Allianz Asset Management GmbH purchased a new position in shares of Bausch + Lomb Corporation (NYSE:BLCO - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 325,000 shares of the company's stock, valued at approximately $4,712,000. Allianz Asset Management GmbH owned approximately 0.09% of Bausch + Lomb as of its most recent SEC filing.

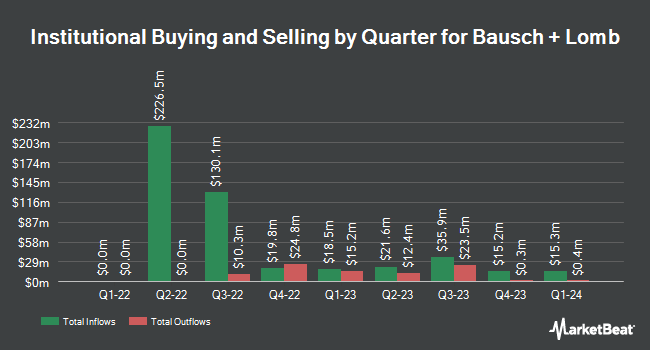

A number of other hedge funds and other institutional investors also recently made changes to their positions in the company. XTX Topco Ltd boosted its position in shares of Bausch + Lomb by 25.4% during the fourth quarter. XTX Topco Ltd now owns 20,077 shares of the company's stock worth $363,000 after purchasing an additional 4,065 shares in the last quarter. Barclays PLC lifted its position in Bausch + Lomb by 1.8% in the 4th quarter. Barclays PLC now owns 305,804 shares of the company's stock valued at $5,523,000 after acquiring an additional 5,304 shares in the last quarter. Commonwealth Equity Services LLC bought a new stake in Bausch + Lomb in the 4th quarter valued at $181,000. Alpine Global Management LLC bought a new stake in Bausch + Lomb in the 4th quarter valued at $181,000. Finally, Covestor Ltd bought a new stake in Bausch + Lomb in the 4th quarter valued at $188,000. 11.07% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, CEO Brent L. Saunders purchased 22,000 shares of the firm's stock in a transaction that occurred on Thursday, May 22nd. The shares were acquired at an average price of $11.28 per share, for a total transaction of $248,160.00. Following the purchase, the chief executive officer owned 719,156 shares in the company, valued at approximately $8,112,079.68. This represents a 3.16% increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 0.76% of the company's stock.

Wall Street Analyst Weigh In

BLCO has been the topic of several research reports. HC Wainwright boosted their price objective on shares of Bausch + Lomb from $15.00 to $16.00 and gave the company a "buy" rating in a research report on Thursday. Needham & Company LLC reaffirmed a "hold" rating on shares of Bausch + Lomb in a research report on Thursday, April 24th. Evercore ISI boosted their price objective on shares of Bausch + Lomb from $15.50 to $16.00 and gave the company an "outperform" rating in a research report on Tuesday, July 8th. Stifel Nicolaus cut their price objective on shares of Bausch + Lomb from $17.00 to $15.00 and set a "hold" rating on the stock in a research report on Thursday, April 3rd. Finally, Citigroup lifted their price target on shares of Bausch + Lomb from $13.00 to $15.00 and gave the company a "neutral" rating in a research note on Wednesday, July 9th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $15.91.

Get Our Latest Stock Report on BLCO

Bausch + Lomb Stock Performance

Shares of Bausch + Lomb stock traded down $0.08 during trading on Friday, hitting $13.55. 500,736 shares of the stock were exchanged, compared to its average volume of 793,581. The stock has a market capitalization of $4.79 billion, a price-to-earnings ratio of -17.38, a price-to-earnings-growth ratio of 1.55 and a beta of 0.62. The company has a fifty day moving average price of $12.85 and a 200-day moving average price of $13.94. Bausch + Lomb Corporation has a 1-year low of $10.45 and a 1-year high of $21.69. The company has a current ratio of 1.56, a quick ratio of 0.96 and a debt-to-equity ratio of 0.74.

Bausch + Lomb (NYSE:BLCO - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The company reported $0.07 earnings per share for the quarter, topping the consensus estimate of $0.06 by $0.01. Bausch + Lomb had a negative net margin of 5.58% and a positive return on equity of 2.32%. The company had revenue of $1.28 billion for the quarter, compared to analyst estimates of $1.25 billion. During the same period in the previous year, the business earned $0.13 EPS. Bausch + Lomb's revenue for the quarter was up 5.1% compared to the same quarter last year. As a group, equities analysts predict that Bausch + Lomb Corporation will post 0.74 EPS for the current fiscal year.

Bausch + Lomb Profile

(

Free Report)

Bausch + Lomb Corporation operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, South Korea, and internationally. It operates in three segments: Vision Care, Pharmaceuticals, and Surgical. The Vision Care segment provides contact lens that covers the spectrum of wearing modalities, including daily disposable and frequently replaced contact lenses; and contact lens care products comprising over-the-counter eye drops, eye vitamins, and mineral supplements that address various conditions, such as eye allergies, conjunctivitis, dry eye, and redness relief.

Further Reading

Before you consider Bausch + Lomb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch + Lomb wasn't on the list.

While Bausch + Lomb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.