XTX Topco Ltd bought a new stake in shares of Darling Ingredients Inc. (NYSE:DAR - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm bought 37,631 shares of the company's stock, valued at approximately $1,176,000.

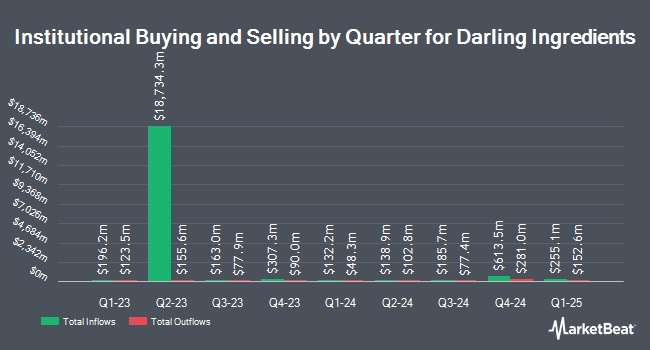

Several other large investors also recently modified their holdings of the business. Peregrine Capital Management LLC lifted its holdings in Darling Ingredients by 16.5% in the first quarter. Peregrine Capital Management LLC now owns 218,806 shares of the company's stock worth $6,835,000 after acquiring an additional 30,952 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. lifted its holdings in Darling Ingredients by 19.3% in the first quarter. Sumitomo Mitsui Trust Group Inc. now owns 30,490 shares of the company's stock worth $953,000 after acquiring an additional 4,933 shares during the last quarter. Oppenheimer Asset Management Inc. lifted its holdings in Darling Ingredients by 14.1% in the first quarter. Oppenheimer Asset Management Inc. now owns 154,315 shares of the company's stock worth $4,821,000 after acquiring an additional 19,113 shares during the last quarter. GAMMA Investing LLC lifted its holdings in Darling Ingredients by 6,187.6% in the first quarter. GAMMA Investing LLC now owns 64,448 shares of the company's stock worth $2,063,000 after acquiring an additional 63,423 shares during the last quarter. Finally, Cornerstone Investment Partners LLC bought a new position in Darling Ingredients in the first quarter worth about $255,000. 94.44% of the stock is currently owned by institutional investors and hedge funds.

Darling Ingredients Price Performance

NYSE:DAR traded up $0.14 during midday trading on Monday, hitting $31.63. 1,651,177 shares of the stock were exchanged, compared to its average volume of 2,262,997. Darling Ingredients Inc. has a one year low of $26.00 and a one year high of $43.49. The company has a market capitalization of $5.00 billion, a price-to-earnings ratio of 47.92 and a beta of 1.19. The business has a 50-day moving average price of $35.29 and a two-hundred day moving average price of $34.18. The company has a current ratio of 1.40, a quick ratio of 0.83 and a debt-to-equity ratio of 0.84.

Darling Ingredients (NYSE:DAR - Get Free Report) last announced its earnings results on Thursday, July 24th. The company reported $0.09 EPS for the quarter, missing the consensus estimate of $0.12 by ($0.03). Darling Ingredients had a return on equity of 2.37% and a net margin of 1.85%. The firm had revenue of $1.48 billion for the quarter, compared to the consensus estimate of $1.49 billion. During the same period in the previous year, the firm earned $0.49 EPS. Darling Ingredients's revenue for the quarter was up 1.8% on a year-over-year basis. Sell-side analysts predict that Darling Ingredients Inc. will post 2.81 EPS for the current year.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on DAR shares. Baird R W cut shares of Darling Ingredients from a "strong-buy" rating to a "hold" rating in a report on Friday, July 25th. Robert W. Baird reissued a "neutral" rating and issued a $36.00 target price (down previously from $40.00) on shares of Darling Ingredients in a report on Friday, July 25th. Citigroup cut their price target on Darling Ingredients from $45.00 to $44.00 and set a "buy" rating on the stock in a report on Tuesday, April 15th. Jefferies Financial Group lifted their price target on Darling Ingredients from $45.00 to $46.00 and gave the company a "buy" rating in a report on Monday, July 7th. Finally, Wall Street Zen raised Darling Ingredients from a "sell" rating to a "hold" rating in a report on Friday, April 25th. Four research analysts have rated the stock with a hold rating, five have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $45.86.

View Our Latest Research Report on Darling Ingredients

About Darling Ingredients

(

Free Report)

Darling Ingredients Inc develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally. The company operates through three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. It offers ingredients and customized specialty solutions for customers in the pharmaceutical, food, pet food, feed, industrial, fuel, bioenergy, and fertilizer industries.

Featured Articles

Before you consider Darling Ingredients, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darling Ingredients wasn't on the list.

While Darling Ingredients currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.