Zurich Insurance Group Ltd FI bought a new position in shares of Carnival Co. & plc (NYSE:CCL - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 4,046,759 shares of the company's stock, valued at approximately $100,845,000. Carnival Co. & accounts for about 0.8% of Zurich Insurance Group Ltd FI's portfolio, making the stock its 28th biggest holding. Zurich Insurance Group Ltd FI owned about 0.35% of Carnival Co. & at the end of the most recent reporting period.

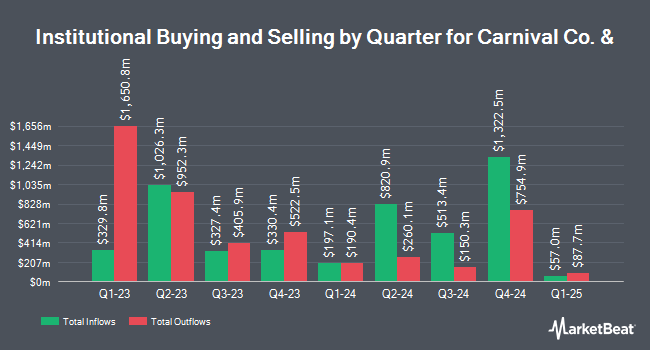

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Vanguard Group Inc. increased its position in Carnival Co. & by 4.0% during the fourth quarter. Vanguard Group Inc. now owns 117,095,566 shares of the company's stock worth $2,918,022,000 after acquiring an additional 4,458,329 shares during the period. Geode Capital Management LLC increased its position in Carnival Co. & by 5.0% during the fourth quarter. Geode Capital Management LLC now owns 25,228,416 shares of the company's stock worth $627,053,000 after acquiring an additional 1,201,256 shares during the period. Nuveen Asset Management LLC increased its position in Carnival Co. & by 33.7% during the fourth quarter. Nuveen Asset Management LLC now owns 22,850,042 shares of the company's stock worth $569,423,000 after acquiring an additional 5,761,489 shares during the period. Arrowstreet Capital Limited Partnership increased its position in Carnival Co. & by 4.9% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 18,649,543 shares of the company's stock worth $464,747,000 after acquiring an additional 877,694 shares during the period. Finally, Renaissance Technologies LLC increased its position in Carnival Co. & by 17.7% during the fourth quarter. Renaissance Technologies LLC now owns 18,097,001 shares of the company's stock worth $450,977,000 after acquiring an additional 2,720,096 shares during the period. Institutional investors own 67.19% of the company's stock.

Carnival Co. & Trading Down 0.7%

NYSE:CCL traded down $0.16 on Friday, hitting $22.27. 15,872,579 shares of the stock were exchanged, compared to its average volume of 25,877,955. The stock has a market capitalization of $25.98 billion, a price-to-earnings ratio of 16.02, a P/E/G ratio of 0.73 and a beta of 2.50. Carnival Co. & plc has a 52 week low of $13.78 and a 52 week high of $28.72. The company has a debt-to-equity ratio of 2.80, a quick ratio of 0.25 and a current ratio of 0.29. The company's 50-day moving average price is $19.72 and its 200 day moving average price is $23.03.

Carnival Co. & (NYSE:CCL - Get Free Report) last announced its quarterly earnings data on Friday, March 21st. The company reported $0.13 earnings per share for the quarter, topping the consensus estimate of $0.02 by $0.11. The firm had revenue of $5.81 billion during the quarter, compared to analysts' expectations of $5.74 billion. Carnival Co. & had a return on equity of 24.13% and a net margin of 7.66%. The company's quarterly revenue was up 7.5% compared to the same quarter last year. During the same period in the previous year, the business posted ($0.14) EPS. On average, equities research analysts forecast that Carnival Co. & plc will post 1.77 earnings per share for the current year.

Analyst Ratings Changes

CCL has been the topic of a number of recent research reports. Tigress Financial reiterated a "buy" rating on shares of Carnival Co. & in a research note on Wednesday, March 26th. HSBC upgraded shares of Carnival Co. & from a "reduce" rating to a "hold" rating and set a $24.00 target price on the stock in a research note on Friday, May 16th. Citigroup reduced their target price on shares of Carnival Co. & from $31.00 to $30.00 and set a "buy" rating on the stock in a research note on Monday, March 24th. Mizuho boosted their target price on shares of Carnival Co. & from $32.00 to $33.00 and gave the company an "outperform" rating in a research note on Monday, March 24th. Finally, Morgan Stanley upgraded shares of Carnival Co. & from an "underweight" rating to an "equal weight" rating and reduced their target price for the company from $25.00 to $21.00 in a research note on Thursday, April 10th. Eight analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the company. Based on data from MarketBeat.com, Carnival Co. & presently has a consensus rating of "Moderate Buy" and a consensus price target of $26.53.

Read Our Latest Report on Carnival Co. &

Carnival Co. & Profile

(

Free Report)

Carnival Corp. engages in the operation of cruise ships. It operates through the following business segments: North America and Australia (NAA) Cruise, Europe and Asia (EA) Cruise Operations, Cruise Support, and Tour and Others. The North America and Australia (NAA) Cruise segment includes the Carnival Cruise Line, Holland America Line, Princess Cruises, and Seabourn.

Further Reading

Before you consider Carnival Co. &, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival Co. & wasn't on the list.

While Carnival Co. & currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.