Villanova Investment Management Co LLC acquired a new stake in shares of Core Natural Resources, Inc. (NYSE:CNR - Free Report) during the first quarter, according to its most recent Form 13F filing with the SEC. The fund acquired 8,262 shares of the energy company's stock, valued at approximately $637,000. Core Natural Resources accounts for about 1.8% of Villanova Investment Management Co LLC's investment portfolio, making the stock its 23rd biggest holding.

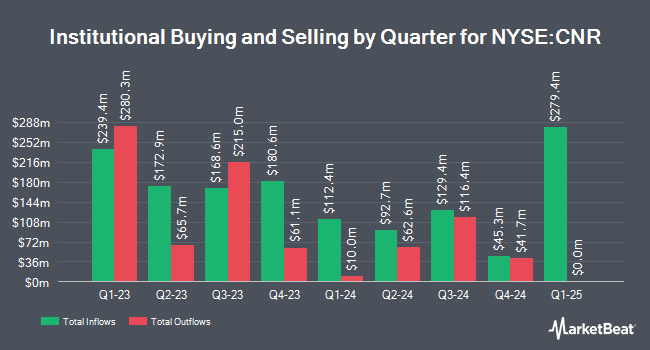

Other hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. bought a new stake in shares of Core Natural Resources during the 1st quarter valued at $482,793,000. Dimensional Fund Advisors LP bought a new stake in shares of Core Natural Resources during the 1st quarter valued at $225,045,000. American Century Companies Inc. bought a new stake in shares of Core Natural Resources during the 1st quarter valued at $123,526,000. Charles Schwab Investment Management Inc. bought a new stake in shares of Core Natural Resources during the 1st quarter valued at $48,630,000. Finally, Victory Capital Management Inc. bought a new stake in shares of Core Natural Resources during the 1st quarter valued at $42,950,000. 86.54% of the stock is owned by hedge funds and other institutional investors.

Core Natural Resources Stock Up 0.2%

Core Natural Resources stock traded up $0.18 during mid-day trading on Tuesday, reaching $76.95. The stock had a trading volume of 187,716 shares, compared to its average volume of 927,217. The company has a market capitalization of $3.96 billion, a price-to-earnings ratio of 35.30 and a beta of 0.76. The company has a 50-day moving average price of $74.24 and a two-hundred day moving average price of $72.61. Core Natural Resources, Inc. has a one year low of $58.19 and a one year high of $134.59. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.78 and a quick ratio of 1.25.

Core Natural Resources (NYSE:CNR - Get Free Report) last posted its earnings results on Tuesday, August 5th. The energy company reported ($0.70) earnings per share (EPS) for the quarter, missing the consensus estimate of $1.31 by ($2.01). The company had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $1.04 billion. Core Natural Resources had a net margin of 0.63% and a return on equity of 3.01%. On average, analysts expect that Core Natural Resources, Inc. will post 11.4 EPS for the current fiscal year.

Core Natural Resources Dividend Announcement

The business also recently announced a dividend, which was paid on Monday, September 15th. Shareholders of record on Monday, September 1st were paid a dividend of $0.10 per share. The ex-dividend date was Friday, August 29th. This represents a yield of 56.0%. Core Natural Resources's dividend payout ratio is currently 18.35%.

Analysts Set New Price Targets

A number of analysts have recently commented on CNR shares. B. Riley dropped their target price on shares of Core Natural Resources from $112.00 to $110.00 and set a "buy" rating on the stock in a report on Tuesday, July 22nd. UBS Group restated a "buy" rating and set a $86.00 target price (up previously from $78.00) on shares of Core Natural Resources in a report on Friday, August 8th. Finally, Jefferies Financial Group reiterated a "hold" rating and issued a $78.00 price target (up previously from $67.00) on shares of Core Natural Resources in a research note on Tuesday, August 5th. Four equities research analysts have rated the stock with a Buy rating and one has given a Hold rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $105.80.

Check Out Our Latest Stock Analysis on Core Natural Resources

Core Natural Resources Profile

(

Free Report)

Core Natural Resources, Inc, together with its subsidiaries, produces and sells bituminous coal in the United States and internationally. It operates through two segments, Pennsylvania Mining Complex (PAMC) and CONSOL Marine Terminal. The company's PAMC segment engages in the mining, preparing, and marketing of bituminous coal to power generators, industrial end-users, and metallurgical end-users.

Featured Articles

Before you consider Core Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Natural Resources wasn't on the list.

While Core Natural Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.