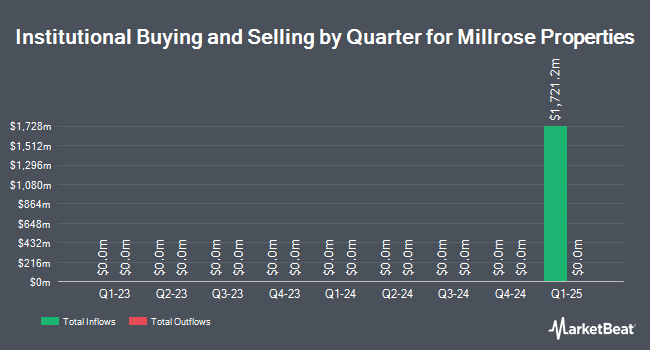

Citigroup Inc. bought a new stake in Millrose Properties, Inc. (NYSE:MRP - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 368,958 shares of the company's stock, valued at approximately $9,781,000. Citigroup Inc. owned 0.22% of Millrose Properties at the end of the most recent quarter.

A number of other hedge funds have also made changes to their positions in the business. CENTRAL TRUST Co purchased a new position in shares of Millrose Properties in the 1st quarter valued at $27,000. Assetmark Inc. purchased a new position in shares of Millrose Properties in the 1st quarter valued at $34,000. Allworth Financial LP purchased a new position in shares of Millrose Properties in the 1st quarter valued at $33,000. Golden State Wealth Management LLC purchased a new position in shares of Millrose Properties in the 1st quarter valued at $37,000. Finally, Advisors Preferred LLC purchased a new position in shares of Millrose Properties in the 1st quarter valued at $43,000.

Analysts Set New Price Targets

Separately, The Goldman Sachs Group lifted their price target on shares of Millrose Properties from $28.00 to $31.50 and gave the stock a "buy" rating in a research note on Thursday, May 15th. Two equities research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, Millrose Properties presently has an average rating of "Buy" and an average price target of $30.75.

View Our Latest Research Report on Millrose Properties

Millrose Properties Stock Performance

Millrose Properties stock traded up $0.66 during midday trading on Thursday, hitting $33.35. 746,265 shares of the stock were exchanged, compared to its average volume of 977,820. Millrose Properties, Inc. has a 1 year low of $19.00 and a 1 year high of $33.38. The company has a debt-to-equity ratio of 0.17, a current ratio of 0.06 and a quick ratio of 0.06. The company has a 50 day simple moving average of $30.01.

Millrose Properties (NYSE:MRP - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The company reported $0.68 earnings per share (EPS) for the quarter. The firm had revenue of $149.00 million for the quarter.

Millrose Properties Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Thursday, July 3rd were issued a dividend of $0.69 per share. This represents a $2.76 annualized dividend and a yield of 8.3%.

Millrose Properties Company Profile

(

Free Report)

Millrose Properties, Inc is a real estate investment and management company that focuses on acquiring, developing, and managing high-quality commercial properties. They are headquartered in Purchase, New York.

Read More

Before you consider Millrose Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Millrose Properties wasn't on the list.

While Millrose Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.