Brandywine Global Investment Management LLC acquired a new position in Mueller Industries, Inc. (NYSE:MLI - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 68,921 shares of the industrial products company's stock, valued at approximately $5,248,000. Brandywine Global Investment Management LLC owned about 0.06% of Mueller Industries at the end of the most recent reporting period.

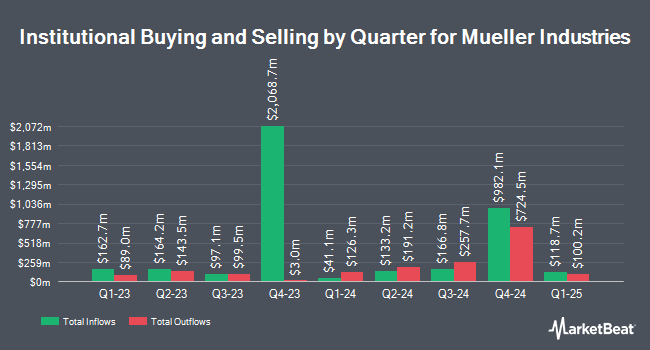

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. Invesco Ltd. boosted its holdings in shares of Mueller Industries by 0.4% in the first quarter. Invesco Ltd. now owns 2,799,575 shares of the industrial products company's stock worth $213,160,000 after buying an additional 10,968 shares during the period. Northern Trust Corp boosted its holdings in shares of Mueller Industries by 28.3% in the fourth quarter. Northern Trust Corp now owns 1,535,625 shares of the industrial products company's stock worth $121,867,000 after buying an additional 338,902 shares during the period. Caisse DE Depot ET Placement DU Quebec boosted its holdings in shares of Mueller Industries by 169.1% in the fourth quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,058,830 shares of the industrial products company's stock worth $84,029,000 after buying an additional 665,413 shares during the period. Systematic Financial Management LP boosted its holdings in shares of Mueller Industries by 0.9% in the fourth quarter. Systematic Financial Management LP now owns 947,650 shares of the industrial products company's stock worth $75,206,000 after buying an additional 8,308 shares during the period. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its holdings in shares of Mueller Industries by 5.7% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 845,344 shares of the industrial products company's stock worth $67,087,000 after buying an additional 45,672 shares during the period. 94.50% of the stock is currently owned by institutional investors and hedge funds.

Mueller Industries Trading Up 3.9%

Shares of MLI traded up $3.5490 during midday trading on Friday, hitting $94.2090. The stock had a trading volume of 671,390 shares, compared to its average volume of 874,775. Mueller Industries, Inc. has a fifty-two week low of $65.24 and a fifty-two week high of $96.81. The business has a 50-day simple moving average of $84.81 and a two-hundred day simple moving average of $79.72. The firm has a market cap of $10.43 billion, a P/E ratio of 14.95 and a beta of 1.02.

Mueller Industries (NYSE:MLI - Get Free Report) last announced its earnings results on Tuesday, July 22nd. The industrial products company reported $1.96 EPS for the quarter, topping the consensus estimate of $1.62 by $0.34. Mueller Industries had a net margin of 17.48% and a return on equity of 24.47%. The company had revenue of $1.14 billion during the quarter, compared to analysts' expectations of $1.12 billion. The firm's revenue was up 14.1% on a year-over-year basis.

Mueller Industries Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Investors of record on Friday, September 5th will be issued a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a dividend yield of 1.1%. The ex-dividend date is Friday, September 5th. Mueller Industries's dividend payout ratio (DPR) is currently 15.87%.

Insider Activity at Mueller Industries

In related news, Director John B. Hansen sold 1,000 shares of the firm's stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $91.97, for a total transaction of $91,970.00. Following the completion of the sale, the director directly owned 92,664 shares in the company, valued at approximately $8,522,308.08. This trade represents a 1.07% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 2.70% of the company's stock.

About Mueller Industries

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Read More

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.