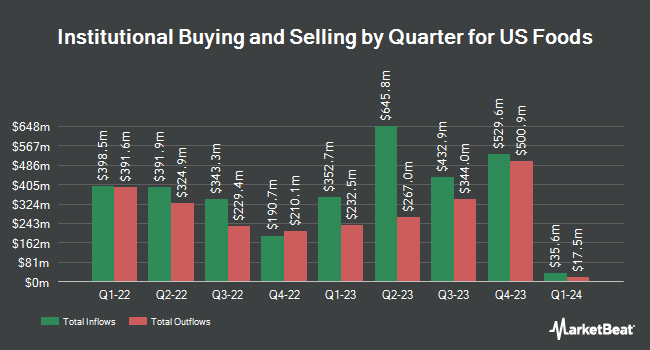

Edgestream Partners L.P. purchased a new stake in US Foods Holding Corp. (NYSE:USFD - Free Report) in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund purchased 35,708 shares of the company's stock, valued at approximately $2,337,000.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in USFD. JPMorgan Chase & Co. boosted its position in US Foods by 7.3% in the fourth quarter. JPMorgan Chase & Co. now owns 4,304,310 shares of the company's stock worth $290,369,000 after purchasing an additional 292,404 shares during the last quarter. Norges Bank purchased a new position in shares of US Foods in the fourth quarter valued at about $211,300,000. Artisan Partners Limited Partnership purchased a new stake in US Foods during the fourth quarter valued at approximately $171,107,000. Ameriprise Financial Inc. grew its stake in US Foods by 1.7% in the fourth quarter. Ameriprise Financial Inc. now owns 2,136,356 shares of the company's stock worth $144,119,000 after purchasing an additional 36,307 shares in the last quarter. Finally, Northern Trust Corp raised its stake in US Foods by 25.0% in the 4th quarter. Northern Trust Corp now owns 2,029,419 shares of the company's stock worth $136,905,000 after acquiring an additional 405,871 shares during the last quarter. 98.76% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on the company. Wall Street Zen raised US Foods from a "buy" rating to a "strong-buy" rating in a report on Saturday, May 24th. Citigroup initiated coverage on US Foods in a research note on Thursday, May 22nd. They issued a "buy" rating and a $95.00 target price on the stock. Guggenheim reiterated a "buy" rating and issued a $80.00 price target on shares of US Foods in a report on Monday, May 12th. Wells Fargo & Company restated an "overweight" rating on shares of US Foods in a report on Sunday, July 13th. Finally, UBS Group upped their price objective on US Foods from $83.00 to $84.00 and gave the stock a "buy" rating in a report on Friday, May 9th. One analyst has rated the stock with a hold rating, ten have issued a buy rating and three have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $77.42.

Read Our Latest Report on US Foods

Insider Activity

In related news, EVP Dirk J. Locascio sold 15,000 shares of the business's stock in a transaction on Thursday, May 15th. The shares were sold at an average price of $75.00, for a total transaction of $1,125,000.00. Following the transaction, the executive vice president owned 115,077 shares in the company, valued at $8,630,775. The trade was a 11.53% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 0.60% of the company's stock.

US Foods Price Performance

NYSE USFD traded up $0.23 on Monday, reaching $83.37. The company's stock had a trading volume of 2,183,570 shares, compared to its average volume of 2,067,460. The firm has a market cap of $19.29 billion, a PE ratio of 38.24, a price-to-earnings-growth ratio of 1.20 and a beta of 1.41. The business has a 50-day moving average price of $77.61 and a 200 day moving average price of $70.80. The company has a current ratio of 1.17, a quick ratio of 0.74 and a debt-to-equity ratio of 1.02. US Foods Holding Corp. has a 52 week low of $50.49 and a 52 week high of $84.44.

US Foods (NYSE:USFD - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The company reported $0.68 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.69 by ($0.01). The company had revenue of $9.35 billion for the quarter, compared to the consensus estimate of $9.42 billion. US Foods had a return on equity of 15.58% and a net margin of 1.38%. The firm's revenue was up 4.5% on a year-over-year basis. During the same period in the prior year, the company earned $0.54 EPS. Sell-side analysts expect that US Foods Holding Corp. will post 3.59 EPS for the current year.

US Foods Company Profile

(

Free Report)

US Foods Holding Corp., together with its subsidiaries, engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States. The company's customers include independently owned single and multi-unit restaurants, regional concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail locations.

Read More

Before you consider US Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and US Foods wasn't on the list.

While US Foods currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.