rating in a report on Monday, July 28th. Truist Financial raised their price objective on Genmab A/S from $45.00 to $46.00 and gave the company a "buy" rating in a research note on Tuesday, July 8th. Finally, Zacks Research lowered Genmab A/S from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 19th. One analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating, three have given a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $37.60.

Check Out Our Latest Research Report on Genmab A/S

Genmab A/S Stock Performance

Genmab A/S stock traded down $0.24 during midday trading on Friday, hitting $24.87. 676,680 shares of the company's stock were exchanged, compared to its average volume of 1,316,170. Genmab A/S Sponsored ADR has a 52-week low of $17.24 and a 52-week high of $27.93. The stock has a 50-day moving average price of $22.22 and a two-hundred day moving average price of $21.28. The company has a market cap of $15.96 billion, a P/E ratio of 14.54, a PEG ratio of 7.22 and a beta of 0.93.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The company reported $0.54 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.39 by $0.15. The firm had revenue of $925.00 million during the quarter, compared to analysts' expectations of $5.77 billion. Genmab A/S had a return on equity of 21.03% and a net margin of 37.53%. Genmab A/S has set its FY 2025 guidance at EPS. As a group, sell-side analysts expect that Genmab A/S Sponsored ADR will post 1.45 earnings per share for the current year.

About Genmab A/S

(

Free Report)

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

See Also

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.