Hoxton Planning & Management LLC purchased a new stake in Best Buy Co., Inc. (NYSE:BBY - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 3,932 shares of the technology retailer's stock, valued at approximately $289,000.

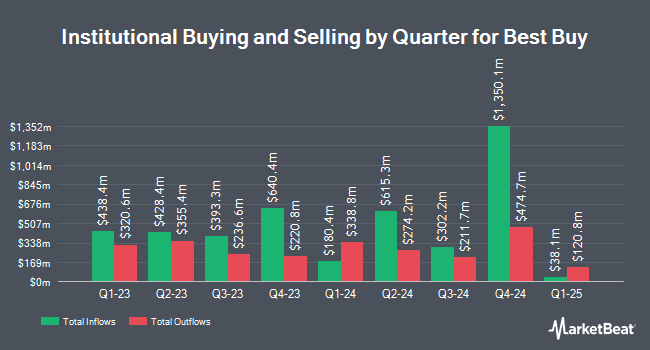

Other institutional investors have also bought and sold shares of the company. Invesco Ltd. raised its position in Best Buy by 20.5% in the 4th quarter. Invesco Ltd. now owns 3,692,118 shares of the technology retailer's stock valued at $316,784,000 after purchasing an additional 629,180 shares during the last quarter. APG Asset Management N.V. bought a new stake in shares of Best Buy during the fourth quarter worth $9,073,000. Mirae Asset Global Investments Co. Ltd. raised its position in shares of Best Buy by 7.1% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 200,960 shares of the technology retailer's stock worth $14,560,000 after acquiring an additional 13,378 shares during the last quarter. GAMMA Investing LLC raised its position in shares of Best Buy by 5,519.3% during the first quarter. GAMMA Investing LLC now owns 173,131 shares of the technology retailer's stock worth $12,744,000 after acquiring an additional 170,050 shares during the last quarter. Finally, Rhumbline Advisers raised its position in shares of Best Buy by 10.2% during the first quarter. Rhumbline Advisers now owns 502,272 shares of the technology retailer's stock worth $36,972,000 after acquiring an additional 46,645 shares during the last quarter. Institutional investors and hedge funds own 80.96% of the company's stock.

Wall Street Analysts Forecast Growth

BBY has been the subject of a number of recent research reports. Guggenheim restated a "buy" rating and set a $90.00 target price on shares of Best Buy in a research report on Tuesday, June 10th. DA Davidson reiterated a "buy" rating and issued a $110.00 price objective on shares of Best Buy in a report on Monday, April 14th. Truist Financial upped their price objective on Best Buy from $64.00 to $69.00 and gave the company a "hold" rating in a report on Friday, May 30th. Wells Fargo & Company dropped their price objective on Best Buy from $75.00 to $67.00 and set an "equal weight" rating for the company in a report on Friday, May 30th. Finally, Barclays decreased their target price on Best Buy from $89.00 to $74.00 and set an "equal weight" rating for the company in a research note on Friday, May 30th. One analyst has rated the stock with a sell rating, twelve have assigned a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $85.72.

Get Our Latest Analysis on Best Buy

Insider Buying and Selling at Best Buy

In other news, Chairman Richard M. Schulze sold 729,201 shares of the stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $72.95, for a total transaction of $53,195,212.95. Following the transaction, the chairman owned 196,100 shares in the company, valued at approximately $14,305,495. This trade represents a 78.81% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.47% of the company's stock.

Best Buy Stock Down 1.5%

NYSE BBY traded down $0.95 during trading hours on Friday, hitting $64.11. 3,188,714 shares of the company traded hands, compared to its average volume of 3,290,663. The business's 50-day moving average is $69.33 and its 200-day moving average is $73.26. Best Buy Co., Inc. has a twelve month low of $54.99 and a twelve month high of $103.71. The company has a debt-to-equity ratio of 0.42, a quick ratio of 0.32 and a current ratio of 1.02. The stock has a market capitalization of $13.55 billion, a price-to-earnings ratio of 15.67, a P/E/G ratio of 1.69 and a beta of 1.21.

Best Buy (NYSE:BBY - Get Free Report) last released its quarterly earnings data on Thursday, May 29th. The technology retailer reported $1.15 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.09 by $0.06. The firm had revenue of $8.77 billion for the quarter, compared to analyst estimates of $8.77 billion. Best Buy had a return on equity of 46.40% and a net margin of 2.13%. The business's revenue for the quarter was down .9% compared to the same quarter last year. During the same quarter in the prior year, the company earned $1.20 earnings per share. Sell-side analysts anticipate that Best Buy Co., Inc. will post 6.18 earnings per share for the current year.

Best Buy Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, July 10th. Stockholders of record on Thursday, June 19th were paid a dividend of $0.95 per share. The ex-dividend date was Wednesday, June 18th. This represents a $3.80 dividend on an annualized basis and a dividend yield of 5.9%. Best Buy's dividend payout ratio (DPR) is 92.91%.

About Best Buy

(

Free Report)

Best Buy Co, Inc engages in the retail of technology products in the United States, Canada, and international. Its stores provide computing and mobile phone products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness products, portable audio comprising headphones and portable speakers, and smart home products, as well as home theaters, which includes home theater accessories, soundbars, and televisions.

Further Reading

Before you consider Best Buy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Best Buy wasn't on the list.

While Best Buy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report