Baader Bank Aktiengesellschaft acquired a new stake in shares of Grupo Financiero Galicia S.A. (NASDAQ:GGAL - Free Report) in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The fund acquired 6,250 shares of the bank's stock, valued at approximately $338,000.

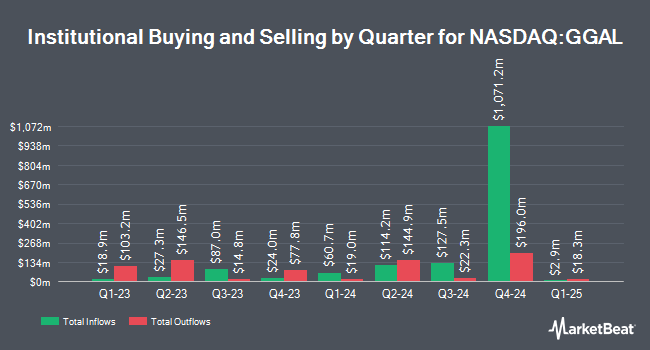

A number of other hedge funds also recently made changes to their positions in the stock. Hsbc Holdings PLC grew its stake in shares of Grupo Financiero Galicia by 9,082.3% during the 4th quarter. Hsbc Holdings PLC now owns 11,492,127 shares of the bank's stock valued at $721,935,000 after acquiring an additional 11,366,972 shares during the period. Canada Pension Plan Investment Board purchased a new position in Grupo Financiero Galicia in the 4th quarter worth approximately $78,711,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in Grupo Financiero Galicia by 19.1% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,222,938 shares of the bank's stock worth $76,213,000 after purchasing an additional 196,270 shares in the last quarter. PointState Capital LP lifted its holdings in Grupo Financiero Galicia by 14.5% in the 4th quarter. PointState Capital LP now owns 577,337 shares of the bank's stock worth $35,980,000 after purchasing an additional 73,168 shares in the last quarter. Finally, Two Sigma Investments LP lifted its holdings in Grupo Financiero Galicia by 0.4% in the 4th quarter. Two Sigma Investments LP now owns 471,443 shares of the bank's stock worth $29,380,000 after purchasing an additional 1,917 shares in the last quarter.

Analysts Set New Price Targets

GGAL has been the topic of several recent research reports. Wall Street Zen cut Grupo Financiero Galicia from a "hold" rating to a "sell" rating in a report on Thursday, May 22nd. Itau BBA Securities started coverage on Grupo Financiero Galicia in a report on Tuesday, May 20th. They set an "outperform" rating and a $70.00 price objective on the stock. One investment analyst has rated the stock with a sell rating and five have assigned a buy rating to the company. Based on data from MarketBeat.com, Grupo Financiero Galicia currently has an average rating of "Moderate Buy" and an average price target of $61.20.

Check Out Our Latest Research Report on GGAL

Grupo Financiero Galicia Stock Up 1.1%

Shares of GGAL traded up $0.53 during midday trading on Monday, reaching $49.44. 547,430 shares of the stock were exchanged, compared to its average volume of 1,273,786. Grupo Financiero Galicia S.A. has a 52 week low of $23.53 and a 52 week high of $74.00. The company has a current ratio of 1.16, a quick ratio of 1.16 and a debt-to-equity ratio of 0.23. The company's 50 day moving average is $52.36 and its two-hundred day moving average is $57.07. The company has a market capitalization of $7.29 billion, a P/E ratio of 7.28 and a beta of 1.60.

Grupo Financiero Galicia Cuts Dividend

The business also recently disclosed a -- dividend, which will be paid on Tuesday, August 5th. Investors of record on Tuesday, July 29th will be given a dividend of $0.1515 per share. The ex-dividend date of this dividend is Tuesday, July 29th. Grupo Financiero Galicia's dividend payout ratio (DPR) is presently 16.94%.

Grupo Financiero Galicia Company Profile

(

Free Report)

Grupo Financiero Galicia SA, a financial service holding company, provides various financial products and services to individuals and companies in Argentina. The company operates through Banks, NaranjaX, Insurance, and Other Businesses segments. It also offers personal loans; express and mortgage loans; pledge and credit card loans; credit and debit cards; and online banking services, as well as savings, deposits, and checking accounts related services.

Featured Articles

Before you consider Grupo Financiero Galicia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Financiero Galicia wasn't on the list.

While Grupo Financiero Galicia currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.