Mills Wealth Advisors LLC purchased a new stake in St. Joe Company (The) (NYSE:JOE - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 63,398 shares of the financial services provider's stock, valued at approximately $2,977,000. St. Joe accounts for about 1.6% of Mills Wealth Advisors LLC's investment portfolio, making the stock its 17th largest holding. Mills Wealth Advisors LLC owned 0.11% of St. Joe at the end of the most recent reporting period.

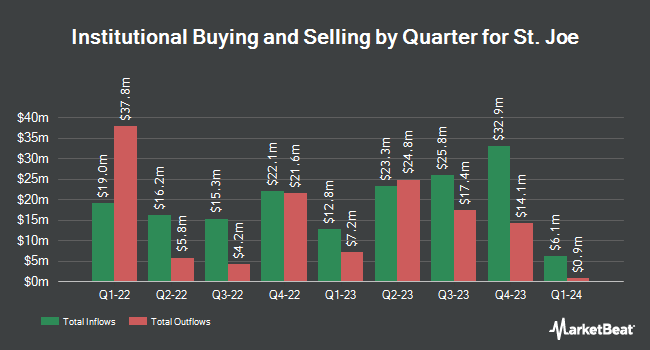

Several other large investors have also recently bought and sold shares of the company. Janney Montgomery Scott LLC purchased a new stake in shares of St. Joe during the 1st quarter valued at $263,000. SG Americas Securities LLC purchased a new stake in shares of St. Joe during the 1st quarter valued at $475,000. Lazard Asset Management LLC purchased a new stake in shares of St. Joe during the 4th quarter valued at $38,000. Millennium Management LLC raised its position in shares of St. Joe by 2,785.5% during the 4th quarter. Millennium Management LLC now owns 209,917 shares of the financial services provider's stock valued at $9,432,000 after buying an additional 202,642 shares in the last quarter. Finally, Steward Partners Investment Advisory LLC raised its position in shares of St. Joe by 108.4% during the 4th quarter. Steward Partners Investment Advisory LLC now owns 11,297 shares of the financial services provider's stock valued at $508,000 after buying an additional 5,875 shares in the last quarter. 86.67% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen cut shares of St. Joe from a "buy" rating to a "hold" rating in a research report on Sunday, June 8th.

Check Out Our Latest Analysis on St. Joe

St. Joe Trading Up 2.1%

NYSE:JOE traded up $1.01 during trading hours on Tuesday, reaching $49.28. The company's stock had a trading volume of 338,010 shares, compared to its average volume of 235,988. The firm has a market capitalization of $2.87 billion, a price-to-earnings ratio of 37.05 and a beta of 1.36. The firm has a 50-day simple moving average of $45.94 and a 200-day simple moving average of $45.78. St. Joe Company has a 1 year low of $40.19 and a 1 year high of $64.69. The company has a debt-to-equity ratio of 0.83, a quick ratio of 1.52 and a current ratio of 1.52.

St. Joe (NYSE:JOE - Get Free Report) last issued its earnings results on Wednesday, April 23rd. The financial services provider reported $0.30 EPS for the quarter. The company had revenue of $94.20 million for the quarter. St. Joe had a net margin of 18.99% and a return on equity of 10.62%.

St. Joe Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, June 26th. Investors of record on Tuesday, June 10th were given a $0.14 dividend. This represents a $0.56 dividend on an annualized basis and a yield of 1.14%. The ex-dividend date was Tuesday, June 10th. St. Joe's payout ratio is presently 42.11%.

About St. Joe

(

Free Report)

The St. Joe Company, together with its subsidiaries, operates as a real estate development, asset management, and operating company in Northwest Florida. It operates through three segments: Residential, Hospitality, and Commercial. The Residential segment engages in the development of communities into homesites for sale to homebuilders and on a limited basis to retail customers.

Further Reading

Before you consider St. Joe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and St. Joe wasn't on the list.

While St. Joe currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.