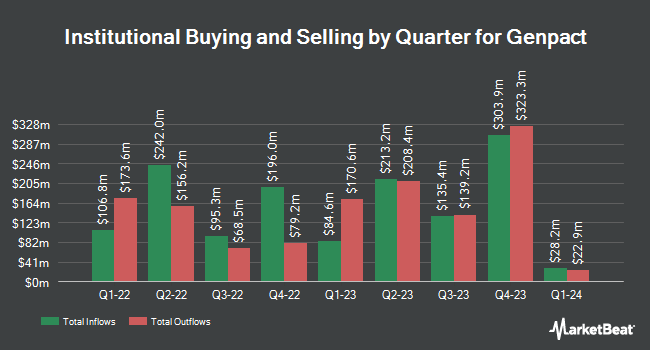

Assenagon Asset Management S.A. bought a new stake in Genpact Limited (NYSE:G - Free Report) in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 47,552 shares of the business services provider's stock, valued at approximately $2,396,000.

A number of other institutional investors have also recently added to or reduced their stakes in G. Coppell Advisory Solutions LLC raised its stake in shares of Genpact by 529.5% in the 4th quarter. Coppell Advisory Solutions LLC now owns 598 shares of the business services provider's stock valued at $25,000 after acquiring an additional 503 shares in the last quarter. Atlas Capital Advisors Inc. grew its holdings in Genpact by 55.8% during the fourth quarter. Atlas Capital Advisors Inc. now owns 603 shares of the business services provider's stock valued at $26,000 after purchasing an additional 216 shares during the last quarter. GeoWealth Management LLC raised its position in shares of Genpact by 199.0% in the fourth quarter. GeoWealth Management LLC now owns 876 shares of the business services provider's stock valued at $38,000 after purchasing an additional 583 shares during the period. Smartleaf Asset Management LLC lifted its stake in shares of Genpact by 416.5% in the fourth quarter. Smartleaf Asset Management LLC now owns 971 shares of the business services provider's stock worth $41,000 after buying an additional 783 shares during the last quarter. Finally, J.Safra Asset Management Corp boosted its holdings in shares of Genpact by 38.8% during the 4th quarter. J.Safra Asset Management Corp now owns 1,622 shares of the business services provider's stock worth $69,000 after buying an additional 453 shares during the period. 96.03% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several brokerages recently weighed in on G. Wall Street Zen upgraded Genpact from a "buy" rating to a "strong-buy" rating in a research note on Friday, June 6th. Robert W. Baird cut their price target on Genpact from $56.00 to $50.00 and set a "neutral" rating for the company in a report on Thursday, May 8th. Finally, Needham & Company LLC lowered their price objective on shares of Genpact from $55.00 to $50.00 and set a "buy" rating on the stock in a research note on Thursday, May 8th. Four investment analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $50.71.

Get Our Latest Report on G

Genpact Price Performance

Shares of G traded down $1.48 on Friday, hitting $40.63. The company's stock had a trading volume of 1,341,901 shares, compared to its average volume of 1,572,100. The company has a market capitalization of $7.10 billion, a PE ratio of 13.86, a PEG ratio of 1.59 and a beta of 0.94. Genpact Limited has a fifty-two week low of $30.38 and a fifty-two week high of $56.76. The company has a 50 day moving average price of $45.22 and a 200 day moving average price of $47.02. The company has a debt-to-equity ratio of 0.48, a current ratio of 2.45 and a quick ratio of 2.45.

Genpact (NYSE:G - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The business services provider reported $0.84 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.80 by $0.04. Genpact had a return on equity of 22.35% and a net margin of 10.88%. The business had revenue of $1.21 billion during the quarter, compared to analysts' expectations of $1.21 billion. During the same period in the previous year, the business posted $0.73 earnings per share. The firm's revenue for the quarter was up 7.4% compared to the same quarter last year. On average, research analysts anticipate that Genpact Limited will post 3.21 earnings per share for the current fiscal year.

Genpact Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, June 30th. Investors of record on Wednesday, June 18th will be issued a $0.17 dividend. The ex-dividend date is Wednesday, June 18th. This represents a $0.68 annualized dividend and a yield of 1.67%. Genpact's dividend payout ratio is currently 23.21%.

Insider Buying and Selling at Genpact

In related news, Director Nicholas C. Gangestad purchased 2,000 shares of the stock in a transaction dated Tuesday, May 13th. The stock was bought at an average cost of $43.97 per share, with a total value of $87,940.00. Following the purchase, the director now directly owns 2,000 shares in the company, valued at $87,940. The trade was a ∞ increase in their position. The purchase was disclosed in a document filed with the SEC, which is available at this link. Insiders own 3.07% of the company's stock.

Genpact Company Profile

(

Free Report)

Genpact Limited provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe. It operates through three segments: Financial services; Consumer and Healthcare; and High Tech and Manufacturing. The Financial Services segment offers retail customer onboarding, customer service, collections, card servicing operations, loan and payment operations, commercial loan, equipment and auto loan, mortgage origination, compliance services, reporting and monitoring, and wealth management operations support; financial crime and risk management services; and underwriting support, new business processing, policy administration, claims management, catastrophe modeling and actuarial services, as well as property and casualty claims.

Featured Articles

Before you consider Genpact, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genpact wasn't on the list.

While Genpact currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.