Stuart Chaussee & Associates Inc. bought a new stake in Northrop Grumman Corporation (NYSE:NOC - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 3,340 shares of the aerospace company's stock, valued at approximately $1,710,000. Northrop Grumman accounts for approximately 0.4% of Stuart Chaussee & Associates Inc.'s holdings, making the stock its 15th largest position.

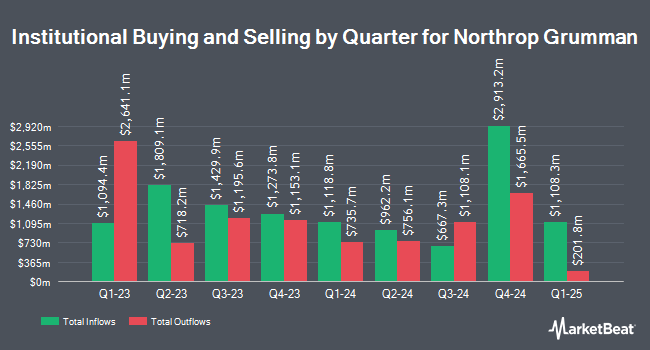

Other hedge funds have also made changes to their positions in the company. IMA Advisory Services Inc. bought a new position in Northrop Grumman during the first quarter worth about $27,000. Saudi Central Bank bought a new position in Northrop Grumman during the first quarter worth about $28,000. Banque Cantonale Vaudoise bought a new position in Northrop Grumman during the first quarter worth about $30,000. Wood Tarver Financial Group LLC bought a new position in Northrop Grumman during the fourth quarter worth about $32,000. Finally, Hollencrest Capital Management lifted its stake in Northrop Grumman by 790.0% during the first quarter. Hollencrest Capital Management now owns 89 shares of the aerospace company's stock worth $45,000 after purchasing an additional 79 shares during the period. Institutional investors own 83.40% of the company's stock.

Northrop Grumman Price Performance

Shares of NOC traded down $7.04 during mid-day trading on Friday, reaching $575.91. The company had a trading volume of 717,854 shares, compared to its average volume of 959,908. The company has a debt-to-equity ratio of 0.98, a quick ratio of 0.93 and a current ratio of 1.04. Northrop Grumman Corporation has a 1-year low of $426.24 and a 1-year high of $600.99. The company has a market capitalization of $82.46 billion, a price-to-earnings ratio of 21.23, a P/E/G ratio of 5.55 and a beta of 0.13. The company's 50 day simple moving average is $565.98 and its 200 day simple moving average is $516.94.

Northrop Grumman (NYSE:NOC - Get Free Report) last announced its earnings results on Tuesday, July 22nd. The aerospace company reported $7.11 earnings per share for the quarter, topping analysts' consensus estimates of $6.84 by $0.27. Northrop Grumman had a net margin of 9.74% and a return on equity of 25.52%. The business had revenue of $10.35 billion during the quarter, compared to the consensus estimate of $10.15 billion. During the same quarter last year, the firm earned $6.36 earnings per share. Northrop Grumman's quarterly revenue was up 1.3% on a year-over-year basis. Northrop Grumman has set its FY 2025 guidance at 25.000-25.400 EPS. Analysts expect that Northrop Grumman Corporation will post 28.05 EPS for the current year.

Northrop Grumman Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, September 17th. Investors of record on Tuesday, September 2nd will be given a dividend of $2.31 per share. This represents a $9.24 annualized dividend and a yield of 1.6%. The ex-dividend date is Tuesday, September 2nd. Northrop Grumman's payout ratio is presently 34.06%.

Wall Street Analysts Forecast Growth

NOC has been the subject of a number of research analyst reports. Susquehanna lifted their target price on shares of Northrop Grumman from $557.00 to $650.00 and gave the company a "positive" rating in a research note on Tuesday, July 22nd. Robert W. Baird boosted their target price on Northrop Grumman from $547.00 to $565.00 and gave the stock a "neutral" rating in a report on Wednesday, July 23rd. Barclays upped their target price on shares of Northrop Grumman from $500.00 to $580.00 and gave the company an "equal weight" rating in a research report on Tuesday, July 29th. Deutsche Bank Aktiengesellschaft reiterated a "hold" rating and set a $542.00 target price (down previously from $580.00) on shares of Northrop Grumman in a research report on Tuesday, July 8th. Finally, Sanford C. Bernstein reissued a "market perform" rating on shares of Northrop Grumman in a report on Monday, July 14th. One research analyst has rated the stock with a Strong Buy rating, eight have assigned a Buy rating and eight have given a Hold rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $588.85.

View Our Latest Stock Analysis on NOC

Northrop Grumman Company Profile

(

Free Report)

Northrop Grumman Corporation operates as an aerospace and defense technology company in the United States, Asia/Pacific, Europe, and internationally. The company's Aeronautics Systems segment designs, develops, manufactures, integrates, and sustains aircraft systems. This segment also offers unmanned autonomous aircraft systems, including high-altitude long-endurance strategic ISR systems and vertical take-off and landing tactical ISR systems; and strategic long-range strike aircraft, tactical fighter and air dominance aircraft, and airborne battle management and command and control systems.

Featured Articles

Before you consider Northrop Grumman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northrop Grumman wasn't on the list.

While Northrop Grumman currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.