Bank of New York Mellon Corp purchased a new position in Zai Lab Limited Unsponsored ADR (NASDAQ:ZLAB - Free Report) during the first quarter, according to its most recent Form 13F filing with the SEC. The fund purchased 8,230 shares of the company's stock, valued at approximately $297,000.

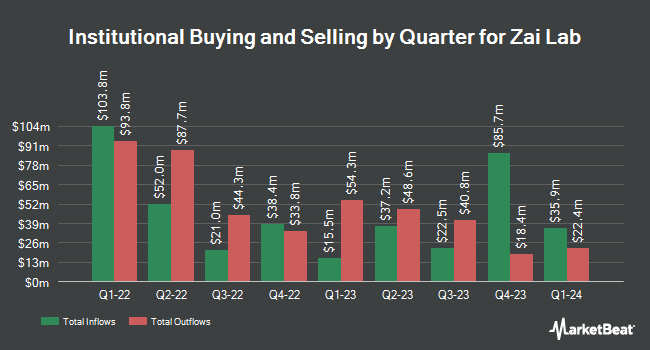

Other hedge funds have also recently made changes to their positions in the company. GF Fund Management CO. LTD. purchased a new position in shares of Zai Lab in the fourth quarter worth $29,000. Pictet Asset Management Holding SA purchased a new position in shares of Zai Lab in the fourth quarter worth $31,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Zai Lab by 2.1% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 57,114 shares of the company's stock worth $1,496,000 after purchasing an additional 1,200 shares during the last quarter. Invesco Ltd. raised its stake in shares of Zai Lab by 4.2% in the fourth quarter. Invesco Ltd. now owns 44,340 shares of the company's stock worth $1,161,000 after purchasing an additional 1,790 shares during the last quarter. Finally, Barclays PLC raised its stake in shares of Zai Lab by 337.6% in the fourth quarter. Barclays PLC now owns 3,702 shares of the company's stock worth $97,000 after purchasing an additional 2,856 shares during the last quarter. 41.65% of the stock is owned by institutional investors.

Zai Lab Stock Performance

Shares of NASDAQ ZLAB traded up $0.76 during midday trading on Friday, hitting $34.84. 344,419 shares of the stock traded hands, compared to its average volume of 1,001,814. The firm has a 50-day moving average of $36.54 and a two-hundred day moving average of $33.14. The firm has a market capitalization of $3.87 billion, a P/E ratio of -14.00 and a beta of 1.03. Zai Lab Limited Unsponsored ADR has a one year low of $16.01 and a one year high of $44.34.

Zai Lab (NASDAQ:ZLAB - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The company reported ($0.45) earnings per share for the quarter, beating the consensus estimate of ($0.50) by $0.05. The firm had revenue of $106.49 million for the quarter, compared to analysts' expectations of $118.40 million. Zai Lab had a negative return on equity of 33.35% and a negative net margin of 60.26%. Equities analysts forecast that Zai Lab Limited Unsponsored ADR will post -2.58 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have recently weighed in on ZLAB shares. Leerink Partners set a $75.00 price target on Zai Lab and gave the stock an "outperform" rating in a research note on Monday, June 30th. Wall Street Zen cut Zai Lab from a "buy" rating to a "hold" rating in a report on Friday, June 27th. Two research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $54.28.

Check Out Our Latest Research Report on ZLAB

Insider Transactions at Zai Lab

In other news, CFO Yajing Chen sold 2,675 shares of the company's stock in a transaction on Thursday, June 26th. The stock was sold at an average price of $36.13, for a total value of $96,647.75. Following the completion of the sale, the chief financial officer directly owned 21,004 shares in the company, valued at $758,874.52. This represents a 11.30% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. Also, CEO Ying Du sold 7,072 shares of the company's stock in a transaction on Wednesday, July 2nd. The stock was sold at an average price of $35.23, for a total value of $249,146.56. Following the completion of the sale, the chief executive officer owned 536,962 shares of the company's stock, valued at $18,917,171.26. This trade represents a 1.30% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 160,155 shares of company stock worth $4,959,535 in the last three months. Corporate insiders own 4.96% of the company's stock.

Zai Lab Company Profile

(

Free Report)

Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience. Its commercial products include Zejula, an orally administered poly polymerase 1/2 inhibitor; Optune, a cancer therapy that uses electric fields tuned to specific frequencies to kill tumor cells; NUZYRA for acute bacterial skin and skin structure infections, and community acquired bacterial pneumonia; Qinlock to treat gastrointestinal stromal tumors, and VYVGART, a human IgG1 antibody fragment for myesthenia gravis.

See Also

Before you consider Zai Lab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zai Lab wasn't on the list.

While Zai Lab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.