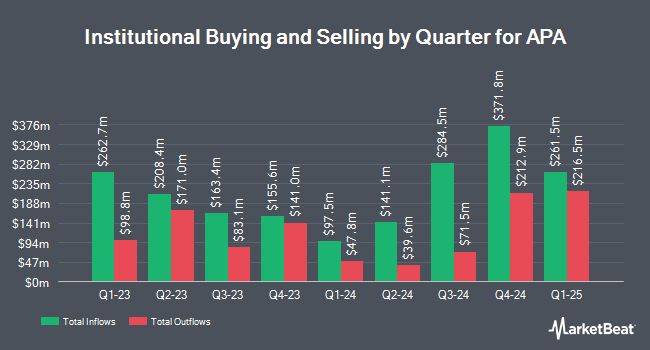

Full Sail Capital LLC acquired a new position in shares of APA Corporation (NASDAQ:APA - Free Report) in the first quarter, according to its most recent Form 13F filing with the SEC. The firm acquired 35,758 shares of the company's stock, valued at approximately $752,000.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Golden State Wealth Management LLC increased its position in shares of APA by 2,709.8% during the 1st quarter. Golden State Wealth Management LLC now owns 1,433 shares of the company's stock worth $30,000 after purchasing an additional 1,382 shares during the last quarter. Rakuten Securities Inc. increased its position in shares of APA by 499.2% during the 1st quarter. Rakuten Securities Inc. now owns 1,546 shares of the company's stock worth $32,000 after purchasing an additional 1,288 shares during the last quarter. Siemens Fonds Invest GmbH acquired a new stake in shares of APA during the 4th quarter worth about $42,000. LRI Investments LLC acquired a new stake in shares of APA during the 4th quarter worth about $44,000. Finally, SVB Wealth LLC acquired a new position in APA in the 1st quarter valued at about $55,000. 83.01% of the stock is owned by institutional investors and hedge funds.

APA Stock Up 2.1%

Shares of APA traded up $0.47 during midday trading on Wednesday, hitting $22.59. The company had a trading volume of 5,533,459 shares, compared to its average volume of 7,563,233. The company's 50-day simple moving average is $19.60 and its 200-day simple moving average is $18.95. The company has a debt-to-equity ratio of 0.62, a quick ratio of 0.80 and a current ratio of 0.80. The firm has a market capitalization of $8.08 billion, a P/E ratio of 7.56, a P/E/G ratio of 6.51 and a beta of 1.23. APA Corporation has a 1 year low of $13.58 and a 1 year high of $29.47.

APA (NASDAQ:APA - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The company reported $0.87 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.45 by $0.42. The business had revenue of $2.18 billion during the quarter, compared to analysts' expectations of $2.03 billion. APA had a return on equity of 20.98% and a net margin of 10.53%.The business's quarterly revenue was down 14.4% compared to the same quarter last year. During the same quarter last year, the business posted $1.17 EPS. As a group, sell-side analysts expect that APA Corporation will post 4.03 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities analysts have weighed in on the company. Cowen reaffirmed a "hold" rating on shares of APA in a research report on Thursday, August 7th. Citigroup lifted their target price on APA from $15.00 to $18.00 and gave the company a "neutral" rating in a research report on Monday, May 19th. Stephens assumed coverage on APA in a research report on Tuesday, August 5th. They issued an "equal weight" rating and a $24.00 target price for the company. Royal Bank Of Canada dropped their target price on APA from $24.00 to $22.00 and set a "sector perform" rating for the company in a research report on Monday, July 14th. Finally, Mizuho dropped their target price on APA from $20.00 to $19.00 and set an "underperform" rating for the company in a research report on Tuesday, May 13th. Three investment analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and three have given a Sell rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $23.72.

Check Out Our Latest Research Report on APA

APA Profile

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Featured Articles

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.