Fiduciary Family Office LLC bought a new position in Norfolk Southern Corporation (NYSE:NSC - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 4,754 shares of the railroad operator's stock, valued at approximately $1,126,000.

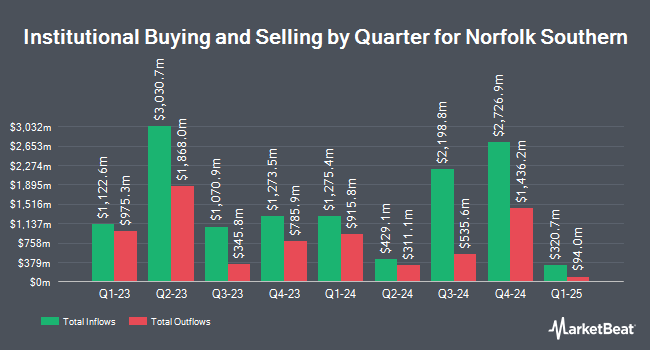

Other institutional investors and hedge funds also recently modified their holdings of the company. Fourth Dimension Wealth LLC purchased a new stake in shares of Norfolk Southern in the fourth quarter worth about $28,000. Putney Financial Group LLC acquired a new position in shares of Norfolk Southern in the fourth quarter worth about $30,000. Greenline Partners LLC acquired a new position in shares of Norfolk Southern in the fourth quarter worth about $31,000. HWG Holdings LP acquired a new position in shares of Norfolk Southern in the first quarter worth about $35,000. Finally, Physician Wealth Advisors Inc. lifted its stake in shares of Norfolk Southern by 129.2% in the first quarter. Physician Wealth Advisors Inc. now owns 149 shares of the railroad operator's stock worth $35,000 after acquiring an additional 84 shares in the last quarter. Hedge funds and other institutional investors own 75.10% of the company's stock.

Norfolk Southern Stock Down 0.1%

Shares of NSC traded down $0.35 during mid-day trading on Tuesday, reaching $277.97. The company's stock had a trading volume of 1,650,880 shares, compared to its average volume of 1,555,074. The business has a fifty day moving average of $264.24 and a 200 day moving average of $245.92. The company has a market cap of $62.44 billion, a price-to-earnings ratio of 18.78, a price-to-earnings-growth ratio of 2.48 and a beta of 1.31. Norfolk Southern Corporation has a 1 year low of $201.63 and a 1 year high of $288.11. The company has a quick ratio of 0.71, a current ratio of 0.79 and a debt-to-equity ratio of 1.11.

Norfolk Southern (NYSE:NSC - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The railroad operator reported $3.29 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.24 by $0.05. Norfolk Southern had a return on equity of 19.35% and a net margin of 27.51%. The business had revenue of $3.11 billion during the quarter, compared to analyst estimates of $3.10 billion. As a group, analysts forecast that Norfolk Southern Corporation will post 13 earnings per share for the current fiscal year.

Norfolk Southern Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, August 20th. Shareholders of record on Friday, August 1st will be issued a dividend of $1.35 per share. This represents a $5.40 annualized dividend and a yield of 1.9%. The ex-dividend date is Friday, August 1st. Norfolk Southern's dividend payout ratio (DPR) is 36.49%.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on NSC shares. Barclays boosted their price target on Norfolk Southern from $290.00 to $300.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 30th. Citigroup boosted their price target on Norfolk Southern from $288.00 to $305.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 30th. The Goldman Sachs Group reiterated a "neutral" rating and issued a $278.00 price target on shares of Norfolk Southern in a research note on Monday, June 2nd. Sanford C. Bernstein boosted their price target on Norfolk Southern from $295.00 to $305.00 and gave the stock an "outperform" rating in a research note on Monday, July 21st. Finally, Robert W. Baird boosted their price target on Norfolk Southern from $255.00 to $300.00 and gave the stock a "neutral" rating in a research note on Tuesday, July 22nd. Fourteen equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $285.15.

Read Our Latest Stock Analysis on NSC

About Norfolk Southern

(

Free Report)

Norfolk Southern Corporation, together with its subsidiaries, engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States. The company transports agriculture, forest, and consumer products comprising soybeans, wheat, corn, fertilizers, livestock and poultry feed, food products, food oils, flour, sweeteners, ethanol, lumber and wood products, pulp board and paper products, wood fibers, wood pulp, beverages, and canned goods; chemicals consist of sulfur and related chemicals, petroleum products comprising crude oil, chlorine and bleaching compounds, plastics, rubber, industrial chemicals, chemical wastes, sand, and natural gas liquids; metals and construction materials, such as steel, aluminum products, machinery, scrap metals, cement, aggregates, minerals, clay, transportation equipment, and military-related products; and automotive, including finished motor vehicles and automotive parts, as well as coal.

Read More

Before you consider Norfolk Southern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norfolk Southern wasn't on the list.

While Norfolk Southern currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.